ASX: BLOCK INC. – SQ2 Elliott Wave Technical Analysis TradingLounge

Welcome to our updated Elliott Wave analysis for BLOCK INC. (SQ2) listed on the Australian Stock Exchange (ASX). This technical review explores the unfolding wave structures and provides actionable insights into potential market movements. As per our analysis, SQ2.ASX is experiencing a minor decline within wave 4, which is expected to complete before wave 5 resumes its upward trajectory.

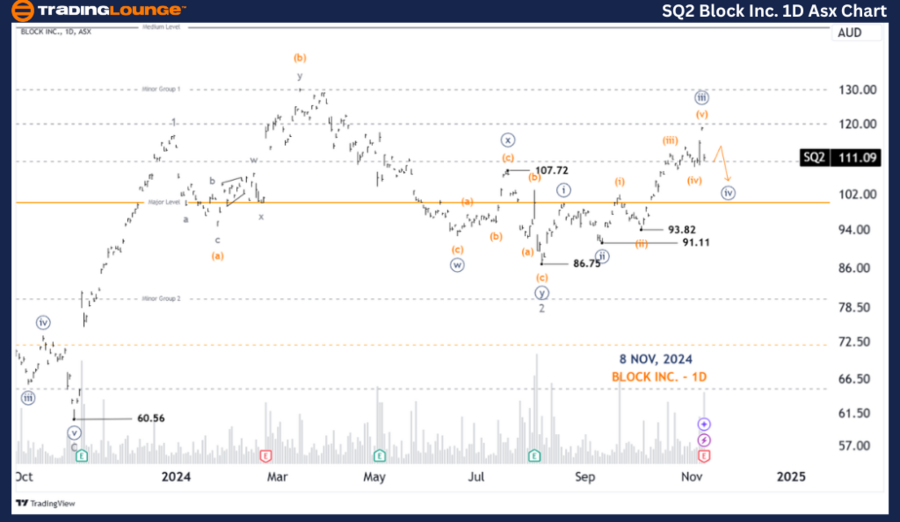

ASX: BLOCK INC. – SQ2 1D Chart (Semilog Scale) Analysis

Wave Characteristics

Function: Major Trend (Minor Degree, Gray)

Mode: Motive

Structure: Impulse

Position: Wave ((iv))-navy of Wave 3-gray

Details: Wave ((iii))-navy has concluded its movement.

Wave ((iv))-navy is currently unfolding, indicating a minor decline before a possible upward push by wave ((v))-navy.

Invalidation Point: 100.00

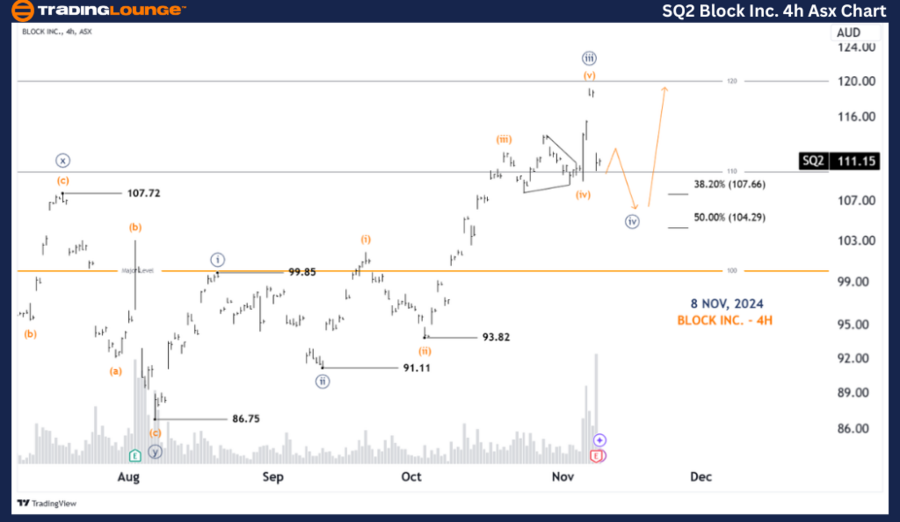

ASX: BLOCK INC. – SQ2 4-Hour Chart Analysis

Wave Characteristics

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave ((iv))-navy of Wave 3-gray

Details

Wave ((iii))-navy has been finalized as a five-wave pattern, labeled from wave (i) to wave (v)-orange.

Currently, wave ((iv))-navy is unfolding and is expected to push lower, targeting a price range of 107.66 to 104.29.

After completing wave ((iv))-navy, wave ((v))-navy is anticipated to resume its upward movement.

The price must remain above 99.85 to validate this scenario.

Invalidation Point: 99.85

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Mineral Resources Limited (MIN) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis offers a structured forecast of ASX: BLOCK INC. – SQ2, emphasizing both contextual trends and short-term market dynamics. The provided price targets and invalidation points serve as critical benchmarks for validating the wave count. By leveraging this detailed analysis, traders can make informed decisions and capitalize on evolving market trends. Our objective is to provide a professional and accurate outlook that helps readers navigate the market effectively.