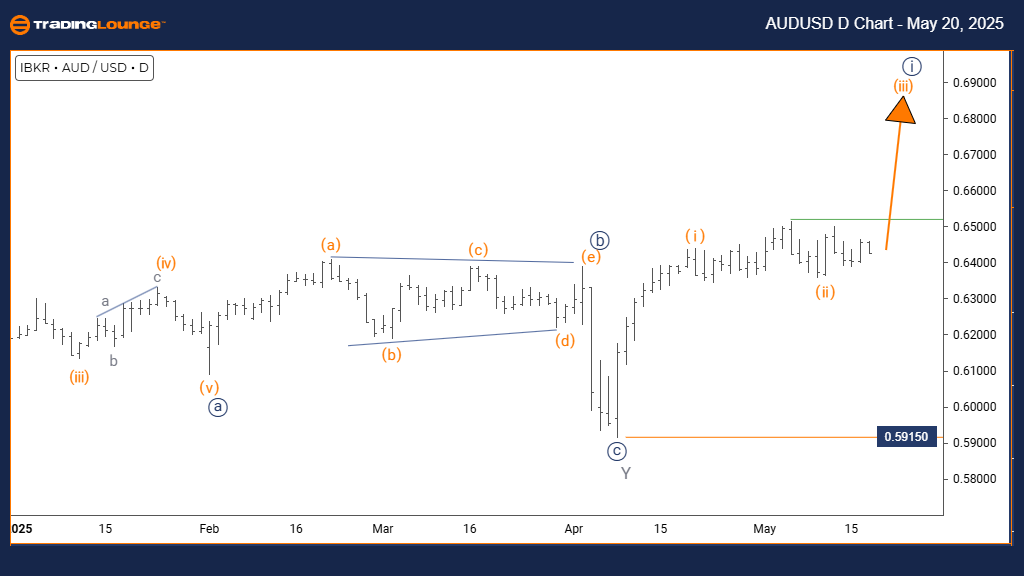

Australian Dollar/U.S. Dollar (AUDUSD) – Daily Chart | Trading Lounge

AUDUSD Technical Summary: Elliott Wave Viewpoint

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

NEXT LOWER DEGREE MOVE: Orange Wave 4

DETAILS: Completion of Orange Wave 2 observed; Orange Wave 3 in progress

INVALIDATION LEVEL: 0.59150

The AUDUSD daily chart signals a bullish trajectory, highlighted by the advance within orange wave 3, which aligns under the larger navy blue wave 1 structure. The preceding orange wave 2 correction has concluded, initiating a typical impulsive leg known for its strength and directional momentum.

The ongoing formation of orange wave 3 indicates sustained buying interest. The pattern aligns with broader bullish cycle expectations, suggesting that price could continue to rise in the near term. The critical invalidation point is 0.59150. A decline below this level would invalidate the current wave structure and potentially introduce a shift in trend.

This technical formation allows traders to position for a potential extension within orange wave 3, with a future correction anticipated in orange wave 4. The setup supports a constructive market stance as long as the price remains above the invalidation zone.

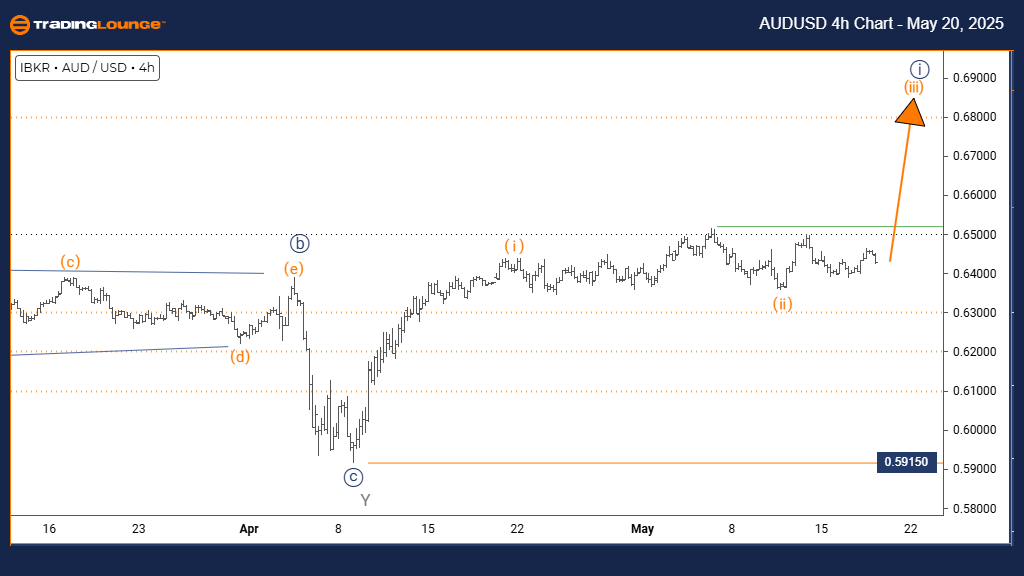

Australian Dollar/U.S. Dollar (AUDUSD) – 4H Chart | Trading Lounge

AUDUSD Technical Summary: Elliott Wave Viewpoint

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

NEXT HIGHER DEGREE MOVE: Ongoing Orange Wave 3

DETAILS: Orange Wave 2 likely completed; Orange Wave 3 started

INVALIDATION LEVEL: 0.59150

On the 4-hour timeframe, AUDUSD continues its upward trajectory, with orange wave 3 developing strongly within navy blue wave 1. The pair has likely completed its orange wave 2 retracement and moved into a forceful advancing wave phase.

Orange wave 3 typically delivers robust price movement. Current momentum supports a bullish perspective. As long as the pair holds above the invalidation point at 0.59150, the upward scenario remains intact. Any move below this level would contradict the impulsive structure and may imply corrective behavior.

This analysis helps traders identify entry points with controlled risk. The strength of orange wave 3 could present notable upward opportunities, while vigilance near the invalidation level is essential to manage potential reversals.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: USDCHF Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Exclusive TradingLounge Offer: $1 Two-Week Trial, then $29 Per Month - 58% Discount NOW

Access 8 analysts, 250+ markets, real-time chat rooms, AI-powered Elliott Wave charting, and portfolio tools.

Claim This Deal Now