Theta Token Elliottwave Crypto Price News Today - Technical Analysis

Unlocking the potential of Theta Token amidst the volatile crypto market requires a keen understanding of Elliott Wave Theory. Today, we delve into the technical intricacies of Theta Token paired with the U.S. dollar (THETAUSD) through Elliott Wave Analysis, offering valuable insights for traders and investors.

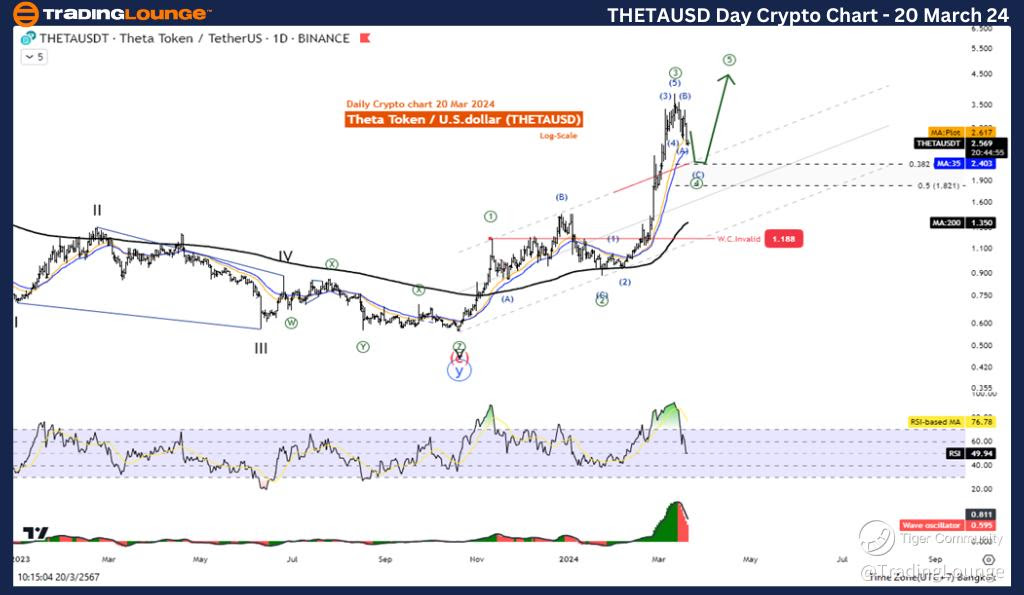

THETAUSD Elliott Wave Analysis TradingLounge Daily Chart,

At TradingLounge, our daily chart examination reveals the current status of THETAUSD within the Elliott Wave framework:

Theta Token/ U.S. dollar(THETAUSD) Daily Chart Analysis

THETAUSD Elliott Wave Technical Analysis

Function: Counter trend

Mode: Corrective

Structure: Flat

Position: Wave ((4))

Direction Next higher Degrees: Wave I of Impulse

Wave Cancel invalid Level: (Not specified)

Details: The corrective Wave 4 exhibits a retracement to 38.2% of Wave 3.

THETAUSD Trading Strategy:

Despite short-term fluctuations, Theta Token maintains an upward trajectory characterized by an Impulse pattern, with the completion of the third wave. Presently, we're undergoing a temporary pullback denoted by the fourth wave correction. As anticipation builds for the fifth wave, prudent traders should await the completion of this corrective phase before considering re-entry into the bullish trend.

THETAUSD Technical Indicators:

Observing the technical landscape, THETAUSD displays resilience:

Price Position: Above the MA200, signalling an Uptrend Wave Oscillator: Reflects Bullish Momentum

THETAUSD Elliott Wave Analysis 4Hr Chart Insights

Continuing our analysis on a shorter timeframe, the 4-hour chart offers supplementary details on THETAUSD's Elliott Wave structure:

Theta Token/ U.S. dollar(THETAUSD) 4Hr Chart Analysis

Elliott Wave Technical Analysis of THETAUSD

Function: Counter trend

Mode: Corrective

Structure: Flat

Position: Wave ((4))

Direction Next higher Degrees: Wave I of Impulse

Wave Cancel invalid Level: (Not specified)

Details: Similar to the daily chart, the corrective Wave 4 retraces to 38.2% of Wave 3.

Refining Theta Token/ U.S. Dollar Trading Strategy:

Echoing the sentiments from the daily chart, Theta Token's overarching uptrend persists, characterized by the Impulse pattern. Presently navigating the corrective fourth wave, investors are advised to exercise patience, awaiting the completion of this temporary setback before capitalizing on the anticipated fifth wave ascent.

Theta Token/ U.S. dollar Technical Indicators Reiteration:

Consistency defines THETAUSD's technical indicators:

Price Position: Remains above the MA200, affirming the prevailing Uptrend Wave Oscillator: Indicates bullish Momentum persists

Theta Token's journey within the Elliott Wave framework underscores the importance of patience and strategic foresight in navigating the cryptocurrency market. Despite short-term fluctuations, the underlying bullish sentiment remains intact, providing opportunities for informed decision-making. By leveraging Elliott Wave Analysis alongside robust technical indicators, traders can navigate the complexities of THETAUSD with confidence, positioning themselves for success in the ever-evolving crypto landscape.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Ethereum/ U.S. dollar (ETHUSD)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.