ASX: RESMED INC - RMD Elliott Wave Technical Analysis

Greetings! In today's Elliott Wave analysis update on the Australian Stock Exchange (ASX), we delve into RESMED INC - RMD. Current indications suggest RMD is preparing for a potential upward move with the third wave.

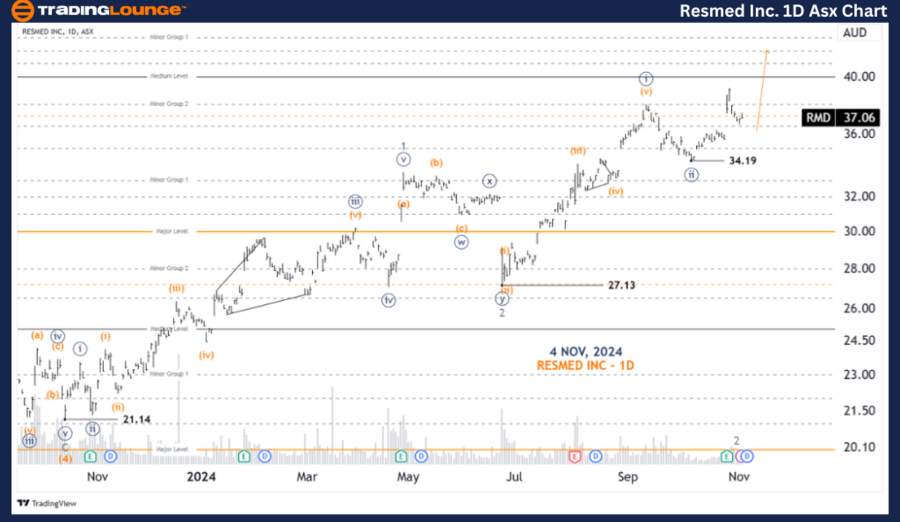

ASX: RESMED INC - RMD 1D Chart Analysis (Semilog Scale)

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - navy of Wave 3 - grey

Analysis:

The completion of Wave ((ii)) - navy appears likely, signaling that Wave ((iii)) - navy may be progressing upwards. This unfolding wave suggests potential targets in the 40.00 – 50.00 range.

- Invalidation Point: 34.19

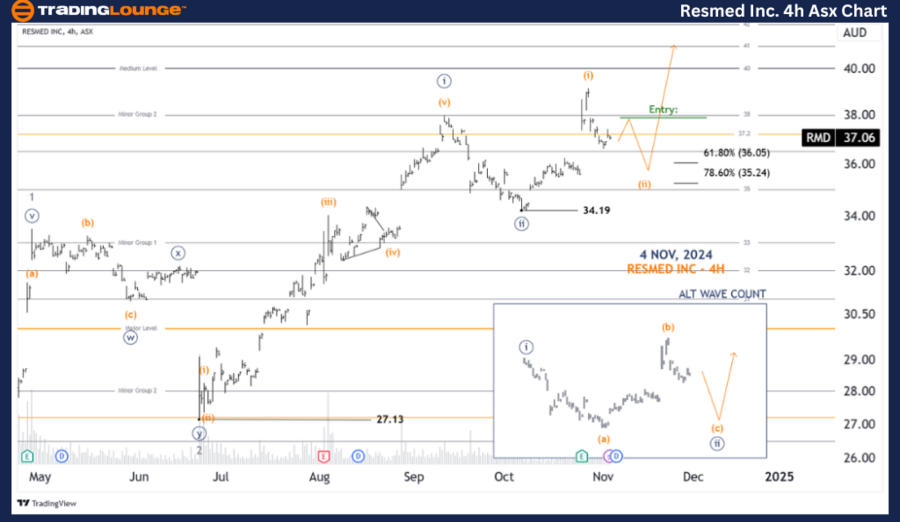

ASX: RESMED INC - RMD 4-Hour Chart Analysis

Function: Major trend (Minuette degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (iii) - orange of Wave ((iii)) - navy

Analysis:

Wave ((iii)) - navy is likely evolving from the 34.19 level, with indications of subdividing into wave (i) and (ii) - orange. This minor wave (ii) - orange might see further declines, targeting the range of 36.05 - 35.24. Once reached, wave (iii) - orange could advance further, provided the price surpasses Wave B of wave (ii) - orange. If the price falls below 35.24, an alternative (ALT) scenario could emerge, suggesting that Wave ((ii)) - navy may not have completed and could need further downward movement.

- Invalidation Point: 34.19

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: MACQUARIE GROUP LIMITED - MQG Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: RESMED INC - RMD provides insights into market trends and potential strategies for effectively leveraging these movements. We emphasize specific price points as confirmation or invalidation signals to reinforce the reliability of our analysis. By integrating these insights, we aim to deliver an objective, professional perspective on the current market trends.