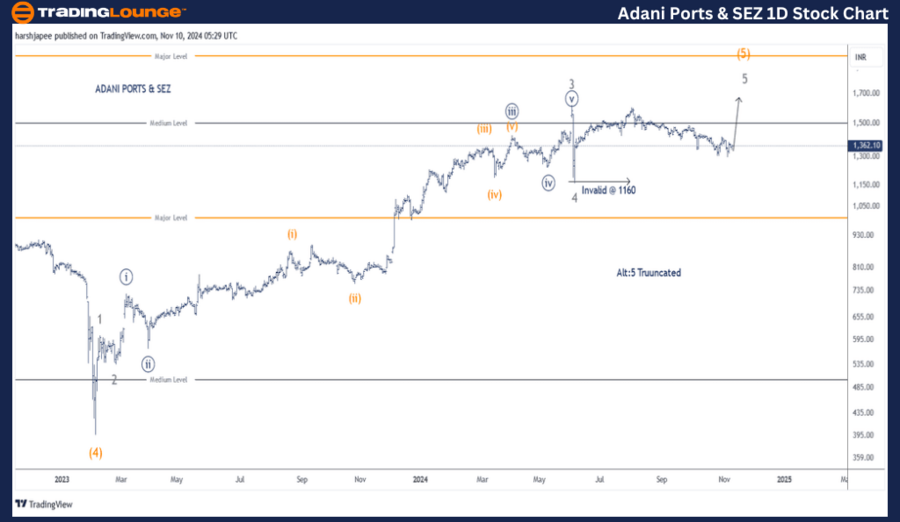

ADANI PORTS and SEZ – ADANIPORTS Elliott Wave Analysis (1D Chart)

ADANIPORTS Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 5 Grey

Details:

- Minor Wave 5 Grey is advancing within Intermediate Wave (5) Orange, moving higher above the 1160 mark.

- Alternatively, Minor Wave 5 Grey might have already ended near 1630 (truncation), leading to a downward trend.

Invalidation Point: 1160

ADANI PORTS & SEZ Daily Chart Technical Analysis and Potential Elliott Wave Counts:

The daily chart for ADANI PORTS & SEZ reflects a continued rally. The stock is currently in Minor Wave 5 of Intermediate Wave (5) Orange, with a potential to break the 1600 level. The crucial support for maintaining the bullish momentum is the 1160 low, marking the end of Minor Wave 4.

- Intermediate Wave (4) Orange concluded near the 395 level in February 2023.

- The upward movement can be subdivided into five waves: Minor Waves 1 through 4 have completed, while Wave 5 is actively forming.

- Minor Wave 3 was extended, which is typical of impulsive structures.

If the current structure holds, prices are expected to rise from the 1360 level, pushing towards and above 1600. However, a break below 1160 would signal a possible trend reversal.

ADANI PORTS and SEZ – ADANIPORTS (4H Chart) Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minor Wave 5 Grey

Details:

- Minor Wave 5 Grey is progressing within Intermediate Wave (5) Orange, maintaining support above 1160.

- Minute Waves ((i)) and ((ii)) appear to have completed around the 1600 and 1300 levels, respectively.

- If this structure holds, Minute Wave ((iii)) should begin soon.

- Alternatively, if Minor Wave 5 Grey ended at 1630 (truncation), the stock may reverse to a bearish trend.

Invalidation Point: 1160

ADANI PORT & SEZ 4H Chart Technical Analysis and Potential Elliott Wave Counts:

The 4-hour chart for ADANI PORT & SEZ illustrates the subwaves following the completion of Minor Wave 4 around 1160 on June 6, 2024.

- Minute Waves ((i)) and ((ii)) within Minor Wave 5 appear completed at the 1600 and 1300 levels, respectively.

- If the structure remains intact, prices are expected to stay above 1160 as Minute Wave ((iii)) unfolds.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: WIPRO Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

ADANI PORT & SEZ remains in an upward trajectory within Minor Wave 5 of Intermediate Wave (5), with critical support at 1160 and a target above the 1600 level.