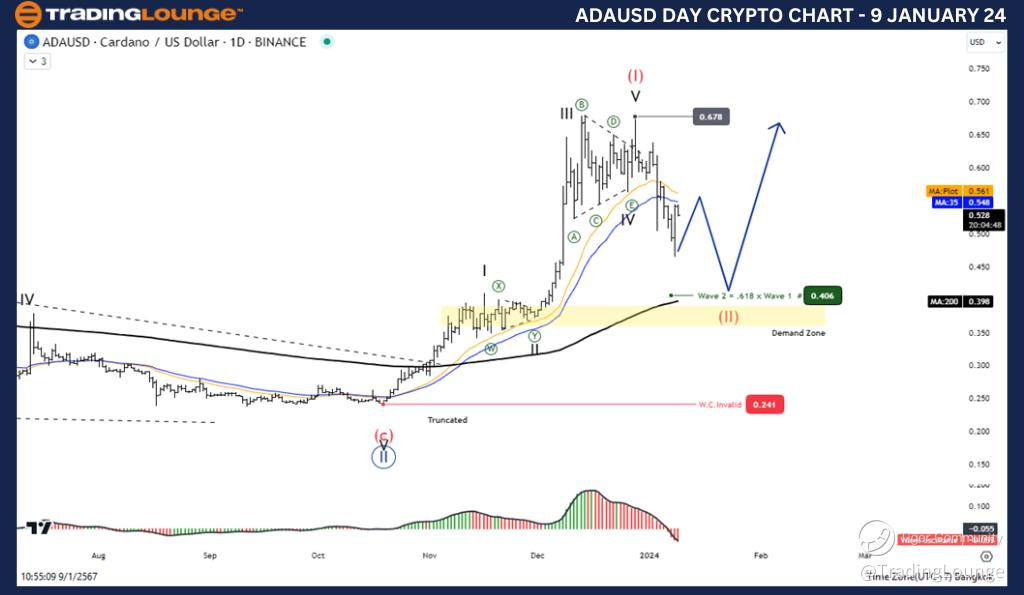

Elliott Wave Analysis TradingLounge Daily Chart, 9 January 24,

Cardano / U.S. dollar(ADAUSD)

ADAUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave A

Direction Next higher Degrees: wave (II) of Impulse

Wave Cancel invalid level: 0.241

Details: Wave (II) is Equal to 61.8% of wave (I) at 0.406

Cardano / U.S. dollar(ADAUSD)Trading Strategy: ADA's rise appears to have ended at the 0.678 level, which was a five-wave Impulse rally in Wave 1. Therefore, the next price structure is a Wave 2 correction pattern with a retracement level of 61.8. % Wave 1, so wait for Wave 2 to complete for an opportunity to rejoin the uptrend.

Cardano / U.S. dollar(ADAUSD)Technical Indicators: The price is Above the MA200 indicating an uptrend, Wave Oscillator is a bearish Momentum.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: Tradinglounge.com get trial here!

Elliott Wave Analysis TradingLounge 4H Chart, 9 January 24,

Cardano / U.S. dollar(ADAUSD)

ADAUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave A

Direction Next higher Degrees: wave (II) of Impulse

Wave Cancel invalid level: 0.241

Details: Wave (II) is Equal to 61.8% of wave (I) at 0.406

Cardano / U.S. dollar(ADAUSD)Trading Strategy: ADA's rise appears to have ended at the 0.678 level, which was a five-wave Impulse rally in Wave 1. Therefore, the next price structure is a Wave 2 correction pattern with a retracement level of 61.8. % Wave 1, so wait for Wave 2 to complete for an opportunity to rejoin the uptrend.

Cardano / U.S. dollar(ADAUSD)Technical Indicators: The price is below the MA200 indicating a dowtrend, Wave Oscillators a bearish Momentum.