Soybean Elliott Wave Technical Analysis

The bounce from August seems to have ended, with the commodity now targeting a new low for the year. This indicates that the bearish sequence from June 2022 is expected to extend further.

Soybean Commodity Daily Chart Analysis

Soybean Elliott Wave Analysis

Soybeans are in a bearish corrective phase on the daily chart, correcting the impulse wave cycle that spanned from May 2019 to June 2022. From the June 2022 high, a 3-wave structure is expected. Wave ((A)) concluded in October 2023 with a diagonal structure, followed by a shallow bounce for wave ((B)), which reached the high in November 2023. Since then, a bearish impulse wave has developed for wave ((C)). Price completed wave (4) of ((C)) in September 2024, leading to a sell-off in wave (5) of ((C)). Wave (5) may extend to the 866-661 zone before a recovery occurs.

Alternatively, the drop from the June 2022 high ($1787) might form an impulsive structure if the price breaks below 535. In either scenario, the downside is expected to continue in the upcoming weeks.

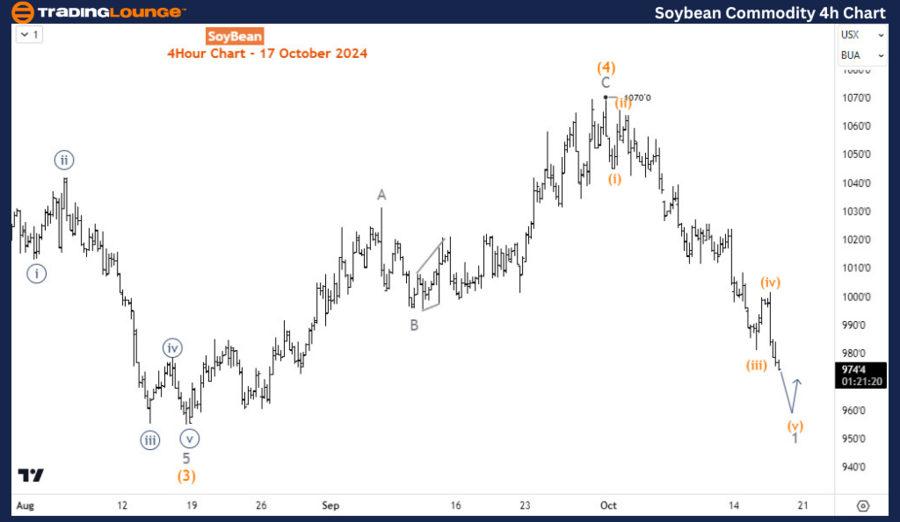

Soybean Commodity H4 Chart Outlook

On the H4 chart, the price remains in wave 1 of (5). This suggests that traders should focus on selling bounces. The decline is likely to breach the 866 level and move toward 661 before completing the impulse wave for (5) of ((C)).

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Copper Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support