ASX: WESTPAC BANKING CORPORATION - WBC Elliott Wave Technical Analysis | TradingLounge

Greetings, our latest Elliott Wave analysis for the Australian Stock Exchange (ASX) focuses on WESTPAC BANKING CORPORATION (ASX: WBC). Our technical evaluation suggests that ASX: WBC may have completed a Triangle pattern, positioning the stock for potential upward movement on Thursday. This analysis outlines key price levels that can confirm or invalidate this perspective and highlight when a bullish trend confirmation is likely.

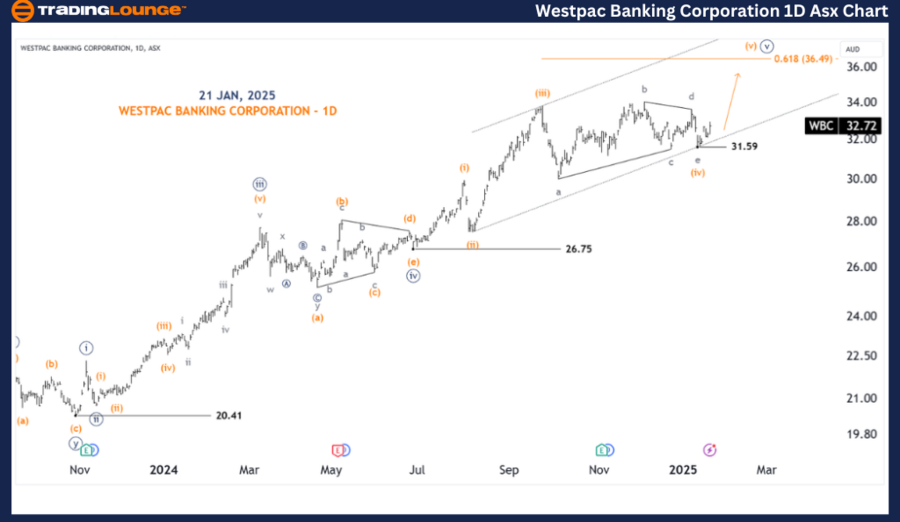

ASX: WESTPAC BANKING CORPORATION - WBC 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (v)-orange of Wave ((v))-navy

Key Insights:

We observe a completed Triangle pattern, with the fourth wave reaching a low of 31.59, followed by the formation of the (v)-orange wave, which is expected to push higher. The price target is around 36.49, or potentially the upper boundary of the price channel. However, the price must stay above 31.59 to validate this outlook.

- Invalidation point: 31.59

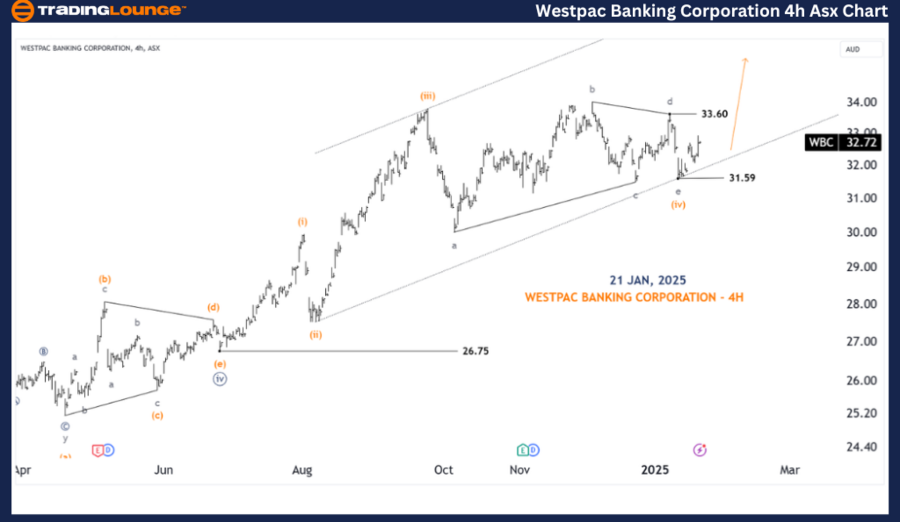

ASX: WESTPAC BANKING CORPORATION - WBC 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave (v)-orange

Key Insights:

Recent price action confirms that the push above 33.60, marking the end of the d-grey wave in the Triangle pattern, strengthens the case for a completed formation. The subsequent fifth wave is anticipated to unfold, further supporting the bullish outlook.

- Invalidation point: 31.59

- Confirmation point: 33.60

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: LIGHT & WONDER INC. – LNW Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis and forecast for ASX: WESTPAC BANKING CORPORATION (WBC) provide valuable insights into current market conditions and actionable strategies. The outlined price levels serve as essential validation and invalidation references for the wave count, increasing confidence in our perspective. By leveraging these insights, traders and investors can better navigate market movements with an informed, professional approach.