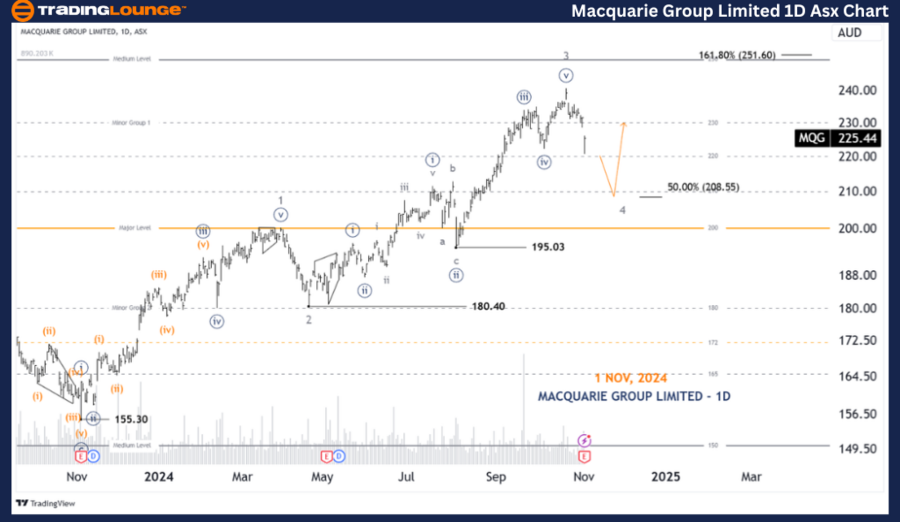

ASX: MACQUARIE GROUP LIMITED - MQG Elliott Wave Technical Analysis by TradingLounge (1D Chart)

Greetings, our latest Elliott Wave analysis provides a technical update for the Australian Stock Exchange (ASX) regarding MACQUARIE GROUP LIMITED - MQG. Currently, MQG.ASX continues showing potential for a downward move, with indications of a 5-grey wave rally developing in the future.

ASX: MACQUARIE GROUP LIMITED - MQG 1D Chart (Semilog Scale) Analysis

MQG Elliott Wave Technical Analysis

Trend: Major trend (Minor degree, grey)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave 4-grey

Details: Wave 3-grey has concluded, and wave 4-grey is in progress, showing potential to decline toward approximately 208.55 before wave 5-grey might resume an upward trajectory.

- Invalidation Point: 200.00

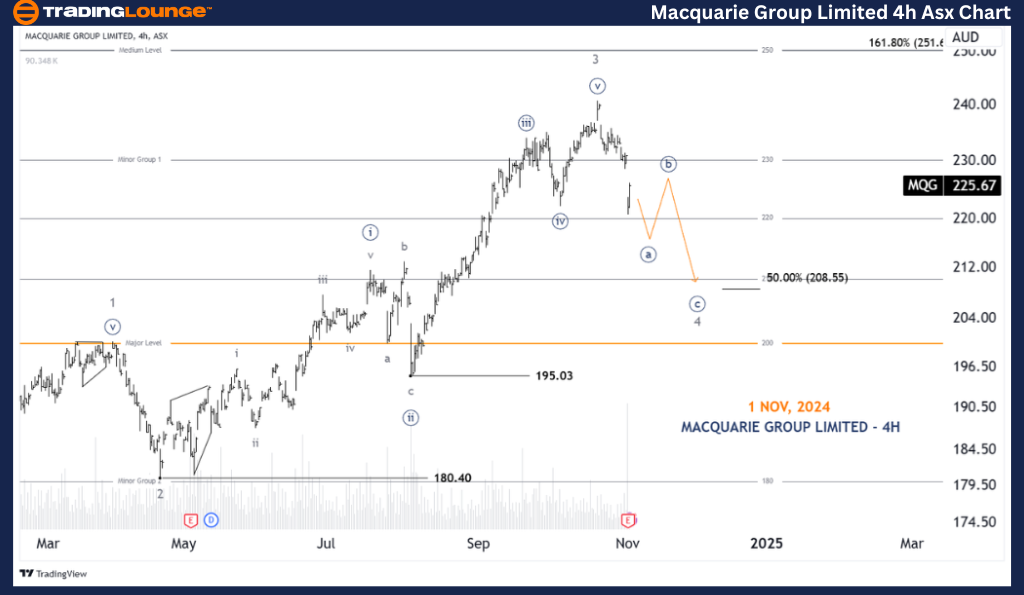

ASX: MACQUARIE GROUP LIMITED - MQG 4-Hour Chart Analysis

Trend: Major trend (Minor degree, grey)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave ((a))-navy of Wave 4-grey

Details: Wave 4-grey is currently developing with a likely Zigzag pattern, marked as ((a))((b))((c))-navy. A final downward push is expected in wave 4-grey before a potential reversal upward with wave 5-grey.

- Invalidation Point: 200.00

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Meridian Energy Limited – MEZ Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our analysis for ASX: MACQUARIE GROUP LIMITED - MQG aims to provide investors with a strategic outlook on potential market movements, identifying price points as validation and invalidation signals for our wave counts. These insights support confidence in our directional perspective, helping readers navigate the market effectively with an objective and professional analysis.