S&P/TSX 60 Elliott Wave Analysis – Trading Lounge Day Chart

S&P/TSX 60 Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 4

Position: Navy Blue Wave 3

Direction Next Higher Degree: Orange Wave 5

Analysis Details

The S&P/TSX 60 daily chart is currently exhibiting a counter-trend correction, aligning with a corrective wave structure as part of Elliott Wave Theory. The market is navigating Orange Wave 4, indicating a temporary retracement within the overarching bullish trend.

Previously, Orange Wave 3 reached completion, marking a shift into the corrective phase of Orange Wave 4. This correction is an expected pause before the potential resumption of the broader uptrend.

Currently, the market sits within Navy Blue Wave 3, representing an intermediate correction inside the larger structure. The anticipated next major movement is Orange Wave 5, expected to commence post the resolution of Orange Wave 4.

Summary

The S&P/TSX 60 daily analysis confirms that the index is in a corrective phase within an ongoing larger uptrend. Orange Wave 4 is actively forming following the completion of Orange Wave 3, hinting at a temporary pullback before a potential rally into Orange Wave 5.

The market remains in a counter-trend state, and further developments are necessary to validate the next directional movement.

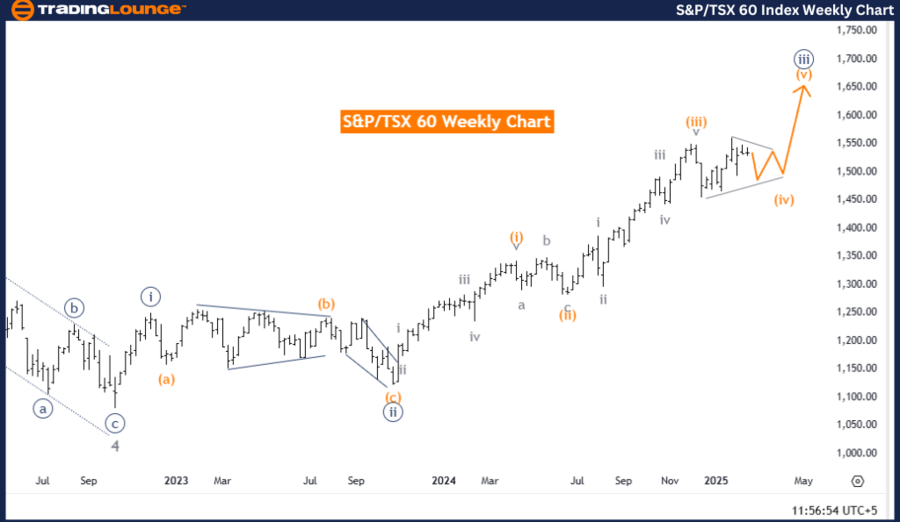

S&P/TSX 60 Elliott Wave Analysis – Trading Lounge Weekly Chart

S&P/TSX 60 Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 4

Position: Navy Blue Wave 3

Direction Next Higher Degree: Orange Wave 5

Analysis Details

The S&P/TSX 60 weekly chart aligns with Elliott Wave Theory, showcasing a corrective counter-trend movement within the broader market cycle. The market is currently navigating Orange Wave 4, signaling a retracement phase before the expected continuation of the uptrend.

With Orange Wave 3 appearing complete, the market has entered Orange Wave 4, a necessary corrective phase before potentially progressing into Orange Wave 5. This correction suggests short-term consolidation before a probable bullish breakout.

Positioned within Navy Blue Wave 3, the market is experiencing an intermediate correction inside a broader bullish structure. The next higher-degree move remains Orange Wave 5, anticipated upon completion of Orange Wave 4.

Summary

The S&P/TSX 60 weekly chart analysis confirms an ongoing corrective wave structure within a larger bullish trend. The unfolding Orange Wave 4 represents a temporary pullback, likely preceding an eventual continuation into Orange Wave 5.

While the market stays in a counter-trend formation, further confirmations are needed to determine the next major directional move.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: CAC 40 (France) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support