ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis | TradingLounge

Hello Traders,

This updated Elliott Wave analysis for CAR GROUP LIMITED (ASX:CAR), traded on the Australian Stock Exchange, reflects the latest chart data. According to our current assessment, the stock has recently concluded a corrective phase marked as Wave (4) – orange, identified as a Zigzag structure. This completion suggests the potential start of a bullish Wave (5) move, highlighting possible upward price action. The overview below outlines expected market direction along with important support and resistance levels derived from Elliott Wave principles.

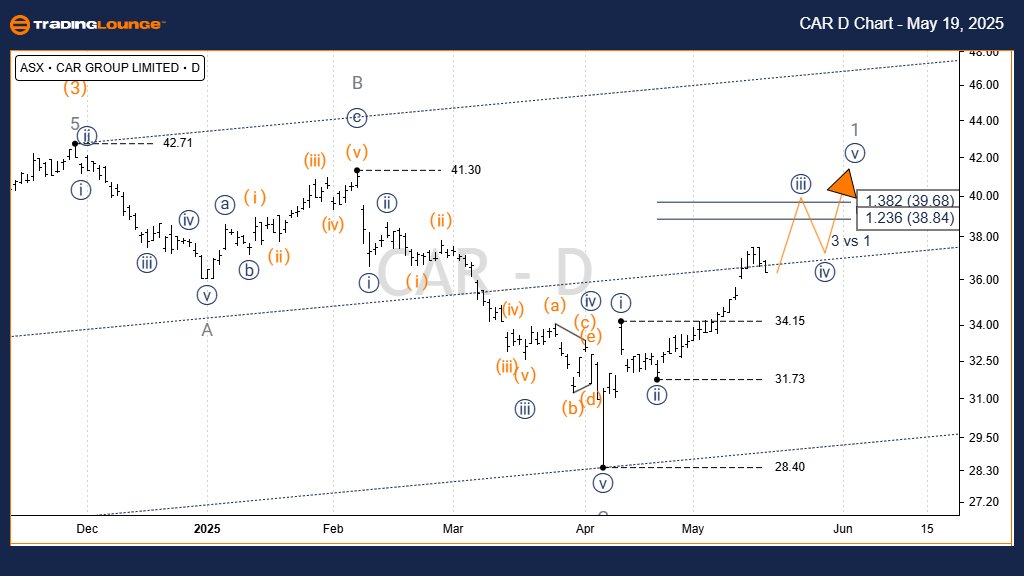

ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis 1D Chart (Semilog Scale) Review

Trend Level: Intermediate (orange label)

Wave Type: Motive

Pattern: Impulse

Wave Status: In Wave iii)) – navy, inside Wave (5) – orange

Technical Breakdown:

Wave (4) – orange is likely complete near the $28.40 mark, forming a Zigzag composed of subwaves A, B, and C (grey). The final leg, subwave C, appears to be a finished five-wave impulse, reinforcing the start of Wave (5) – orange. Currently, Wave iii)) – navy is advancing toward the resistance zone between $39.68 and $40.00.

Critical Support (Invalidation Level):

A price drop below $31.73 would invalidate this wave count and require reevaluation of the Elliott structure.

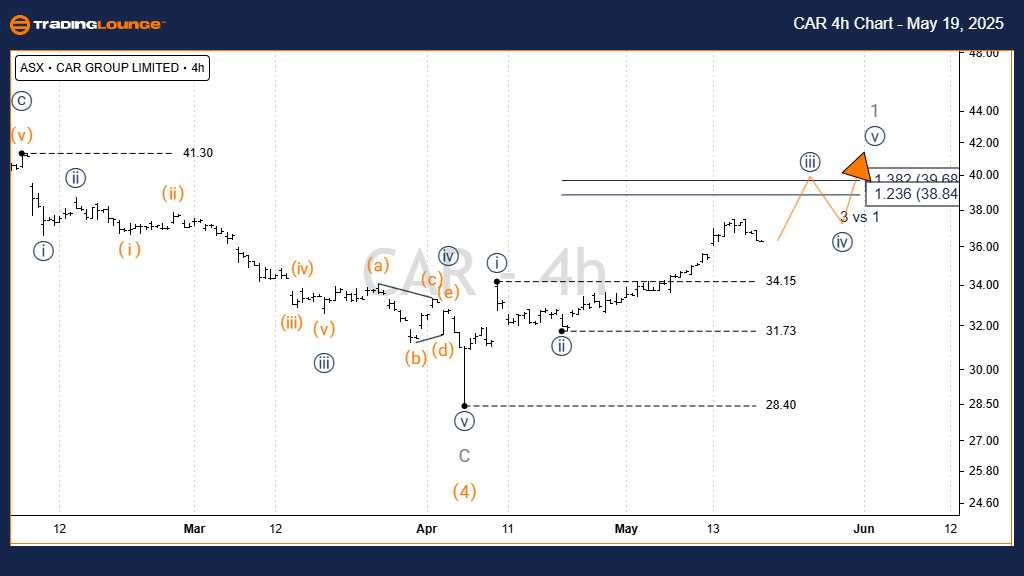

ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

Trend Level: Minor (grey label)

Wave Type: Motive

Pattern: Impulse

Wave Status: In Wave ((iii)) – navy of Wave (5) – orange

Short-Term Analysis:

Wave iii)) – navy continues from the $31.73 pivot, advancing upward. For this bullish Elliott Wave scenario to remain valid, prices must hold above $31.73.

Critical Support (Invalidation Level):

A close below $31.73 would question the current wave count and prompt a structural review.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: INSURANCE AUSTRALIA GROUP LIMITED – IAG Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave analysis for ASX: CAR GROUP LIMITED (CAR) provides a clear outlook on potential bullish momentum and technical entry levels. Key resistance and support zones are outlined to support traders in verifying wave progress or adjusting their strategies. This insight, grounded in Elliott Wave theory, strengthens the forecast confidence and aids in making informed trading decisions.