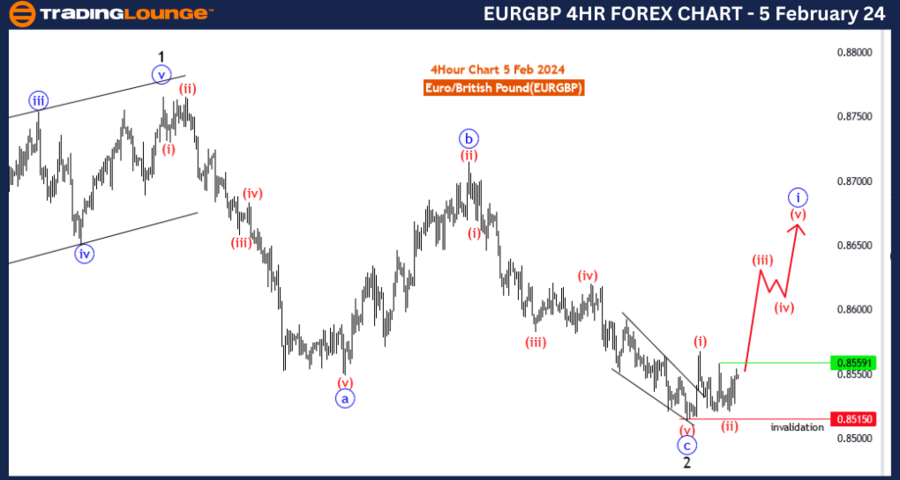

EURGBP Elliott Wave Analysis: 4-Hour Chart, 5 February 24

The "EURGBP Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated February 5, 2024, offers a comprehensive review of the Euro/British Pound (EURGBP) currency pair using Elliott Wave Technical Analysis.

Identified as a "Trend" analysis, it focuses on deciphering and leveraging the prevailing market trend, catering to traders inclined towards strategies aligned with sustained directional movements.

Characterized as "Impulsive," indicating robust and directional price actions, this mode often signifies the onset or continuation of a trend, presenting trading opportunities for trend-following approaches.

The analysis breaks down the "STRUCTURE" into "Red wave 3 of 1," providing a detailed insight into the ongoing wave count within the broader first higher degree structure, aiding traders in understanding market dynamics intricately.

Positioned as "Black wave 3," it denotes the current position within the broader wave count, typically correlating with potent and prolonged trends within the Elliott Wave framework.

Anticipating the "DIRECTION NEXT LOWER DEGREES" as "Red wave 4 of 1," it suggests an imminent correction or consolidation phase following the completion of red wave 3.

In the "DETAILS" section, it indicates the completion of red wave 2 at 0.85212, with red wave 3 of 1 now in play. The wave cancel invalidation level stands at 0.85150, serving as a pivotal reference for potential wave count adjustments.

In summary, the EURGBP Elliott Wave Analysis for the 4-Hour Chart on 5 February 24 underscores an impulsive movement within red wave 3. Traders are urged to monitor the market closely, particularly the specified invalidation level at 0.85150, for probable wave count variations.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

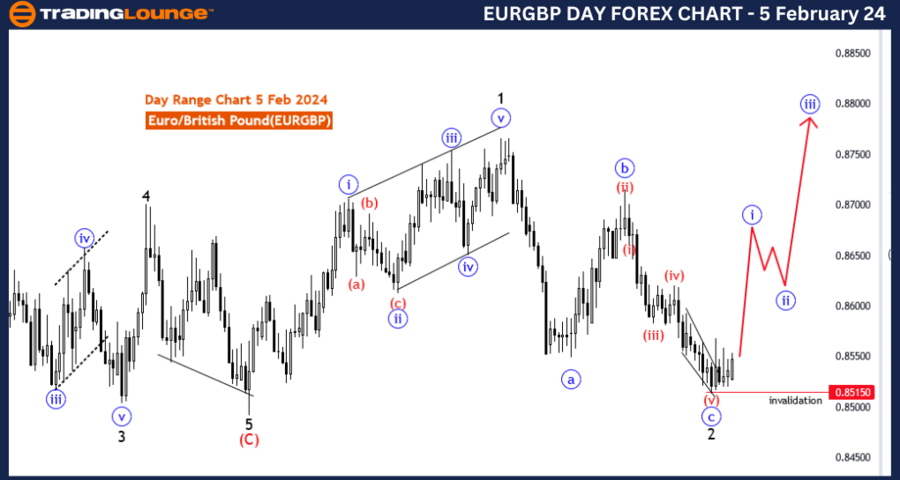

EURGBP Elliott Wave Analysis: Daily Chart, 5 February 24

The "EURGBP Elliott Wave Analysis Trading Lounge Daily Chart" dated February 5, 2024, presents a detailed examination of the Euro/British Pound (EURGBP) currency pair using Elliott Wave Technical Analysis.

Identified as a "Trend" analysis, it prioritizes grasping and capitalizing on the prevailing market trend, indicating an inclination towards strategies aligned with capturing sustained directional movements.

Characterized as "Impulsive," it suggests robust and directional price actions, typically signaling the initiation or continuation of a trend, offering opportunities for trend-following strategies.

The analysis delineates the "STRUCTURE" as "Blue wave 1," providing insight into the current wave count within the broader Elliott Wave structure, enabling traders to comprehend market dynamics with granularity.

Positioned as "Black wave 3," it signifies the current position within the broader wave count, often indicative of potent and prolonged trends within the Elliott Wave framework.

Anticipating the "DIRECTION NEXT LOWER DEGREES" as "Blue wave 2," it suggests an impending correction or consolidation phase following the completion of blue wave C of black wave 2.

In the "DETAILS" section, it notes the completion of blue wave C of black wave 2 at 0.85150, with blue wave 1 of black wave 3 of 1 now in play. The wave cancel invalidation level remains at 0.85150, acting as a crucial reference for potential adjustments in the wave count.

In summary, the EURGBP Elliott Wave Analysis for the Daily Chart on 5 February 24 emphasizes an impulsive movement within blue wave 1. Traders are advised to monitor the market closely, particularly the specified invalidation level at 0.85150, for possible variations in the wave count.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: U.S.Dollar/Swiss Franc(USDCHF)