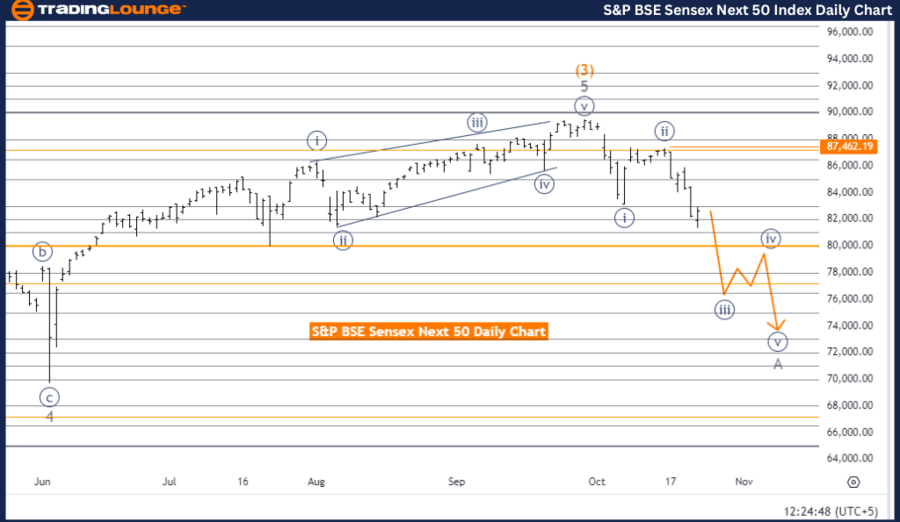

S&P BSE Sensex (India) Elliott Wave Analysis – Day Chart

S&P BSE Sensex (India) Elliott Wave Technical Analysis

Key Analysis:

The S&P BSE Sensex daily chart highlights a counter-trend movement within an impulsive mode. The primary wave structure is navy blue wave 3, with gray wave A forming the initial phase of this wave. This suggests a strong downward movement within the broader corrective phase of navy blue wave 3, signaling a potential bearish market sentiment.

Navy blue wave 2 has concluded, and navy blue wave 3 is actively unfolding. This typically signifies an impulsive downward movement within the overall corrective pattern. The market is expected to maintain this downward momentum as gray wave A continues to progress.

The current focus is on gray wave A within navy blue wave 3, which marks the initial phase of the structure. As gray wave A concludes, the next sequence in the wave will continue the downward momentum within navy blue wave 3. Traders should closely monitor the market behavior as this wave unfolds and approaches completion.

The invalidation level for this wave structure is 81,462.19. If the market breaches this level, the existing wave count will be invalidated, necessitating a reevaluation of the current Elliott Wave structure.

Summary:

Invalidation Level: 81,462.19.

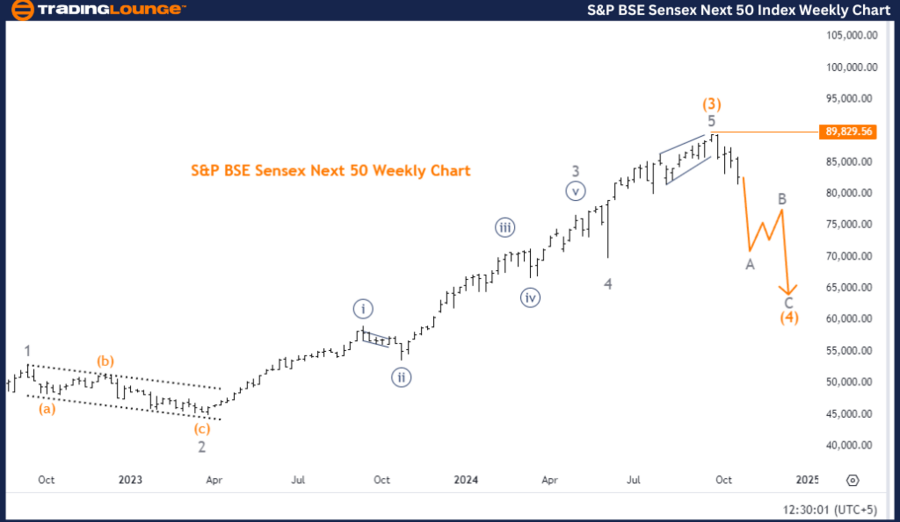

S&P BSE Sensex (India) Elliott Wave Analysis – Weekly Chart

S&P BSE Sensex (India) Elliott Wave Technical Analysis

invalidation level is 89,829.56.

Key Analysis:

The S&P BSE Sensex weekly chart reveals a counter-trend correction, indicating a retracement within the broader upward trend. The current wave structure under observation is gray wave A, which is unfolding within orange wave 4.

Orange wave 3 has concluded, marking the end of a significant upward movement. The market is now in a corrective phase, with wave A of orange wave 4 currently developing. This phase represents a temporary reversal or consolidation within the broader bullish trend. Once wave A of orange wave 4 completes, the market will transition into the next corrective phase, leading into gray wave B.

This consolidation period is typical in corrective wave structures, where the market pauses to absorb previous gains before resuming the upward trend. Traders should focus on gray wave B, which is the next higher-degree wave expected to lead the market into its next significant movement.

The invalidation level for the current wave structure is set at 89,829.56. A breach of this level will require a reassessment of the current Elliott Wave structure.

Summary:

Invalidation Level: 89,829.56.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Shanghai Composite Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support