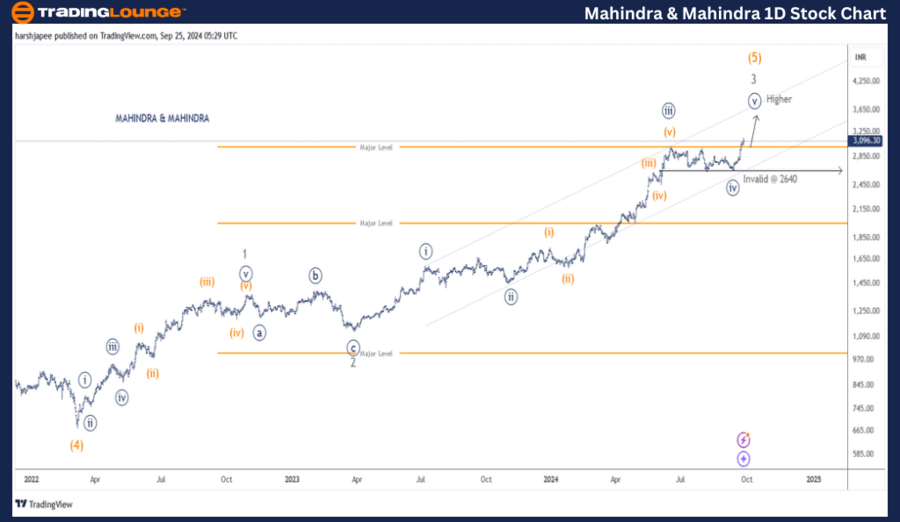

Mahindra & Mahindra – M_M Elliott Wave Technical Analysis (1D Chart)

M_M Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate Degree, Wave (5) Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((v)) Navy

Details: Minute Wave ((v)) Navy is moving upward within Minor Wave 3 Grey of Intermediate Wave (5) Orange, with a critical risk level tightened at 2640.

Invalidation Point: 2640

MAHINDRA & MAHINDRA Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart for Mahindra & Mahindra indicates a continued uptrend targeting the 3300-3400 range in the short term. Minute Wave ((v)) is advancing within Minor Wave 3 Grey of Intermediate Wave (5) Orange. The immediate support level and risk management point is set at 2640.

The stock has been in an upward movement since the March 2022 lows of around 670-75, marking the end of Intermediate Wave (4) Orange. Minor Wave 1 Grey completed near 1370, followed by Minor Wave 2 Grey, an expanded flat, near the 1120 level.

Currently, Minor Wave 3 Grey is extended and within its final upward push. Minute Wave ((v)) is expected to reach at least 3200-3300. The risk level is now tightened at 2640, as a break below this level would suggest the end of Wave 3.

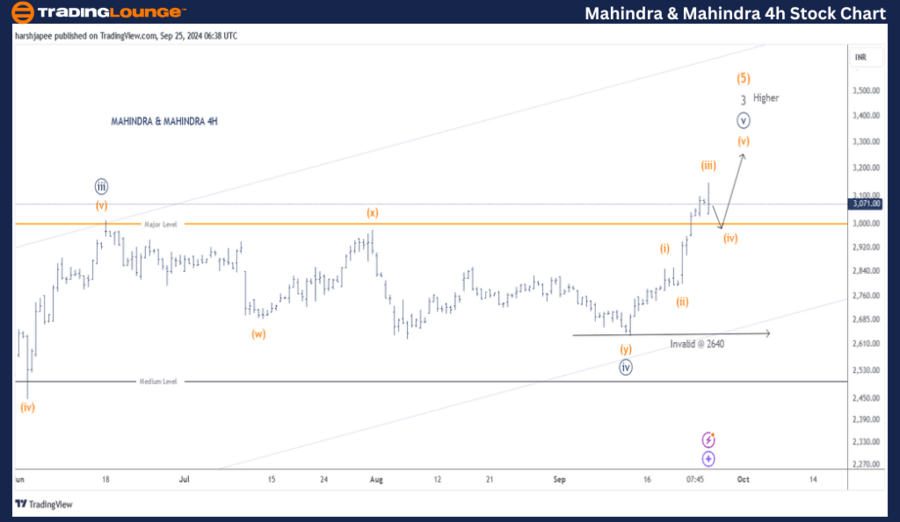

MAHINDRA & MAHINDRA – M_M Elliott Wave / Technical Analysis (4H Chart)

Function: Larger Degree Trend Higher (Intermediate Degree, Wave (5) Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((v)) Navy

Details: Minute Wave ((v)) Navy is progressing higher within Minor Wave 3 Grey of Intermediate Wave (5) Orange, with critical support at 2640. It’s possible that Minuette Wave (iii) Orange completed around the 3150 mark, and if accurate, Minuette Wave (iv) may pull back slightly before the upward trend continues.

Invalidation Point: 2640

MAHINDRA & MAHINDRA 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4-hour chart of Mahindra & Mahindra shows the sub-waves after Minute Wave ((iii)) topped near the 3000 mark. Wave ((iv)) unfolded as a combination before concluding near 2640. From that point, Minute Wave ((v)) is potentially advancing towards the 3300 level.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: COAL INDIA LTD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Mahindra & Mahindra is expected to continue rising towards the 3200-3300 range as Minute Wave ((v)) progresses within Minor Wave 3 Grey of Intermediate Wave (5) Orange.