Coffee Elliott Wave Technical Analysis - October 2024

Coffee prices have been trending lower in the second half of October 2024 after a corrective bounce earlier in the month. The long-term Elliott wave forecast, however, projects that Coffee will continue its bullish cycle, which began in October 2001, with a more recent cycle starting in June 2019. Despite this long-term outlook, a short to medium-term pullback is anticipated, likely taking the price back to the lows seen in August/September 2024.

Long-Term Elliott Wave Forecast

The long-term bullish corrective cycle for Coffee started in May 2019. In Elliott Wave theory, corrective structures, aside from triangles, typically subdivide into 3-wave patterns. The first wave of this structure, labeled as cycle degree wave w, ended in February 2022. This was followed by a pullback, which was the cycle degree wave x, ending in January 2023. From there, the next phase, cycle degree wave y, began and is currently in progress.

Coffee Daily Chart Analysis

The daily chart outlines the ongoing wave development of cycle degree wave y. This wave is subdivided into a ((W))-(X)-((Y)) structure. Both waves ((W)) and ((X)) have already completed, and prices are currently within wave ((Y)). Specifically, within ((Y)), Coffee is in a pullback for wave (b) of Y of (W) of ((Y)). This suggests that despite the current pullback, Coffee remains in a bullish cycle, and the market is expected to resume its upward movement after completing this correction.

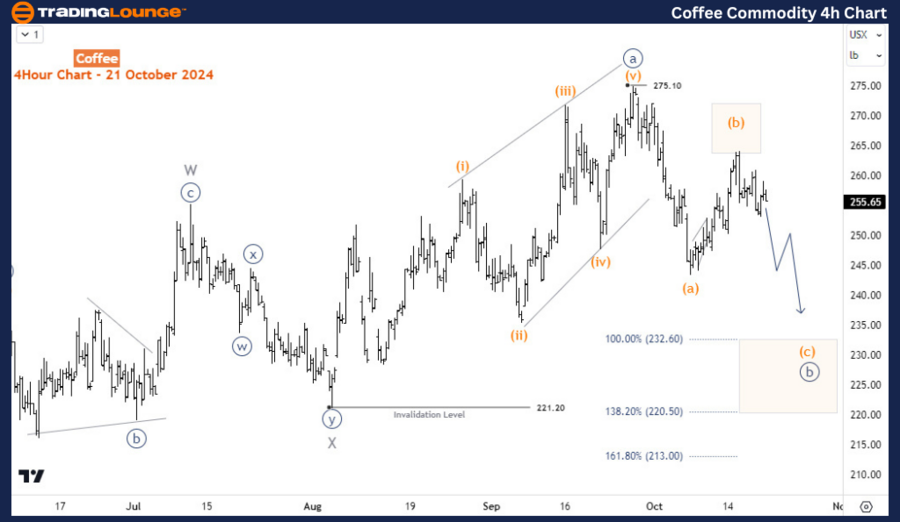

Coffee H4 Chart Analysis

On the 4-hour chart, the pullback from the September 2024 high of $275 is expected to continue lower for wave (c) of ((b)). This pullback could find support in the Fibonacci zone between $223.85 and $216.80. Once prices reach this zone, wave ((c)) is expected to reverse, leading to the completion of wave (W) of ((Y)) and signaling the resumption of the bullish trend.

Although the pullback from $275 may extend further in the short term, the long-term bullish trend remains intact. Traders should focus on the larger uptrend as Coffee prices are expected to rally following the correction.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Soybean Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support