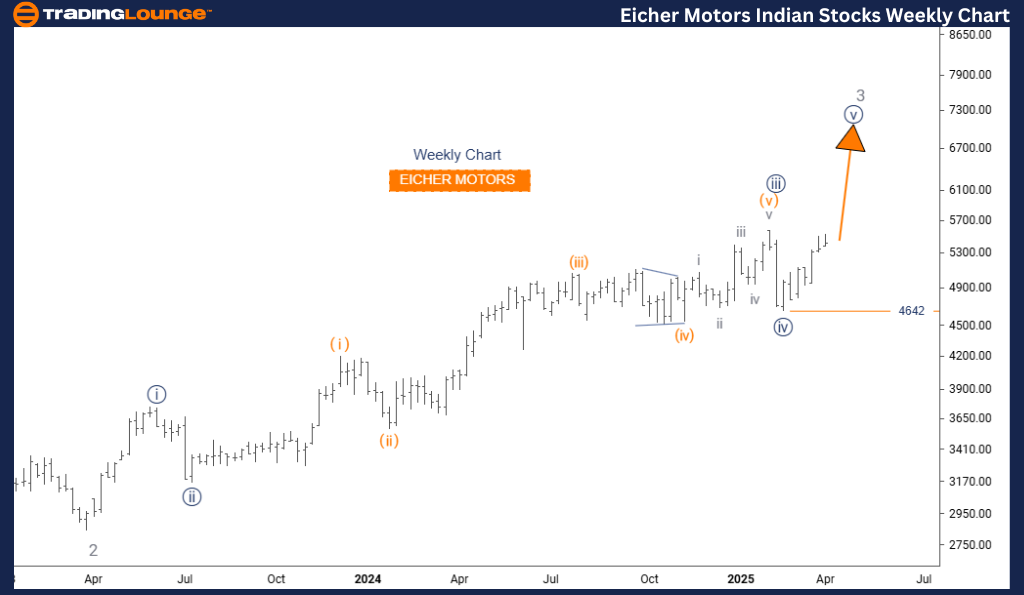

EICHER MOTORS – Elliott Wave Technical Analysis | Daily Chart

EICHERMOTO Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 5

Current Position: Gray Wave 3

Next Lower Degree Direction: Gray Wave 4

Invalidation Level: 4642

Analysis Summary

The Elliott Wave daily chart for EICHER MOTORS maintains a strong bullish trend. The stock is moving in navy blue wave 5, signaling the last impulsive leg of gray wave 3.

After confirming the end of navy blue wave 4, analysts identify the market entering the final upward phase—navy blue wave 5. This move suggests the current wave cycle, which began at gray wave 1, is nearing the top of this bullish momentum.

Technical Insights

- The invalidation level stands at 4642. Any movement below this level would question the present wave count.

- Completion of navy blue wave 5 is expected to lead to a corrective gray wave 4, before potentially continuing in gray wave 5.

- This wave reflects both short-term trading potential and a critical segment of the medium-term trend.

Key traits to watch during this phase:

- Divergences in momentum indicators

- Slowing price movement

- Signals indicating correction or reversal

Conclusion

The bullish outlook holds, but caution is necessary as wave 5 may be nearing its end. Traders might consider adjusting risk exposure, especially if technical indicators begin to diverge. The daily setup offers valuable insights for those tracking the final leg of the upward movement in EICHER MOTORS shares.

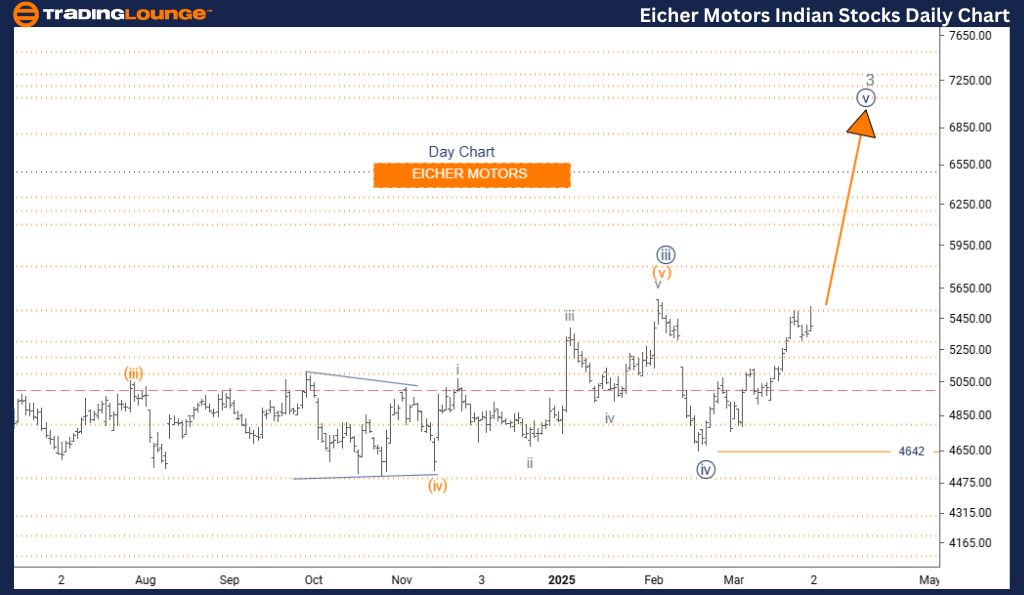

EICHER MOTORS – Elliott Wave Analysis | Weekly Chart

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 5

Current Position: Gray Wave 3

Next Lower Degree Direction: Gray Wave 4

Invalidation Level: 4642

Analysis Summary

The weekly chart for EICHER MOTORS supports a bullish Elliott Wave pattern, currently progressing through navy blue wave 5, which concludes gray wave 3. Completion of the earlier wave 4 phase implies the market is now in the terminal part of this impulse cycle.

This indicates the stock is likely in the final phase of a major bullish sequence, initiated with gray wave 1, suggesting a possible approach toward a larger correction at the gray wave level.

Technical Insights

- The critical invalidation point is at 4642. A decline below would invalidate the current structure.

- The market is inside navy blue wave 5, forming part of a larger move that will eventually close gray wave 3 and begin gray wave 4.

Typical fifth wave signals include:

- Decreasing momentum

- Lower trading volumes

- Divergences in trend-following indicators

These characteristics often point toward a maturing trend that could soon correct or consolidate.

Conclusion

The bullish structure stays intact, but it calls for vigilance. Investors should keep positions aligned with the trend but start to tighten risk limits as the wave structure nears completion. The weekly chart provides a broad view that helps traders stay positioned for both near-term gains and potential trend reversals.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASIAN PAINT Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support