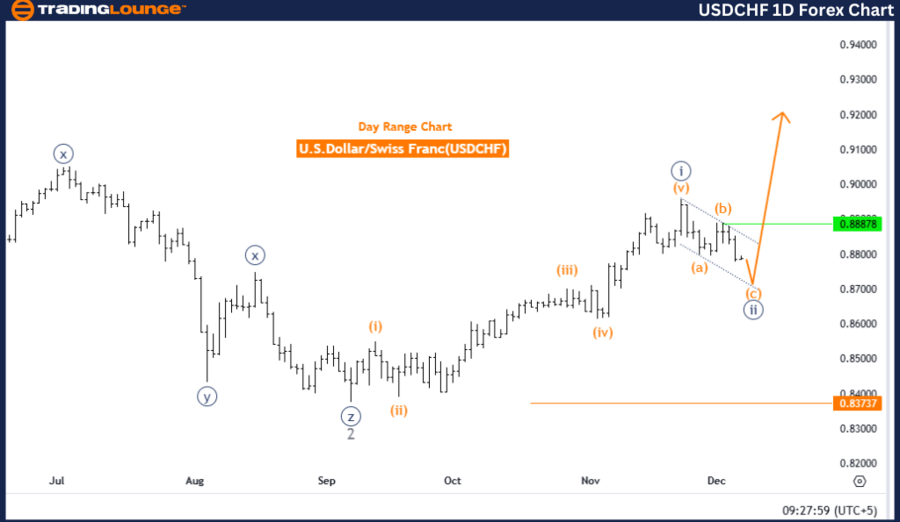

U.S. Dollar/Swiss Franc (USDCHF) Elliott Wave Analysis - Trading Lounge Day Chart

USDCHF Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave 3

Direction Next Higher Degrees: Navy Blue Wave 3

Details: Navy Blue Wave 1 appears complete; Navy Blue Wave 2 is currently active.

Wave Cancel Invalid Level: 0.83737

Analysis Overview

The USDCHF daily chart presents a detailed Elliott Wave analysis, highlighting a counter-trend correction currently in progress. The chart indicates the development of Navy Blue Wave 2, representing a corrective phase within the broader upward trend. The position of Gray Wave 3 signals the continuation of this corrective activity.

The analysis suggests Navy Blue Wave 1 has concluded, allowing the transition to Navy Blue Wave 2. In Elliott Wave Theory, corrective waves typically signify temporary reversals within a primary trend. Following the completion of Navy Blue Wave 2, the market is expected to resume its upward trajectory with the development of Navy Blue Wave 3.

Critical Levels and Observations

- Invalidation Level: 0.83737 – A drop below this point would require reevaluating the current wave structure and could indicate a shift away from the expected corrective pattern.

This analysis provides essential insights for traders tracking the current correction phase. By identifying key levels and directional signals, it assists in navigating this transitional period as the market readies for its next impulsive phase.

U.S. Dollar/Swiss Franc (USDCHF) Elliott Wave Analysis - Trading Lounge 4-Hour Chart

USDCHF Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Impulsive

Structure: Orange Wave C

Position: Navy Blue Wave 2

Direction Next Higher Degrees: Navy Blue Wave 3

Details: Orange Wave B appears complete; Orange Wave C of 2 is in progress.

Wave Cancel Invalid Level: 0.83737

Analysis Overview

The USDCHF 4-hour chart elaborates on the ongoing Elliott Wave dynamics, emphasizing a counter-trend correction led by Orange Wave C. This wave signifies an impulsive phase within the broader Navy Blue Wave 2 correction, highlighting the market’s preparation for the next phase in the prevailing trend.

The analysis points to the conclusion of Orange Wave B, paving the way for the development of Orange Wave C within Navy Blue Wave 2. This final leg aligns with the expectations of Elliott Wave Theory, signifying the culmination of the corrective structure before the broader trend resumes with Navy Blue Wave 3.

Critical Levels and Observations

- Invalidation Level: 0.83737 – A move below this price would necessitate a review of the wave structure and potentially indicate a deviation from the expected path.

This analysis outlines the ongoing corrective dynamics, highlighting significant levels and providing traders with a clear understanding of the current transitional stage as the market prepares for its next impulsive move.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: USDJPY Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support