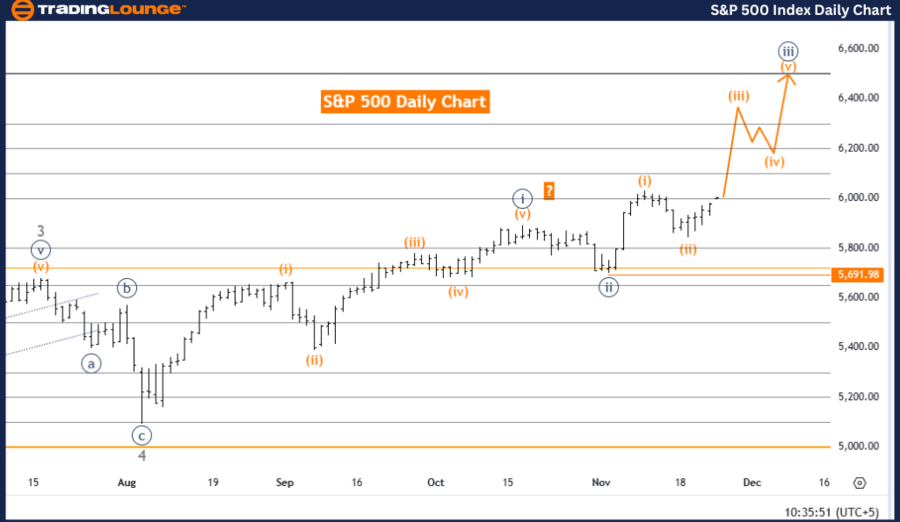

S&P 500 Elliott Wave Analysis - TradingLounge Daily Chart

S&P 500 Index Daily Chart Analysis

S&P 500 Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Next Lower Degree Direction: Orange Wave 4

Details:

Invalidation Level: 5,691.98

Analysis Summary:

This analysis applies Elliott Wave theory to the S&P 500 daily chart, identifying a bullish trend in progress. The current mode is impulsive, indicative of strong upward momentum.

Key Points:

- The analysis focuses on orange wave 3, which began after the completion of orange wave 2, signaling continued bullish movement.

- The S&P 500 is positioned within navy blue wave 3, with orange wave 3 propelling this phase of the market.

- The next projected movement is a corrective phase, orange wave 4, expected to follow the completion of orange wave 3.

Critical Benchmark for Validation:

The invalidation level is defined at 5,691.98. A drop to this level invalidates the current Elliott Wave count and the bullish outlook, emphasizing the importance of this threshold for risk management.

Conclusion:

The Elliott Wave analysis for the S&P 500 daily chart points to a bullish trend, with orange wave 3 within navy blue wave 3 driving upward movement. The conclusion of orange wave 2 confirms the impulsive phase, and the robust momentum suggests more gains ahead. The trend remains valid as long as the index remains above 5,691.98, with further growth expected before transitioning to the corrective orange wave 4 phase.

S&P 500 Elliott Wave Analysis - TradingLounge Weekly Chart

S&P 500 Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 3

Position: Gray Wave 5

Next Lower Degree Direction: Navy Blue Wave 4

Details:

Invalidation Level: 5,691.98

S&P 500 Analysis Summary:

This analysis evaluates the S&P 500 using Elliott Wave theory on a weekly timeframe, highlighting an ongoing bullish trend. The impulsive mode reflects sustained upward movement.

Key Points:

- The focus is on navy blue wave 3, initiated after the completion of navy blue wave 2, continuing the long-term bullish trend.

- The market is advancing within gray wave 5, the final upward phase of this impulsive movement.

- The next anticipated development is navy blue wave 4, a corrective phase expected to follow navy blue wave 3.

Critical Benchmark for Validation:

The invalidation level is defined at 5,691.98. A decline to this point invalidates the current wave count and bullish scenario. This benchmark is key for confirming the trend and managing risks.

Conclusion:

The weekly Elliott Wave analysis underscores a bullish phase, with navy blue wave 3 within gray wave 5 driving the market higher. The completion of navy blue wave 2 confirms this impulsive phase, with strong momentum suggesting continued gains. The bullish outlook remains intact as long as the index stays above 5,691.98. Expect upward potential before the market transitions into the corrective navy blue wave 4 phase.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: S&P/ASX 200 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support