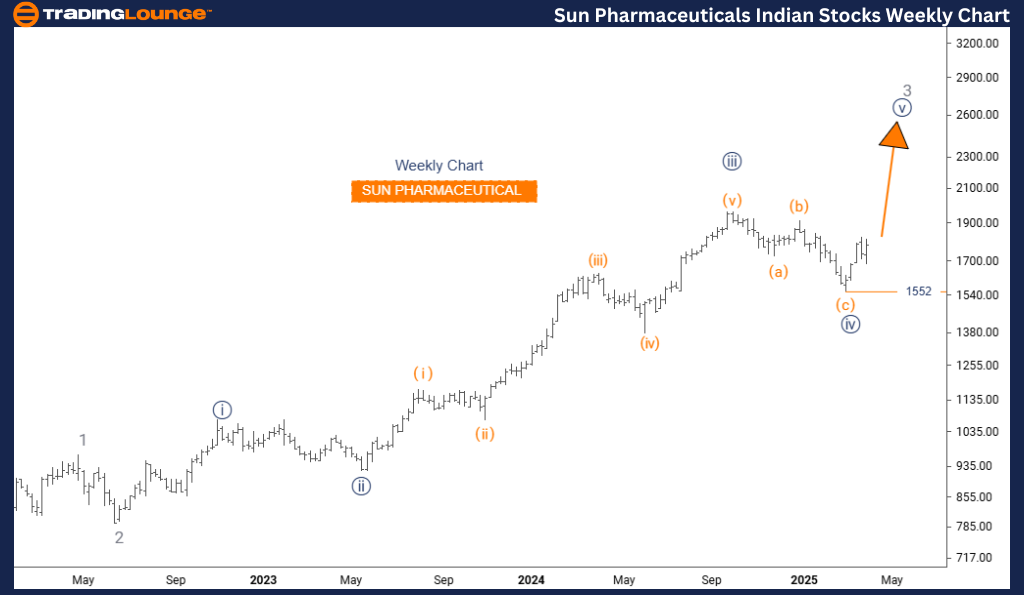

SUN PHARMACEUTICAL Elliott Wave Analysis – TradingLounge Daily Chart

SUN PHARMACEUTICAL Daily Chart Analysis

SUN PHARMACEUTICAL Elliott Wave Technical Analysis

Technical Overview

- Function: Uptrend Continuation

- Wave Mode: Impulsive Structure

- Current Pattern: Navy Blue Wave 5

- Wave Position: Gray Wave 3

- Anticipated Direction (Lower Degree): Gray Wave 4

- Critical Invalidation Level: 1552

SUNPHARMA Analysis Summary

The daily Elliott Wave analysis for SUN PHARMACEUTICAL highlights a strong bullish market structure, nearing its final stage. The current focus is on the development of navy blue wave 5, which forms the last component of the broader gray wave 3 trend cycle.

With navy blue wave 4 completed, the stock has entered its last impulsive segment, confirming the maturity of the ongoing uptrend that began from gray wave 1. This signals a potential short-term upside before a corrective phase.

SUNPHARMA Technical Outlook

The key support level stands at 1552—a breach of this would invalidate the active Elliott Wave count. So long as prices remain above this threshold, the bullish scenario is considered intact.

Post the completion of navy blue wave 5, a pullback into gray wave 4 is likely. This correction could offer traders a strategic entry before another potential bullish leg unfolds.

SUNPHARMA Trading Strategy

Traders should be alert for typical fifth wave characteristics, such as momentum divergence or slowing volume, which often precede market reversals. Although the trend supports holding long positions, caution is essential as the final wave advances.

This stage might be one of the last favorable opportunities to trade the current uptrend in SUN PHARMACEUTICAL stock, based on Elliott Wave forecasting.

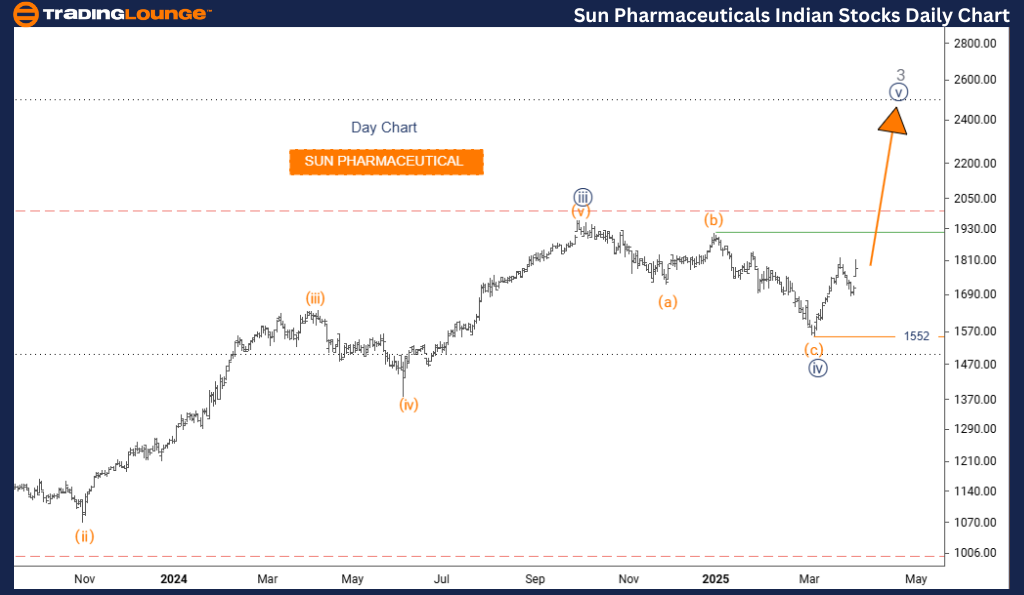

SUN PHARMACEUTICAL Elliott Wave Analysis – TradingLounge Weekly Chart

SUN PHARMACEUTICAL Elliott Wave Technical Analysis

SUNPHARMA Technical Overview

- Function: Uptrend Continuation

- Wave Mode: Impulsive Structure

- Current Pattern: Navy Blue Wave 5

- Wave Position: Gray Wave 3

- Anticipated Direction (Lower Degree): Gray Wave 4

- Critical Invalidation Level: 1552

SUNPHARMA Analysis Summary

The weekly Elliott Wave chart for SUN PHARMACEUTICAL maintains a bullish outlook, identifying the final impulse wave in an extended upward trend. The analysis is focused on navy blue wave 5, part of the larger gray wave 3 formation.

With navy blue wave 4 now complete, the market has entered navy blue wave 5, potentially marking the end of a significant bullish cycle that started with gray wave 1.

SUNPHARMA Technical Outlook

The invalidation level is firmly set at 1552. A drop below this value would disrupt the current wave structure. Until then, navy blue wave 5 remains dominant, indicating further upside momentum.

Following the conclusion of this wave, a corrective move into gray wave 4 is anticipated. This phase could transition the market into a consolidation or reversal zone.

SUNPHARMA Trading Strategy

Wave 5 phases are typically associated with the final leg of an uptrend, making it essential to watch for signals like momentum divergence or reduced buying pressure. While the bullish bias remains valid, risk management becomes increasingly important at this stage.

This current wave setup provides a strategic opportunity for swing and position traders, while also suggesting preparation for possible trend exhaustion.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: EICHER MOTORS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support