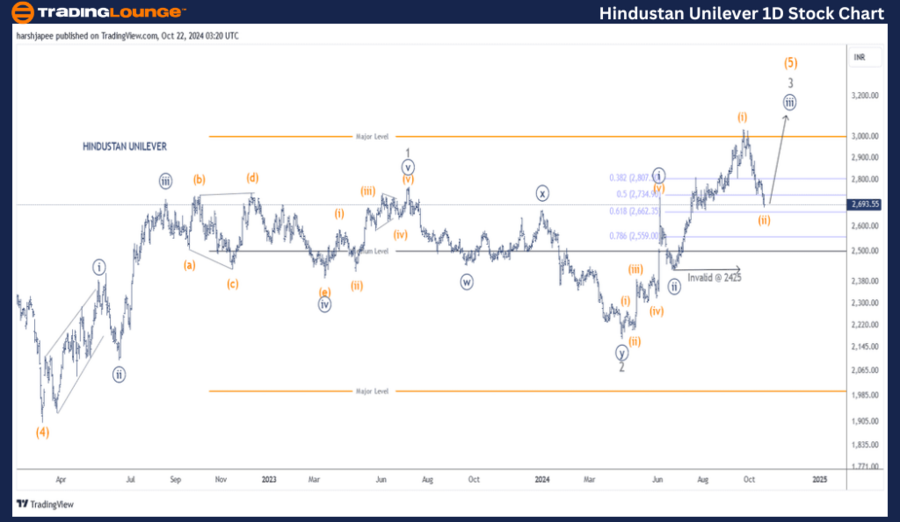

HINDUSTAN UNILEVER – HINDUNILVR Elliott Wave Analysis (1D Chart)

HINDUNILVR Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) Navy is moving higher within Minor Wave 3 Grey of Intermediate Wave (5) Orange, against the key support level of 2425. Currently, a corrective phase is occurring in the form of Minuette Wave (ii) Orange, before the upward trend resumes.

Invalidation Point: 2425

HINDUSTAN UNILEVER Daily Chart Technical Analysis and Elliott Wave Counts

The HINDUSTAN UNILEVER daily chart shows a strong upward trend, progressing within Minor Wave 3 Grey, targeting levels above 2170, which marks the termination of Minor Wave 2. At the time of this analysis, the stock is trading near 2675, with support expected around the 2660 level.

In March 2022, the stock completed Intermediate Wave (4) near 1890. Since then, Minor Waves 1 and 2 have formed near 2770 and 2170, respectively. The stock is now advancing within Minor Wave 3 Grey.

Minute Waves ((i)) and ((ii)) of Minor Wave 3 seem to be complete around the 2733 and 2425 levels. The ongoing Minute Wave ((iii)) is likely to extend, subdividing into five smaller waves in the coming period.

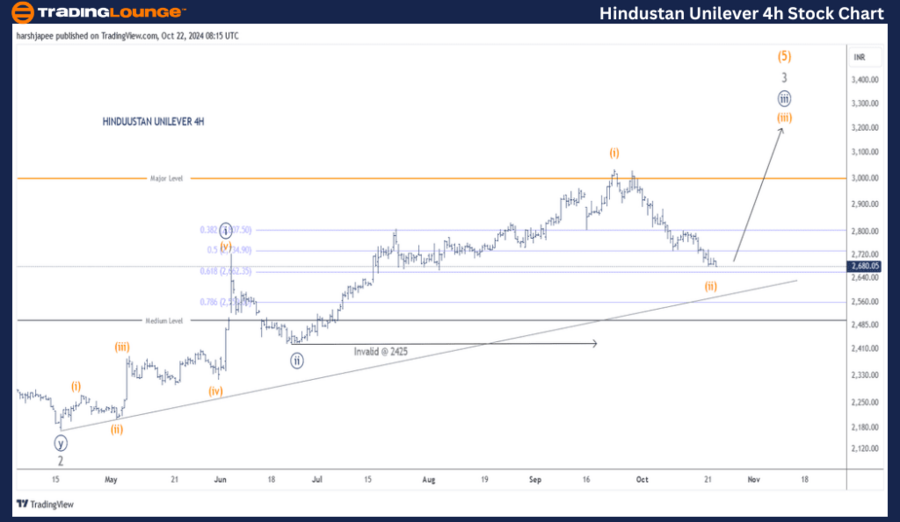

HINDUSTAN UNILEVER – HINDUNILVR Elliott Wave Analysis (4H Chart)

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) Navy is advancing within Minor Wave 3 Grey of Intermediate Wave (5) Orange, maintaining support above 2425. Currently, a corrective Minuette Wave (ii) Orange is unfolding before the rally in Minute Wave ((iii)) potentially extends.

Invalidation Point: 2425

HINDUSTAN UNILEVER 4H Chart Technical Analysis and Elliott Wave Counts

The HINDUSTAN UNILEVER 4H chart illustrates the continuation of the uptrend following the completion of Minor Wave 2 Grey near the 2170 level. Minute Waves ((i)) and ((ii)) seem complete around 2730 and 2425, respectively. With the 2425 level intact, Minute Wave ((iii)) is expected to unfold soon.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASIAN PAINTS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

HINDUSTAN UNILEVER is currently progressing within Minuette Wave (iii) Orange, part of the larger Minute Wave ((iii)) Navy, and is advancing within Minor Wave 3 Grey of Intermediate Wave (5) Orange. The key invalidation level remains at 2425.