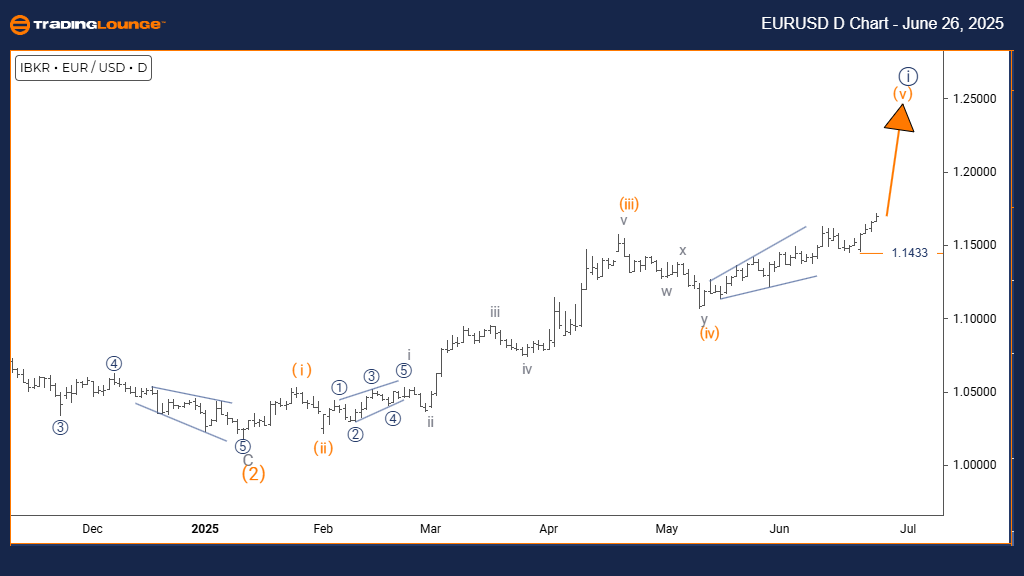

Euro/ U.S. Dollar (EURUSD) Elliott Wave Analysis – Trading Lounge Day Chart

EURUSD Elliott Wave Technical Review

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Completion of Orange Wave 4; Orange Wave 5 in progress

Wave Cancel/Invalidation Level: 1.1433

The daily EURUSD Elliott Wave chart continues to indicate a bullish market structure, driven by impulsive wave dynamics. Currently, Orange Wave 5 is underway, forming part of the larger Navy Blue Wave 1. This development suggests the final push in an extended uptrend, aligning with bullish technical expectations.

The conclusion of Orange Wave 4 supports the start of Orange Wave 5, which typically marks the final leg in an impulsive sequence. This phase often accelerates before a pullback or correction begins. The next expected movement is a corrective pattern under Navy Blue Wave 2 once this fifth wave is complete.

Traders should observe the invalidation level at 1.1433. A break below this price would invalidate the current wave count, prompting a reassessment. Until that threshold is breached, the technical outlook remains bullish with continued upward pressure likely.

From a trading perspective, EURUSD may experience additional gains as Orange Wave 5 progresses. The impulsive behavior indicates strong buying interest, but caution is advised near potential wave completion to anticipate any reversal.

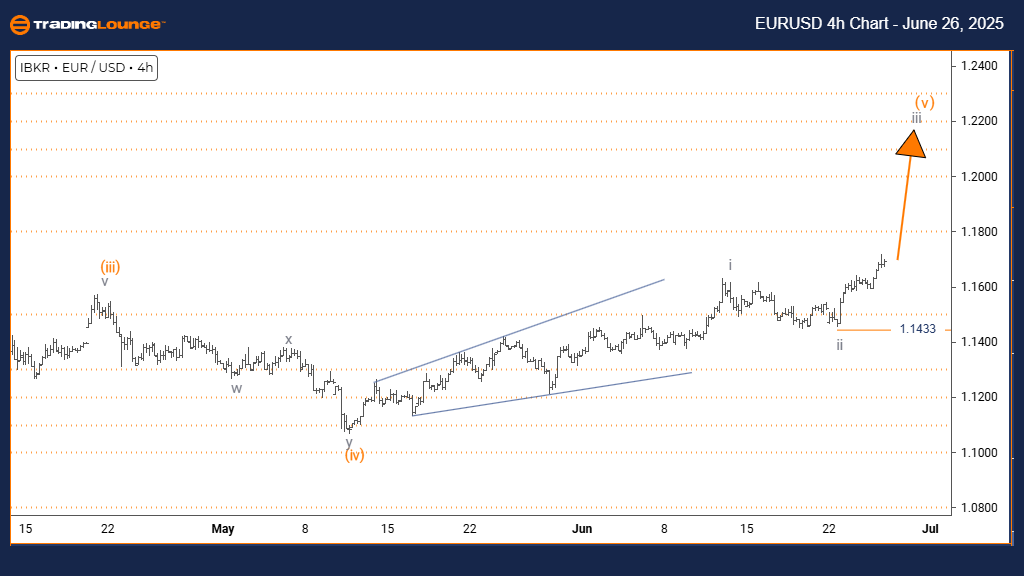

Euro/ U.S. Dollar (EURUSD) Elliott Wave Analysis – Trading Lounge 4-Hour Chart

EURUSD Elliott Wave Technical Review

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 3

POSITION: Orange Wave 5

DIRECTION NEXT HIGHER DEGREES: Gray Wave 3

DETAILS: Gray Wave 2 completed; Gray Wave 3 unfolding

Wave Cancel/Invalidation Level: 1.1433

The 4-hour chart for EURUSD reflects a strong bullish trend led by impulsive price action. The current wave, Gray Wave 3, is evolving within Orange Wave 5, signaling high momentum typical of third waves in Elliott Wave theory.

The preceding Gray Wave 2 appears finalized, giving way to Gray Wave 3, known for sharp and extended movement. This progression suggests increasing bullish sentiment, potentially driving price action further upward in the near term.

The key technical level remains at 1.1433. If EURUSD falls below this point, the current analysis becomes invalid, and a revised interpretation is needed. Holding above this level supports the ongoing bullish setup.

With Gray Wave 3 developing, the EURUSD remains well-positioned for continued upward activity. The impulsive structure confirms sustained market interest and opens the door for further potential gains.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: EURGBP Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support