Natural Gas Elliottwave Analysis

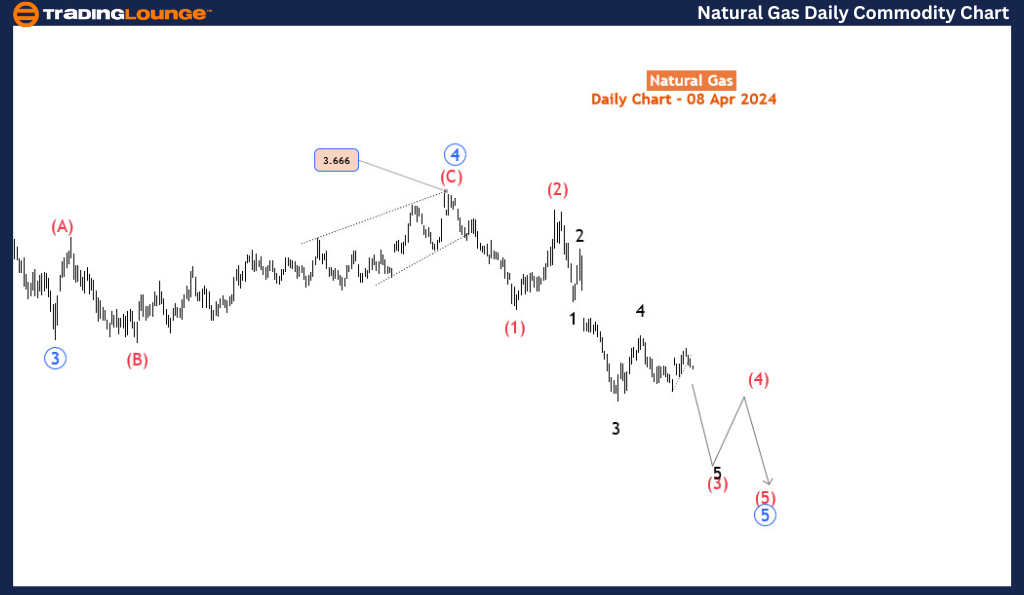

Natural Gas Day Chart Analysis

Natural Gas Elliottwave Technical Analysis

Mode - Impulsive

Structure - Impulse Wave

Position - Wave (ii) of 5

Direction - Wave (iii) of 5

Details: Wave (ii) is completed and the price is now in wave (iii) and expected to extend to 1.35 or below. Wave 4 invalidation is around 2.00.

The journey of Natural Gas embarked on a bearish impulse wave pattern on August 22, 2022. Since then, the trend has persistently carved lower lows without revisiting previous highs, emblematic of the steadfast bearish sentiment prevailing in the market. Despite a minor bounce, the commodity has struggled to breach the low set on February 20, 2024. It's unlikely that this modest recovery will dissuade sellers from reentering the market. Ultimately, the price is anticipated to breach that low, signaling a continuation of the bearish trend. In today's blog post, we aim to scrutinize the extent of the bearish trend and forecast when a substantial recovery might materialize.

On the daily chart, the bearish trend since August 22, 2022, is identified as the 5th wave - circled as blue wave 5. This 5th wave is further subdivided into 5 waves, characteristic of an impulse wave. Presently, the price is within wave 5 of (3) of blue wave 5. However, wave 5 has yet to conclude - a prerequisite being a breach of the low recorded on February 20, 2024 (wave 3 low). This wave count remains valid as long as the price remains below the low of wave (1) (2.236).

TradingLounge Natural Gas Elliott Wave Analysis

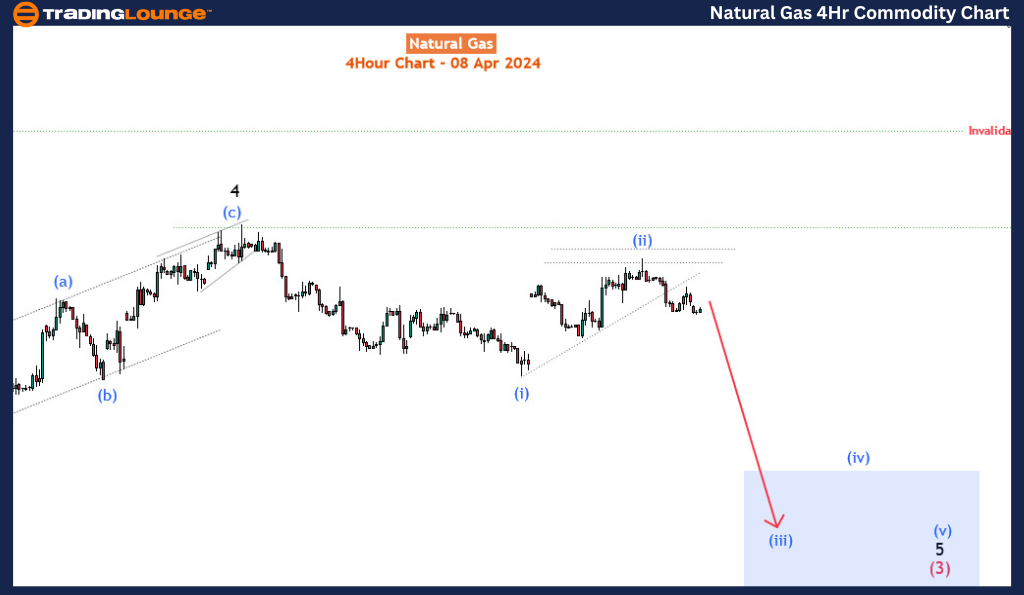

Natural Gas 4-Hour Chart Analysis

Transitioning to the H4 timeframe, Wave 4 of (3) terminated around the 2.00 major level on March 5, 2024. Subsequently, wave 5 of (3) commenced, expected to finalize either as an impulse or an ending diagonal. The retracement observed from March 25 occurred at a critical supply zone, eliciting a downward reaction in price. Consequently, wave (iii) is currently unfolding, poised for confirmation upon a break below the low of wave (i) at 1.589. There's still ample room for bears to exert downward pressure on this commodity. The medium-term target for the culmination of blue wave 5 is projected to be 1.00, assuming price action unfolds as anticipated. In summary, the bearish trend remains steadfast and could persist below 2.00 in the near term. Traders should remain vigilant and adjust their strategies in line with the evolving market dynamics.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Coffee

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE