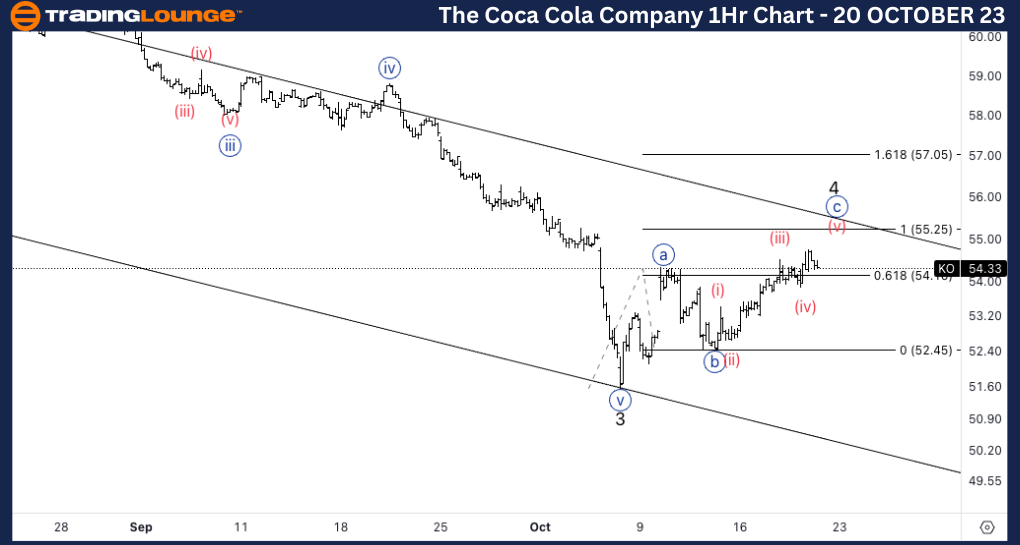

The Coca Cola Company, (KO:NYSE): 4H Chart 20 October 23

The Coca Cola Company, Elliott Wave Technical Analysis

KO Stock Market Analysis: We have been looking for the end of the correction in Primary wave 2 for a while as we seem to be extending lower into wave (C). We are now looking for another leg lower into wave 5 as we seem to be missing one wave to the downside.

KO Elliott Wave Count: Wave {c} of 4.

KO Technical Indicators: Above 20EMA and below 200EMA.

KO Trading Strategy: Invalidation stands at the end of wave 1, looking for downside into wave 5.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

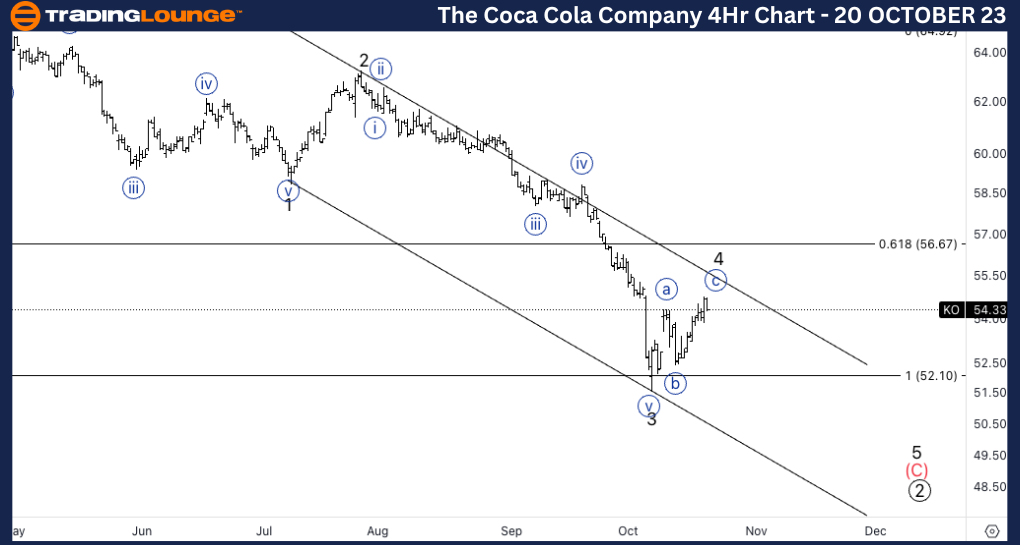

The Coca Cola Company, KO: 1-hour Chart, 20 October 23

The Coca Cola Company, Elliott Wave Technical Analysis

KO Stock Market Analysis: We seem to have a three wave move into wave {a} which makes the up move corrective in nature. Looking for the end of wave {c} soon as we seem to already have a potential five wave move.

KO Elliott Wave count: Wave {c} of 4.

KO Technical Indicators: Above 20EMA and below 200EMA.

KO Trading Strategy: Looking for downside into wave 5.