Explore TXN Elliott Wave Analysis: Texas Instruments Inc. (TXN) Daily & 4Hr Charts

In this TXN Elliott Wave analysis, we delve into the intricate patterns of Texas Instruments Inc. (TXN) to identify potential trading opportunities. By utilizing Elliott Wave Theory, we aim to discern the market's directional movements, providing valuable insights for traders and investors alike.

TXN Elliott Wave Technical Analysis

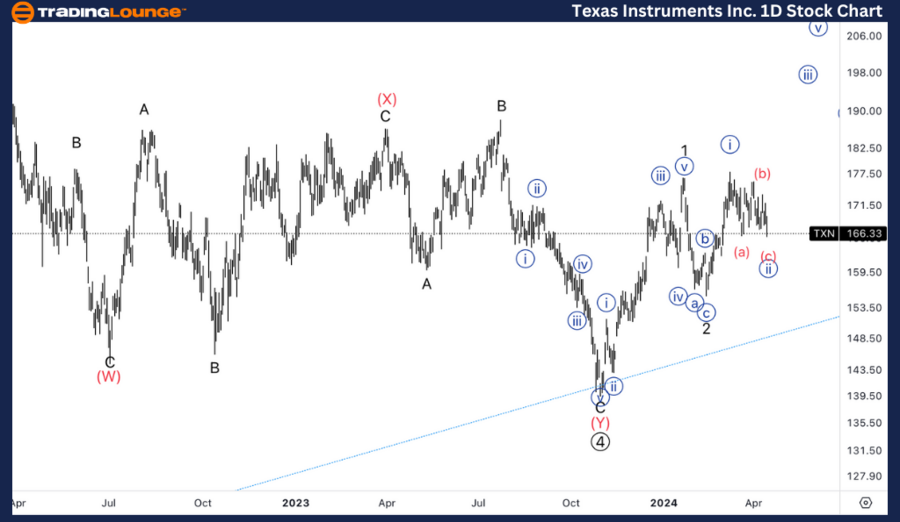

Texas Instruments Inc., (TXN) Daily Chart Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 3

Direction: Upside in wave 3

In our TXN Elliott Wave analysis on the daily chart, we observe a compelling impulsive trend characterized by a motive structure, indicating the presence of Minor wave 3. Our focus lies on discerning whether this wave is undergoing an extension or if it is part of a larger corrective pattern, potentially wave {b} of 2. In the most bearish scenario, the recent upswing from the $140 support might not signify the initiation of wave 1, suggesting the possibility of a broader corrective phase.

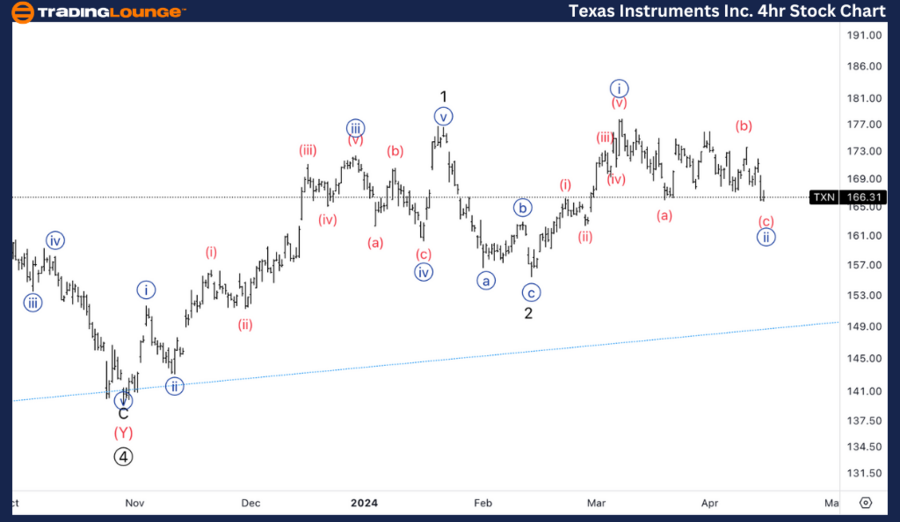

Insights into TXN 4Hr Chart Movements: Texas Instruments Inc. (TXN)

TXN Elliott Wave Analysis

Texas Instruments Inc., (TXN) 4Hr Chart Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave {ii}

Direction: Bottom in wave (c) of {ii}

Turning our attention to the 4-hour chart, our TXN Elliott Wave analysis reveals a counter-trend movement characterized by corrective patterns. The structure of wave {ii} appears to form a flat correction, indicating a temporary pause in the prevailing trend. We anticipate completion of the three-wave move within wave {ii}, with the bottom likely to materialize imminently. Our analysis suggests that the support level around $165, marking the onset of MGM2, could serve as a pivotal point for the upcoming price action.

Conclusion

Empower your trading journey with our SEO-optimized TXN Elliott Wave analysis, tailored to enhance your understanding of Texas Instruments Inc. (TXN) market dynamics. Whether you're a seasoned trader or a novice investor, our comprehensive analysis equips you with the insights needed to navigate the ever-changing landscape of financial markets. Unlock the potential for sustainable profits and elevate your trading strategies with our cutting-edge analysis.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Amazon.com Inc.Stock Analysis

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE