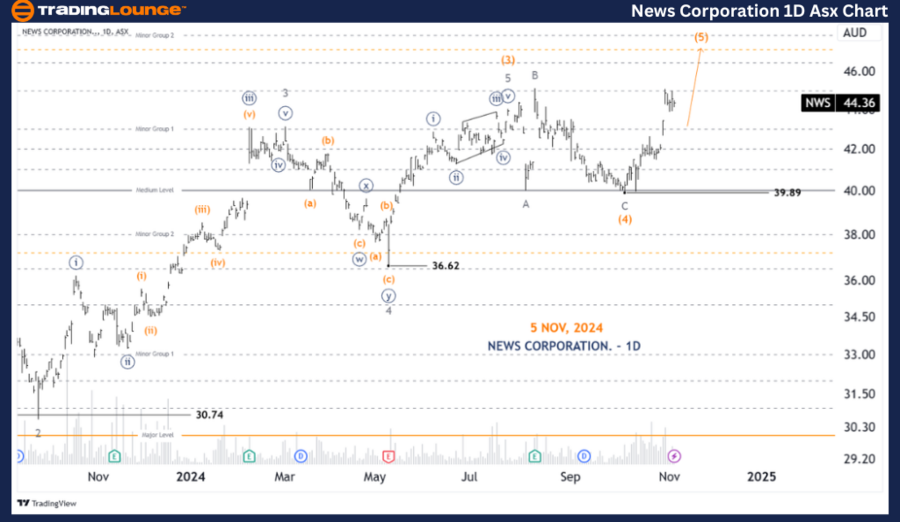

ASX: NEWS CORPORATION – NWS Elliott Wave Analysis Daily Chart

Our latest Elliott Wave analysis for the Australian Stock Exchange (ASX) provides insights into NEWS CORPORATION (NWS). We observe that NWS.ASX continues to trend higher, advancing with wave (5)-orange.

ASX: NEWS CORPORATION – NWS 1-Day Chart Analysis (Semilog Scale)

NWS Elliott Wave Technical Analysis

Trend: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Current Position: Wave (5)-orange

Analysis Details: Wave (4)-orange has concluded in an Expanded Flat structure. From the low at 39.89, wave (5)-orange is progressing upward, targeting higher price levels at approximately 47.00, 48.00, and 50.00.

Key Invalidation Level: 39.89

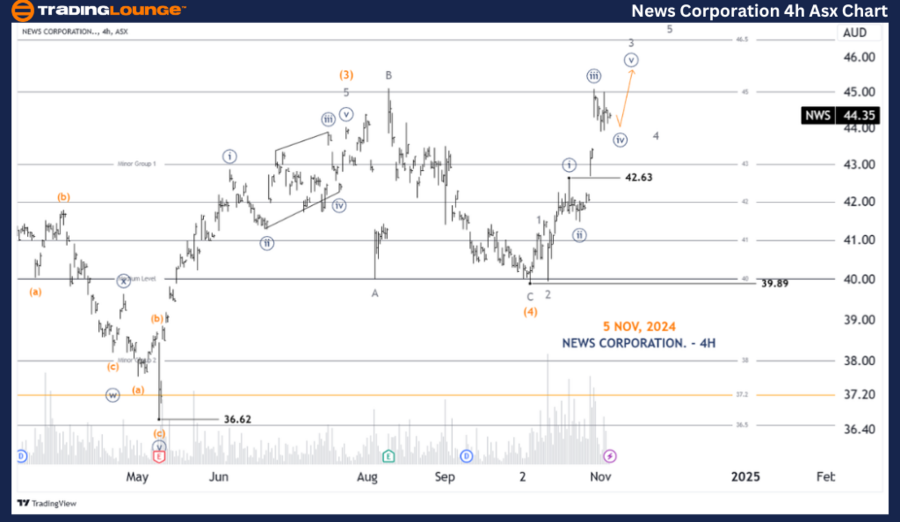

ASX: NEWS CORPORATION – NWS 4-Hour Chart Analysis

Trend: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Current Position: Wave ((iv))-navy of Wave 3-grey

Analysis Details: Following the low of 39.89, wave (5)-orange is gaining momentum toward the higher targets of 47.00, 48.00, and 50.00. Within this upward trend, it is subdividing into minor waves, including wave 1-grey to wave 3-grey. Wave 3-grey itself is extending further and subdividing into wave ((iv))-navy. A brief consolidation period is expected, allowing wave ((v))-navy to complete the full wave 3-grey structure. After this, a slight pullback (wave 4-grey) may occur before resuming an upward trend with wave 5-grey.

Key Invalidation Level: 42.63

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: RESMED INC - RMD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis on ASX: NEWS CORPORATION (NWS) provides detailed insights into current market trends and short-term trading opportunities. By identifying critical price points that confirm or invalidate our wave structure, we aim to boost the accuracy and confidence of our forecast. This approach is designed to offer readers a clear and professional perspective on the prevailing market dynamics.