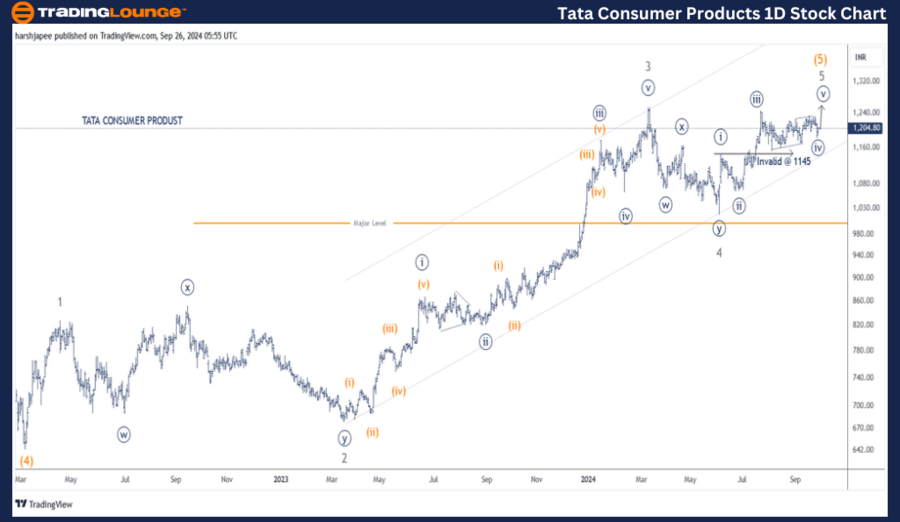

TradingLounge TATA Consumer Product Stock Analysis – Day Chart

TATA Consumer Product Stock Chart Analysis

TATACONSUM Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave (iv) Navy

Details: Minute Wave (v) Navy is moving higher within Minor Wave 5 Grey of Intermediate Wave (5) Orange, holding above 1145.

Invalidation Point: 1145, Risk tightened

TATA Consumer Product Daily Chart Technical Analysis and Potential Elliott Wave Counts:

The daily chart of TATA Consumer Product indicates an ongoing uptrend, with the stock in the final phase of its fifth wave at various degrees, aiming for the 1300 level. It is currently progressing within Minute Wave ((v)) Navy of Minor Wave 5 Grey, holding against the 1145 level.

In March 2022, TATA Consumer Product's stock concluded Intermediate Wave (4) Orange around the 645 mark. Since then, the stock has rallied past 1260, completing Minor Wave 3 Grey. Minor Wave 4 concluded around 1020 on June 04, 2024.

Minor Wave 5 has been developing since then, with the potential completion of Minute Waves ((i)) through ((iv)) as depicted on the chart. If correct, the stock is now unfolding Minute Wave ((v)), likely targeting above the 1300 level.

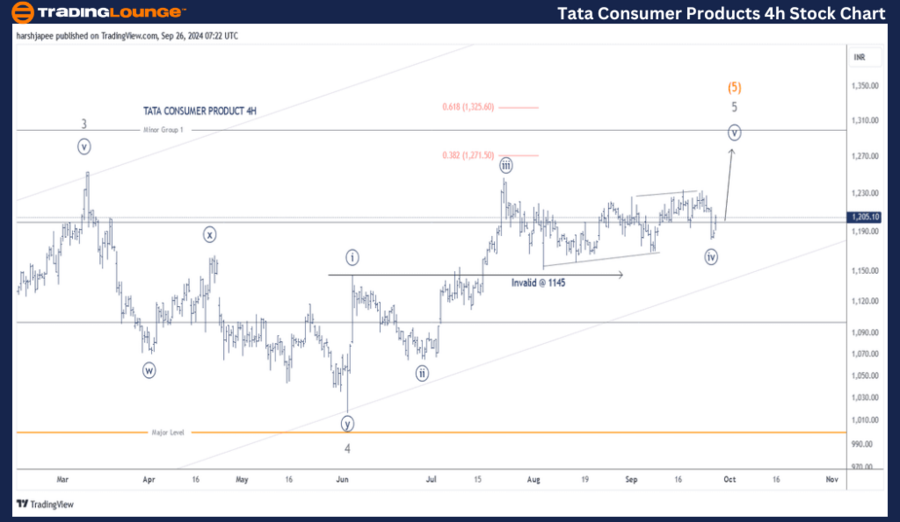

TradingLounge TATA Consumer Product Stock Analysis – 4H Chart

TATA CONSUMER PRODUCT – TATACONSUM Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave (iv) Navy

Details: Minute Wave (v) Navy is advancing within Minor Wave 5 Grey of Intermediate Wave (5) Orange, with potential upside toward the 1325 mark, while maintaining a key support at 1145.

Invalidation Point: 1145, Risk tightened

TATA Consumer Product 4H Chart Technical Analysis and Potential Elliott Wave Counts:

The 4H chart for TATA Consumer Product outlines the sub-waves following the completion of Minor Wave 3 Grey near the 1260 level. Minor Wave 4 developed as a combination wave ((w))-((x))-((y)), finishing around 1020. Minor Wave 5 is likely unfolding as an impulse wave, with the potential to push towards the 1325 level. The stock should ideally remain above the 1145 support level.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: MAHINDRA & MAHINDRA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

TATA Consumer Product is advancing within Minute Wave ((v)) of Minor Wave 5, part of Intermediate Wave (5), while holding above the 1145 support level.