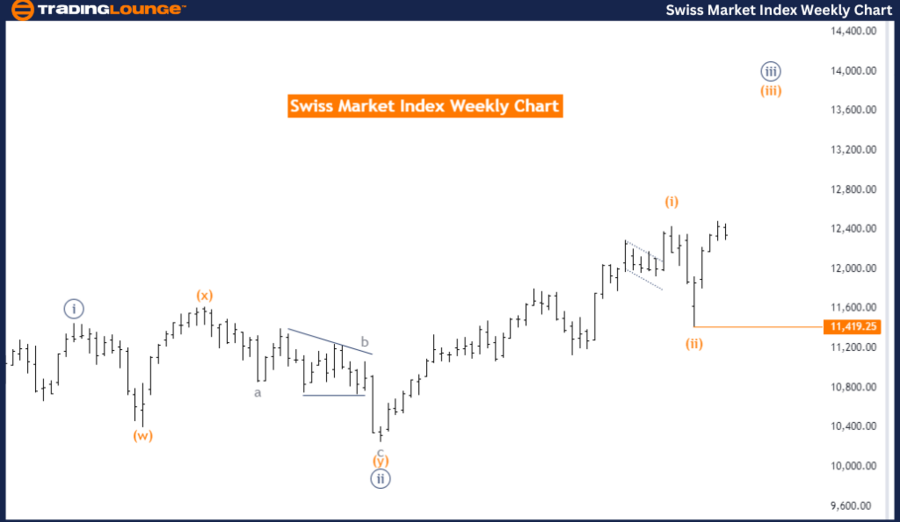

Swiss Market Index Elliott Wave Analysis Trading Lounge Day Chart

Swiss Market Index Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Gray Wave 2

POSITION: Orange Wave 3

DIRECTION NEXT HIGHER DEGREES: Gray Wave 3

DETAILS: Gray Wave 1 completed, now Gray Wave 2 is in progress. Wave Cancel Invalid level: 11,419.25

The Swiss Market Index is currently in a counter-trend phase based on Elliott Wave analysis on the Day Chart. The market is in a corrective mode, indicating a retracement phase rather than a continuous upward trend. The present wave structure is identified as Gray Wave 2, a part of the larger corrective cycle.

In terms of wave progression, the market has already completed Gray Wave 1, and Gray Wave 2 is now unfolding. This ongoing phase suggests a retracement that may continue before moving into the next wave.

The next major move is expected to be Gray Wave 3, which would signify the market resuming its broader trend once Gray Wave 2 completes. Monitoring Gray Wave 2 is essential to predict when the market will shift toward this next phase.

An important aspect of the analysis is the wave cancel invalidation level set at 11,419.25. If the market hits or surpasses this level, the current Elliott Wave count becomes invalid, meaning the projected wave structure will no longer be accurate. This level is a crucial point for traders to ensure that the wave analysis remains valid.

Summary:

The Swiss Market Index is in a corrective phase, with Gray Wave 2 currently in progress after the completion of Gray Wave 1. The anticipated next move is Gray Wave 3, which will signal a continuation of the broader trend. The wave cancel invalidation level at 11,419.25 is a critical marker for maintaining the validity of the current wave count.

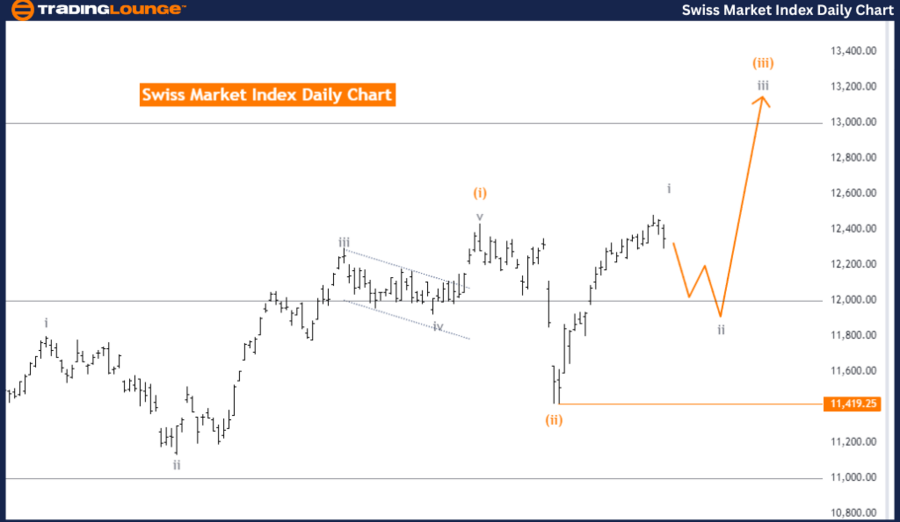

Swiss Market Index Elliott Wave Analysis Trading Lounge Weekly Chart

Swiss Market Index Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 3

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3 (started)

DETAILS: Orange Wave 2 completed, now Orange Wave 3 is in play. Wave Cancel Invalid level: 11,419.25

According to Elliott Wave analysis on the Weekly Chart, the Swiss Market Index is in a bullish trend. The market is in an impulsive mode, signifying strong price movements in line with the broader upward trend. The current structure is defined as Orange Wave 3, which represents the larger impulsive wave.

At this stage, the market is within Navy Blue Wave 3, a subwave of Orange Wave 3, suggesting that the market is undergoing significant bullish momentum. Navy Blue Wave 3 is typically characterized by stronger price moves that align with the overall upward direction.

The next higher-degree move is Orange Wave 3, which has already commenced. This wave is expected to push the market higher, further advancing the bullish trend. The completion of Orange Wave 2 has set the stage for Orange Wave 3 to take hold, indicating potential market gains ahead.

The wave cancellation invalidation level is set at 11,419.25. Should the market exceed this level, the current Elliott Wave count would be rendered invalid, signaling that the anticipated wave structure no longer applies. This invalidation level is vital for traders and analysts to track the validity of the ongoing wave analysis.

Summary:

The Swiss Market Index is in a strong bullish trend, with Orange Wave 3 in progress following the completion of Orange Wave 2. The market is positioned within Navy Blue Wave 3, and further upward momentum is expected. The wave cancellation invalidation level is set at 11,419.25, making it essential for maintaining the accuracy of the current Elliott Wave count.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NASDAQ Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support