ASX: Newmont Corporation – NEM Elliott Wave Technical Analysis – TradingLounge

Greetings,

This Elliott Wave analysis update covers Newmont Corporation (ASX: NEM), listed on the Australian Stock Exchange.

Our technical review indicates that ASX: NEM is advancing within a bullish wave three pattern. This report includes key price targets and invalidation levels to help assess the trend’s strength and sustainability.

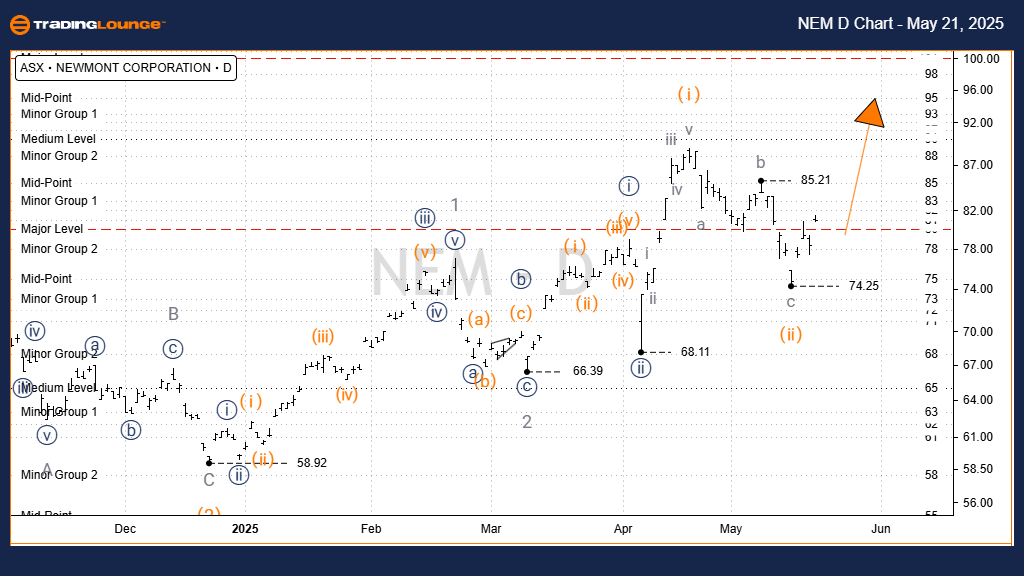

ASX: Newmont Corporation – NEM Elliott Wave Technical Analysis – Daily Chart (Semilog Scale)

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave (iii) – orange of Wave (iii) – navy of Wave 3 – grey

Analysis Overview:

The corrective wave ii) – orange appears complete at 74.25, forming a classic zigzag pattern (a, b, c – grey). Since reaching this low, wave iii) – orange has initiated an upward move, with a projected target near the 100.00 level.

Key Invalidation Level: 74.25

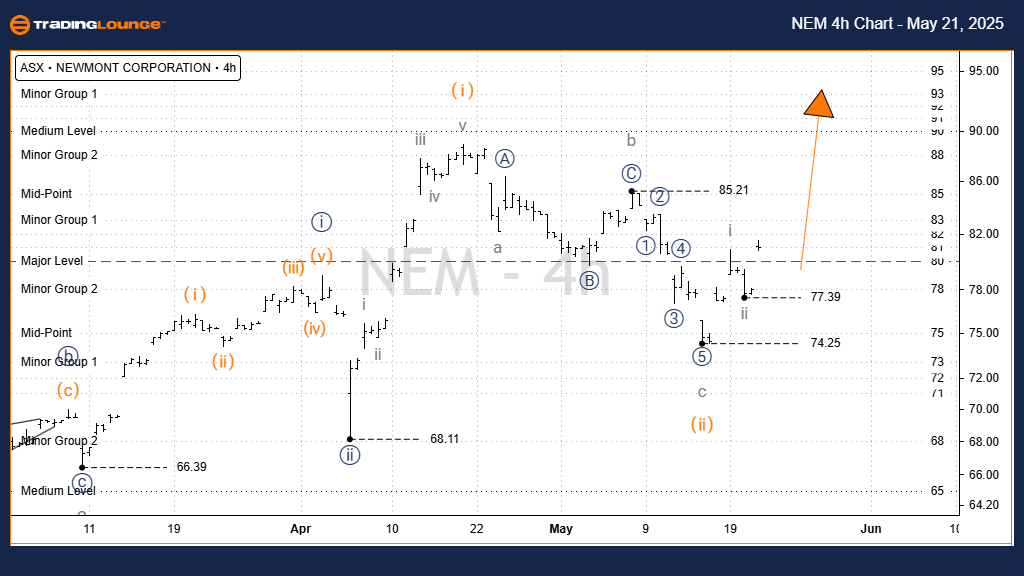

ASX: NEM Elliott Wave Technical Analysis – TradingLounge (4-Hour Chart)

Newmont Corporation

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave iii) – orange of Wave ((iii)) – navy of Wave 3 – grey

Short-Term Forecast:

Consistent with the daily chart, wave iii) – orange continues to gain strength, maintaining an upward trajectory toward 100.00. In the near term, wave iii – grey is pushing higher with a closer target around 90.00.

Key Invalidation Level: 77.39

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: COCHLEAR LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave forecast for ASX:NEM highlights both medium and short-term bullish momentum. The analysis delivers precise price objectives and invalidation markers to enhance decision-making confidence. For traders focused on ASX-listed mining stocks like Newmont Corporation, this structured technical outlook provides a reliable reference for identifying potential opportunities and risks.