Shanghai Composite Elliott Wave Analysis - Trading Lounge Day Chart

Shanghai Composite Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange wave 2

Position: Navy blue wave 3

Next Higher Degree: Orange wave 3

Details: The Elliott Wave analysis for the Shanghai Composite on the daily chart signals a counter-trend phase currently in a corrective mode. The ongoing structure is identified as orange wave 2, following the completion of orange wave 1. The market is positioned within navy blue wave 3, implying that the corrective phase is in progress.

With orange wave 1 completed, orange wave 2 is now developing as a retracement within the overall trend. Once this correction phase concludes, the next expected move will be orange wave 3, resuming the broader upward momentum.

The key focus is on the upcoming orange wave 3, which will likely take place after the completion of the current corrective phase. Price action may experience fluctuations during orange wave 2, as this wave signifies a temporary pullback before the continuation of the main trend.

- Wave Cancellation Level: 2684.5610 – A price drop below this level would invalidate the current wave count, requiring a reassessment of the wave structure.

Summary: The Shanghai Composite's daily chart is undergoing a corrective phase within orange wave 2, following the completion of orange wave 1. The market's position in navy blue wave 3 suggests that after the correction, an upward movement in orange wave 3 is anticipated. The key level to monitor is 2684.5610; a breach of this level would invalidate the current Elliott Wave count.

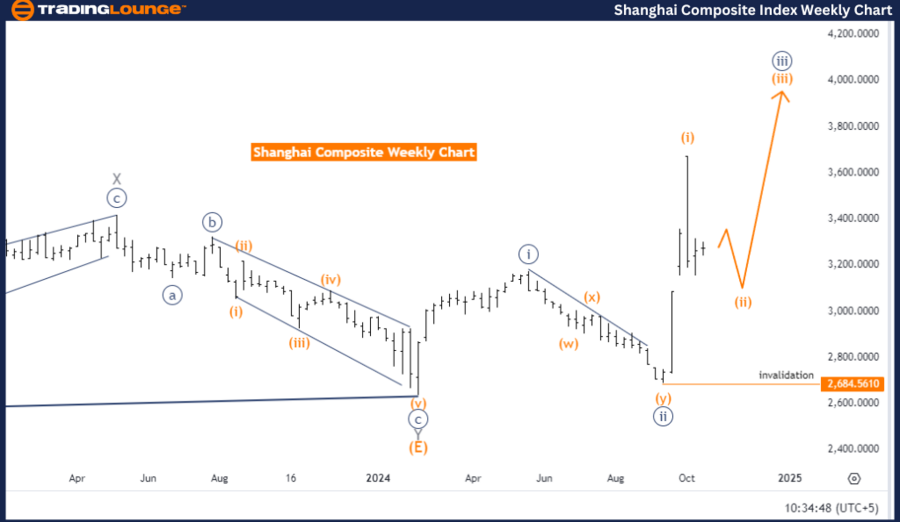

Shanghai Composite Elliott Wave Analysis - Trading Lounge Weekly Chart

Shanghai Composite Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange wave 2

Position: Navy Blue Wave 3

Next Higher Degree: Orange wave 3

Details: The Elliott Wave analysis on the weekly chart for the Shanghai Composite reveals a counter-trend correction in progress, with the market moving through orange wave 2, following the end of orange wave 1. This phase represents a temporary retracement within the broader upward trend.

Currently positioned within navy blue wave 3, the market is expected to continue higher once orange wave 2 concludes. The onset of orange wave 3 should resume the upward momentum after this corrective wave completes.

The higher-degree structure points toward the anticipated rise in orange wave 3, which is expected to take place after the current correction in orange wave 2 finishes.

- Wave Cancellation Level: 2684.5610 – A fall below this level would invalidate the current wave count, requiring a reevaluation.

Summary: The weekly chart of the Shanghai Composite is in a corrective phase within orange wave 2, following the completion of orange wave 1. The market is currently positioned in navy blue wave 3, with an upward movement expected in orange wave 3 once the correction ends. The key level to watch is 2684.5610, as a breach of this level would invalidate the current Elliott Wave count.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: DOW JONES – DJI Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support