ASX: ANZ GROUP HOLDINGS LIMITED – ANZ Elliott Wave Technical Analysis

Greetings, Traders!

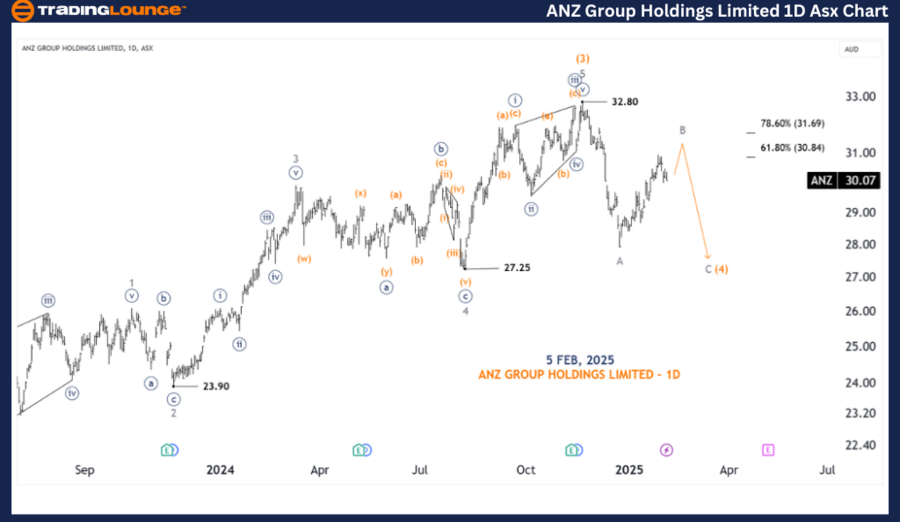

Today's Elliott Wave analysis presents an in-depth look at the Australian Stock Exchange (ASX) focusing on ANZ GROUP HOLDINGS LIMITED (ASX: ANZ).

Our latest analysis indicates that ASX: ANZ is likely to experience further downward movement in the short term. However, once the corrective wave completes, there is a strong likelihood of a bullish continuation with Wave 5.

Key Questions Addressed:

- Is this the right time to buy ANZ stocks?

- What is the best approach to entering a position?

- Where is the optimal buy entry point?

Today's technical breakdown aims to provide clarity on these essential trading decisions.

ASX: ANZ GROUP HOLDINGS LIMITED – Elliott Wave Analysis (1D Chart – Semilog Scale)

Market Structure & Wave Count:

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ((b)) – Navy of Wave 4 – Orange

ANZ Stock Analysis & Key Levels:

Critical Level – Invalidation Point:

🚨 Invalidation Level: 32.80 – Any move above this level would invalidate the current wave structure.

ASX: ANZ Group Holdings Limited – Elliott Wave Analysis (4-Hour Chart Analysis)

Market Structure & Wave Count:

- Function: Major Trend (Minor Degree, Grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave B-Grey of Wave (4) – Orange

Analysis & Key Levels:

- Wave A-Grey of Wave (4) – Orange has completed.

- Wave B-Grey is nearing its end, reaching a key resistance level.

- Once Wave B-Grey concludes, Wave C-Grey is expected to drive prices lower, finalizing the corrective phase.

Critical Level – Invalidation Point:

🚨 Invalidation Level: 32.80 – A break above this level would require a reassessment of the wave structure.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SONIC HEALTHCARE LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: ANZ GROUP HOLDINGS LIMITED (ANZ) aims to provide key insights into current market conditions and potential trading opportunities.

By identifying crucial price levels that confirm or invalidate the wave count, traders can enhance their decision-making process with greater confidence.

Leveraging technical expertise and market trends, we provide a professional, data-driven outlook for traders looking to navigate ASX: ANZ effectively.