Natural Gas Elliott Wave Analysis - bearish trend persists

Natural Gas Elliott Wave Technical Analysis

Function - Trend

Mode - Impulsive

Structure - Impulse Wave

Position - Black wave 4 of red wave (3)

Direction - Black wave 5 of red wave (3)

Natural Gas (NG) embarked on a minor rally between late February and early March, marking a recovery of over 31%. However, this ascent encountered a formidable barrier, casting a shadow over the recovery journey from the low of $1.51. Despite this recovery surge, the bears appear resolute in their stance, and the Elliott wave theory provides additional confirmation that NG prices are poised for further faltering in the forthcoming weeks.

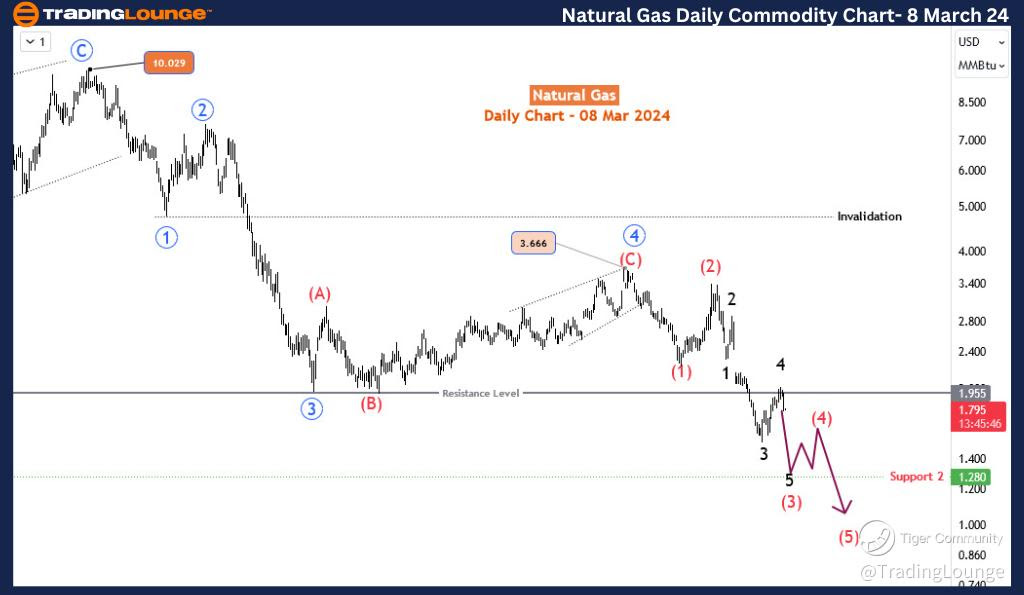

Natural Gas Daily Chart Analysis, 8 March 24

Examining the daily time frame reveals a clear continuation of the bearish impulse wave trend originating from $10 in August 2022. This analysis has been reiterated a few times in recent weeks. The completion of the 4th wave of this downward trajectory (denoted as the blue primary degree) occurred at 3.666. Subsequently, the 5th wave has assumed control, unfolding as an impulse wave and presently finalizing its third sub-wave (termed red intermediate degree). Thus, the current position resides within wave (3) of blue 4. Further scrutiny into wave (3) indicates that it’s completing wave 4 of (3), projected to terminate near the psychological level of $2. The recent market reaction aligns closely with this forecast, and absent unforeseen developments, wave 5 of (3) is anticipated to continue its downward trajectory, as evidenced on the H4 chart.

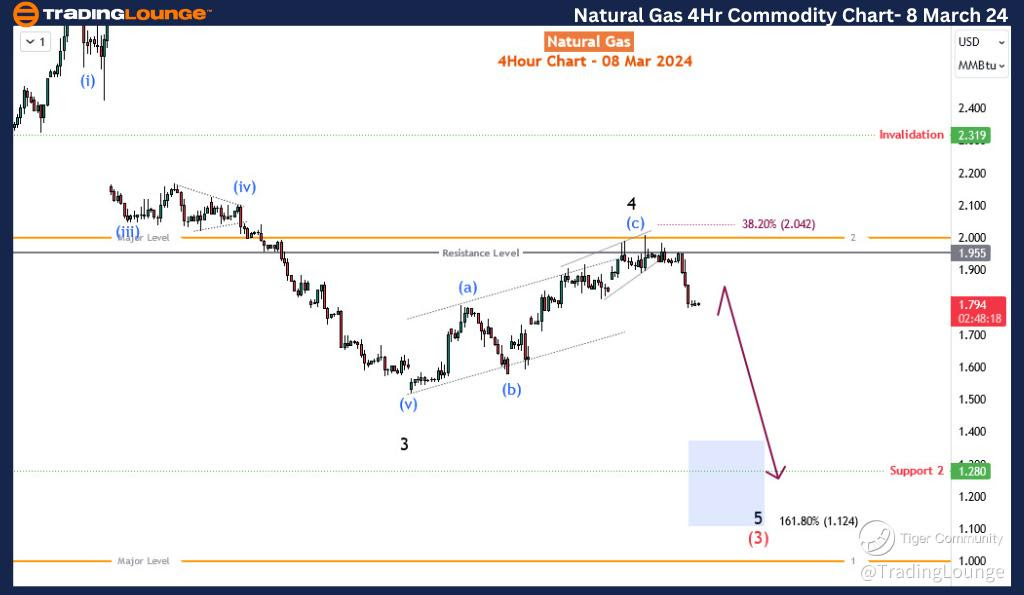

Natural Gas Daily 4-Hour Analysis, 8 March 24

Detailed analysis of the H4 chart delineates the conclusion of wave 4, characterized by a zigzag pattern, with wave (c) culminating in a diagonal formation. The breach beneath the diagonal boundary serves as an early indication of an impending decline in wave 5, ultimately leading to the completion of wave (3). Consequently, a further descent toward the range of 1.28-1.124 (constituting the 161.8% Fibonacci extension of wave 1-3 from 4) is anticipated. Any unforeseen surge beyond 2.319 would invalidate this projection, although such an outcome appears improbable. Looking ahead, the projected culmination of wave (3) does not signify the conclusion of the overall bearish progression initiated in 2022, as wave (4) pullback and wave (5) sell-off remain imminent within this bearish sequence.

In summation, Natural Gas is poised for a continued downward trajectory. By extrapolation, the bearish trend stemming from August 2022's $10 mark could persist, potentially reaching $1 in the ensuing months.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WTI Crude Oil

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.