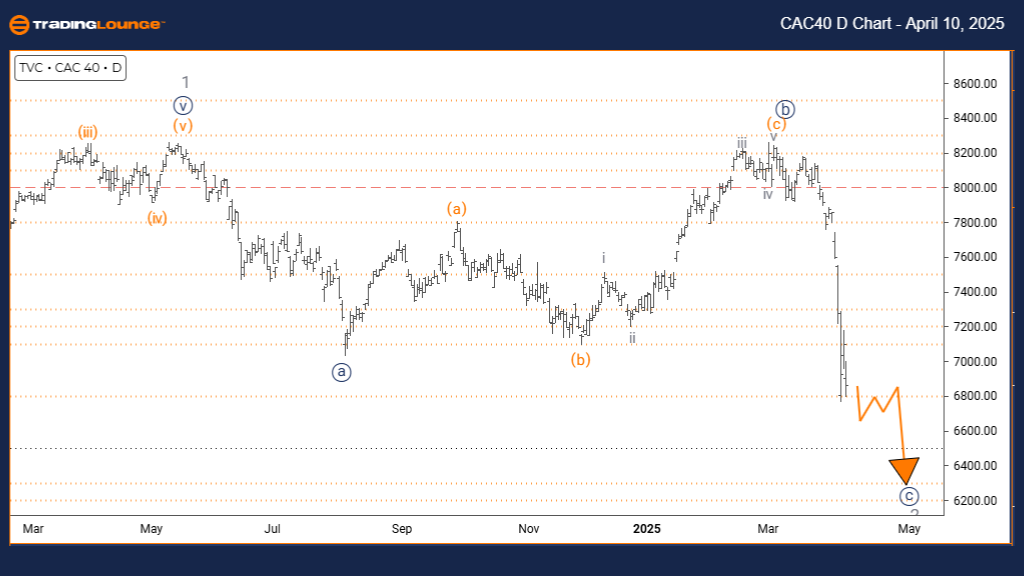

CAC 40 (France) Elliott Wave Analysis | Trading Lounge Daily Chart

CAC 40 (France) Index Daily Chart Forecast

CAC 40 (France) Elliott Technical Wave Analysis

FUNCTION: Counter-Trend

MODE: Corrective

STRUCTURE: Navy blue wave C

POSITION: Gray wave 2

DIRECTION NEXT HIGHER DEGREES: Navy blue wave 1 of 3

DETAILS: Navy blue wave B is likely complete; navy blue wave C of 2 is now unfolding.

The Elliott Wave forecast for the CAC 40 Index on the daily chart indicates a developing corrective counter-trend move. Currently, navy blue wave C is unfolding as part of the broader gray wave 2 corrective structure. With navy blue wave B appearing complete, the index is progressing through wave C of this correction.

This daily analysis provides traders with key insight into the CAC 40’s position within the larger Elliott Wave cycle. Wave C’s active development signals a temporary deviation from the main bullish trend. Upon completion of this corrective wave, the market is projected to begin navy blue wave 1 of 3, aligning with a bullish continuation.

Wave hierarchy is crucial in this phase, as navy blue wave C represents a medium-term corrective move within a larger bullish context. Traders should monitor for classic corrective patterns like ABC formations or lateral consolidation, which are typical in counter-trend markets.

This current structure presents opportunities for both short-term retracement trades and strategic long-term entries. Confirmation of wave C’s end will be key to positioning for the next impulsive move higher.

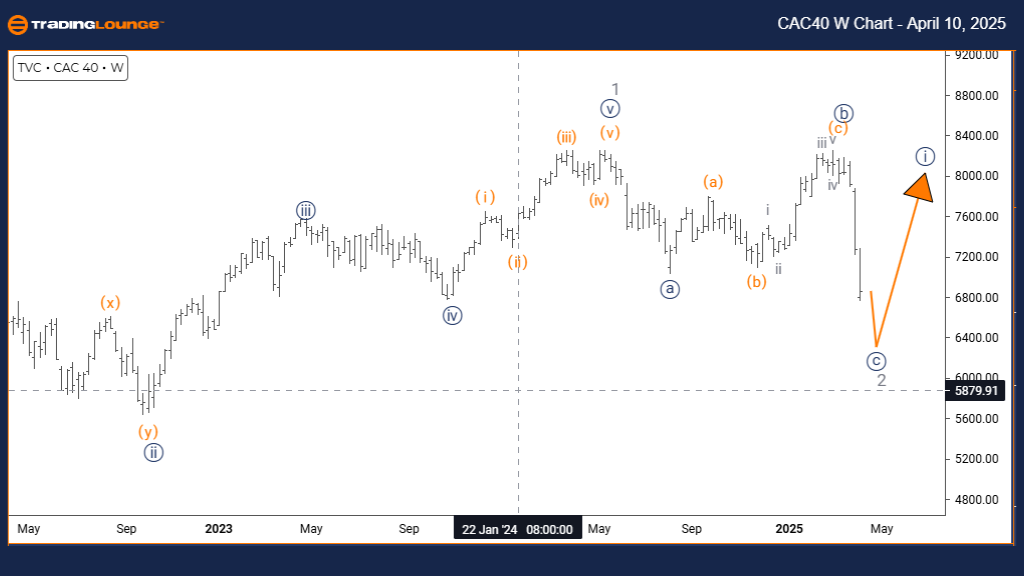

CAC 40 (France) Elliott Wave Analysis | Trading Lounge Weekly Chart

CAC 40 (France) Long-Term Wave Structure

FUNCTION: Counter-Trend

MODE: Corrective

STRUCTURE: Navy blue wave C

POSITION: Gray wave 2

DIRECTION NEXT HIGHER DEGREES: Navy blue wave 1 of 3

DETAILS: Navy blue wave B looks complete; navy blue wave C of 2 is currently active.

The weekly Elliott Wave analysis of the CAC 40 Index presents a larger-scale corrective counter-trend pattern. The main structure, navy blue wave C, continues to evolve as part of gray wave 2. With wave B now considered complete, wave C is underway in this broader corrective phase.

From a macro view, the weekly chart helps identify the CAC 40’s position within its long-term Elliott Wave structure. The active correction in wave C of 2 reflects a pause in the primary trend, with expectations of transitioning into navy blue wave 1 of 3 once this move completes.

This chart underscores the significance of wave degree relationships, with navy blue wave C offering a medium-term trading setup within the overarching bullish scenario. Traders should watch for standard corrective wave features such as three-wave structures or price consolidation, which frequently signal counter-trend developments.

This Elliott Wave setup is ideal for swing and position traders awaiting confirmation before committing to directional trades. The weekly perspective is essential for aligning short-term strategies with long-term bullish opportunities once wave C concludes.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: TASI INDEX Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support