COCHLEAR LIMITED (ASX: COH) – Elliott Wave Analysis by TradingLounge

Hello traders,

This updated Elliott Wave analysis provides a detailed look at COCHLEAR LIMITED (ASX:COH) trading on the Australian Securities Exchange. The recent ABC correction appears to have finalized, indicating a possible bullish impulse wave is forming. This technical review highlights key price targets, directional trends, and invalidation levels—presented through a clear visual and wave-based framework.

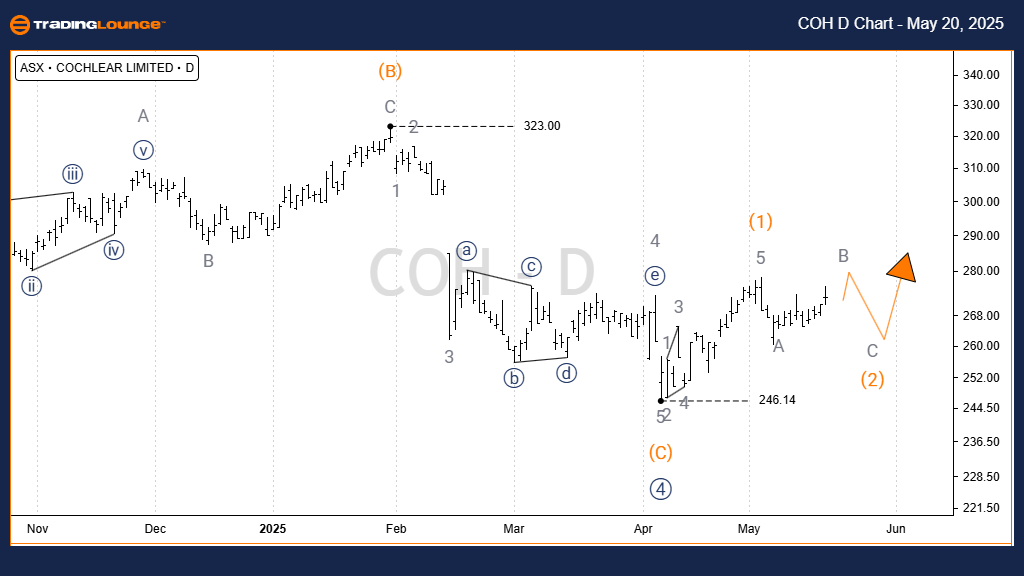

COCHLEAR LIMITED (ASX:COH) – Elliott Wave Technical Analysis 1-Day Chart (Semilog Scale) Overview

Trend: Intermediate Degree (Orange)

Market Mode: Motive

Wave Structure: Impulse

Current Elliott Wave Position: Wave 5))-navy

Summary:

Wave 4))-navy has likely completed an A,B,C)-orange corrective formation. This sets the stage for wave 5))-navy to continue the upward movement. A bullish extension may lead the stock price back toward the previous high near the wave 3))-navy level at $350.00.

Invalidation Level: $246.14

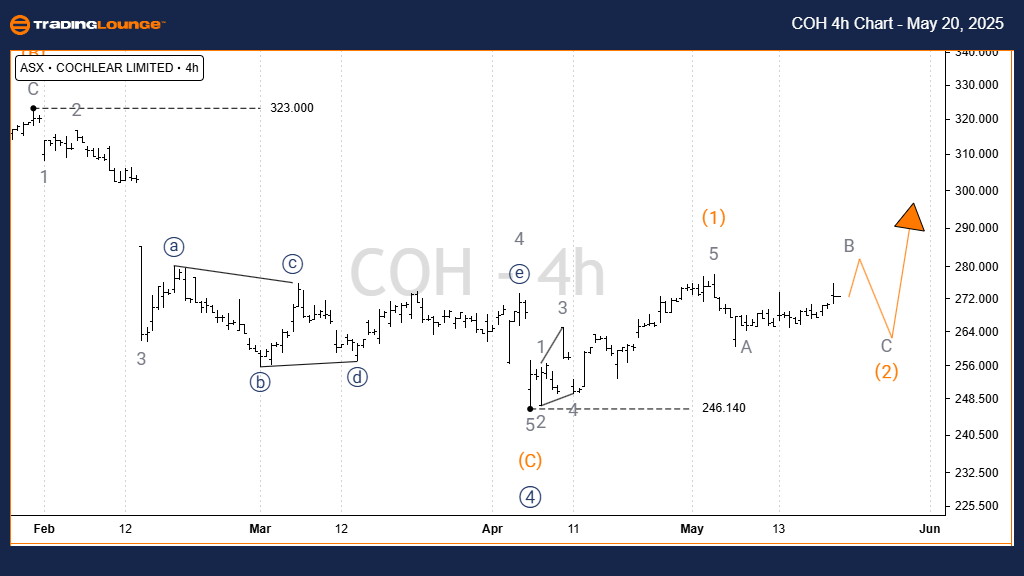

COCHLEAR LIMITED (ASX:COH) – Elliott Wave Technical Analysis 4-Hour Chart Breakdown

Trend: Intermediate Degree (Orange)

Market Mode: Motive

Wave Structure: Impulse

Current Elliott Wave Position: Wave B-grey within Wave 2)-orange

Summary:

Starting from the $246.140 low, wave 1)-orange appears to have unfolded as a Leading Diagonal. This implies a deeper retracement might be underway in wave 2)-orange. Wave A and wave B have already played out, suggesting a final wave C-grey correction is expected. Upon completion, wave 3)-orange could mark the beginning of a strong bullish phase.

Invalidation Level: $246.140

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This comprehensive Elliott Wave forecast for COCHLEAR LIMITED (ASX:COH) maps out essential support and resistance levels and trend structures. By identifying potential pivot points and invalidation markers, traders can apply a disciplined, strategy-driven approach. Our analysis aims to deliver actionable insights based on Elliott Wave principles to support your trading strategy.

Exclusive TradingLounge Offer: $1 Two-Week Trial, then $29 Per Month - 58% Discount NOW

Access 8 analysts, 250+ markets, real-time chat rooms, AI-powered Elliott Wave charting, and portfolio tools.

Claim This Deal Now