KOSPI Composite Elliott Wave Analysis – Trading Lounge Day Chart

KOSPI Composite Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy blue wave 1

Next Lower Degrees Direction: Orange wave 4

Invalidation Level: 2381.93

The daily KOSPI Composite Elliott Wave analysis points to a developing trend with impulsive momentum. The current wave structure highlights orange wave 3, signaling a strong upward movement, characteristic of a third wave in a five-wave Elliott Wave sequence. This wave is positioned within navy blue wave 1.

Key Observations:

- Orange wave 2 (the corrective phase) appears to have completed.

- Orange wave 3 is now active, pushing the market higher. As a third wave, it typically generates the most powerful gains in an impulsive wave cycle.

- Orange wave 4 is expected to follow, representing the next corrective phase after the completion of orange wave 3.

- A pullback in wave 4 may occur before the continuation of an upward trend in wave 5.

- If the price falls below 2381.93, the current wave structure becomes invalid, potentially altering the bullish forecast.

Summary:

The daily KOSPI Composite chart indicates a robust upward trend driven by orange wave 3, following the completion of the corrective orange wave 2. As long as the price stays above the 2381.93 level, the Elliott Wave structure remains valid. A corrective phase in wave 4 is expected after wave 3 completes, with the bullish trend likely to resume in wave 5.

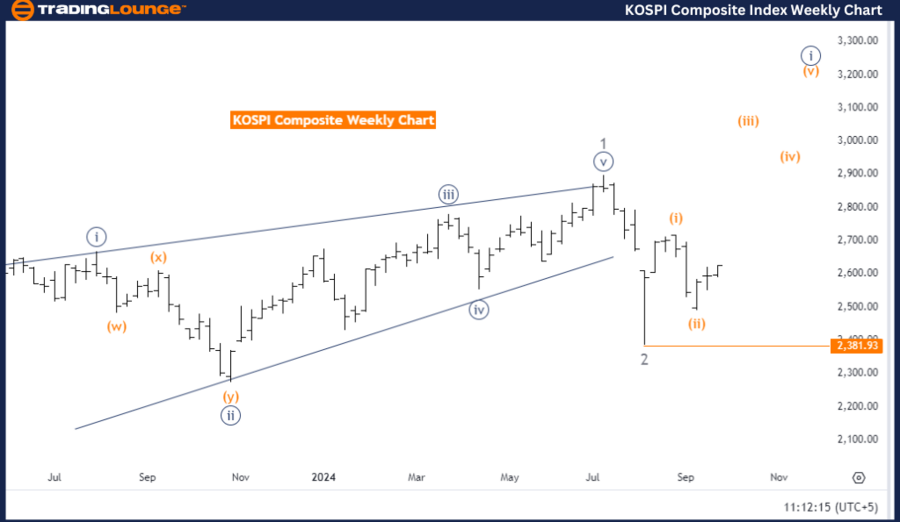

KOSPI Composite Elliott Wave Analysis – Trading Lounge Weekly Chart

KOSPI Composite Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy blue wave 1

Next Lower Degrees Direction: Orange wave 4

Invalidation Level: 2381.93

The weekly KOSPI Composite Elliott Wave analysis reveals a strong bullish trend, following an impulsive wave structure. The current wave, orange wave 3, highlights a phase of upward momentum, typical of the strongest part of the Elliott Wave cycle. This wave is positioned within navy blue wave 1, indicating that the trend is still in its early stages.

Key Observations:

- Orange wave 2, a corrective phase, appears to be completed.

- Orange wave 3 is now in progress, propelling the market higher with strong bullish momentum.

- Orange wave 4 is expected as the next phase, likely introducing a brief correction after wave 3 concludes. This correction could lead to continued upward movement in wave 5.

- The wave structure holds as long as the price remains above the invalidation level of 2381.93. A price drop below this level would invalidate the current Elliott Wave count and suggest a possible trend reversal.

Summary:

The KOSPI Composite weekly chart demonstrates a continuing upward trend, driven by the strength of orange wave 3 after the completion of the corrective orange wave 2. As long as the price remains above 2381.93, the bullish outlook persists. A minor correction in orange wave 4 is expected after wave 3 completes, followed by a continuation of the upward trend in wave 5.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: NASDAQ Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support