GRASIM INDUSTRIES – GRASIM (1D Chart) Elliott Wave Technical Analysis

GRASIM Elliott Wave Technical Analysis

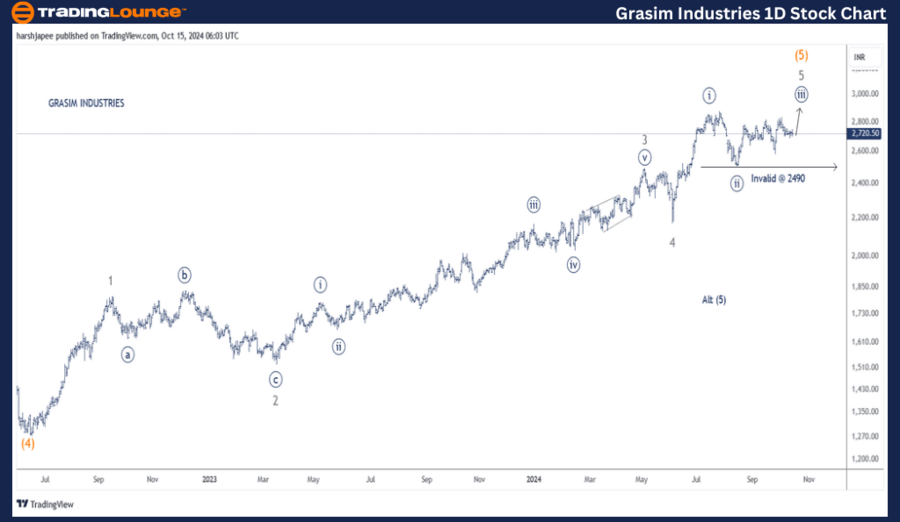

Function: Larger Degree Trend: Higher (Intermediate Degree, Orange – Wave (5))

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iii)) Navy

Details:

- Minute Wave ((iii)) Navy of Minor Wave 5 Grey is moving higher within Intermediate Wave (5) Orange, maintaining support at 2490.

- Alternatively, Intermediate Wave (5) Orange could already be complete above 2900.

- Invalidation Point: 2490

Grasim Industries Daily Chart: Elliott Wave Analysis & Key Levels

- The daily chart suggests an active rally, with Minute Wave ((iii)) Navy unfolding within Minor Wave 5 Grey, all moving upward within Intermediate Wave (5) Orange. Key support lies at 2490.

- Alternatively, if Wave (5) Orange has already completed, it may have peaked around the 2900 level.

Grasim Industries has followed a strong uptrend since reaching a low around 1270 in June 2022, marking the termination of Intermediate Wave (4).

The structure appears to be forming five waves, unfolding as Minor Waves 1 through 5 Grey (with Wave 5 still progressing).

- If the bullish structure holds, the stock may target a push above 3000, signaling the completion of Intermediate Wave (5) Orange.

- A sustained move above 2450, where Minute Wave ((ii)) ended, will confirm that the bullish trend remains intact.

GRASIM INDUSTRIES – GRASIM (4H Chart) Elliott Wave Technical Analysis

Function: Larger Degree Trend: Higher (Intermediate Degree, Orange – Wave (5))

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iii)) Navy

Details:

- Minute Wave ((iii)) Navy of Minor Wave 5 Grey is progressing higher within Intermediate Wave (5) Orange, with Minuette Wave (ii) Orange appearing complete near 2700.

- If this count holds, Minuette Wave (iii) should be in progress.

- Alternatively, Intermediate Wave (5) Orange may already have concluded above 2900.

- Invalidation Point: 2490

Grasim Industries 4H Chart: Elliott Wave Insights

The 4H chart highlights the formation of Minuette Waves within the Minute Waves ((i)) and ((ii)) Navy.

- Minute Wave ((i)) completed as an impulse, followed by a corrective 3-3-5 expanded flat pattern for Minute Wave ((ii)), ending around 2490.

- Minute Wave ((iii)) is now advancing higher, maintaining support at 2490.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: BRITANNIA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Grasim Industries continues to move higher within Minute Wave ((iii)) Navy of Minor Wave 5 Grey, part of Intermediate Wave (5) Orange, with key support at 2490.