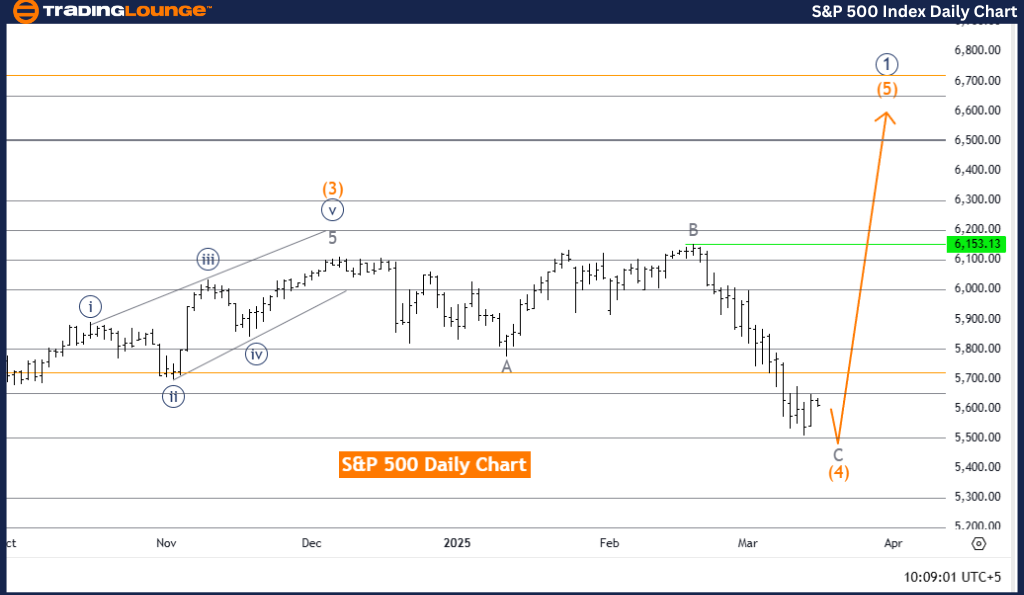

S&P 500 Elliott Wave Analysis – Trading Lounge Daily Chart

S&P 500 Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 4

Position: Navy Blue Wave 1

Next Higher Degree Direction: Orange Wave 5

Detailed Market Analysis

The S&P 500 Elliott Wave Analysis on the daily chart offers an in-depth perspective on the index’s current trend and its likely future direction.

- The market remains in a counter-trend phase, indicating corrective price action rather than a strong directional movement.

- The primary focus is Orange Wave 4, part of an ongoing correction within the broader Elliott Wave structure.

- This wave is positioned within Navy Blue Wave 1, defining its place in the long-term wave count.

- Following the completion of Orange Wave 3, the market has now entered Orange Wave 4, a phase typically characterized by sideways movement or retracements before resuming its main trend.

- Analysis suggests Orange Wave 4 is nearing completion, which signals the potential beginning of Orange Wave 5.

- The next key phase to monitor is Orange Wave 5, expected to initiate once Orange Wave 4 concludes.

- Traders should closely track Orange Wave 4’s evolution and be prepared for the transition into Orange Wave 5, which could bring renewed market momentum.

Market Insights & Trading Strategy

The S&P 500 daily chart analysis provides a structured approach to identifying key Elliott Wave patterns, helping traders anticipate market shifts and align their strategies effectively.

- Analyzing the daily chart allows traders to identify critical trend shifts, ensuring alignment with longer-term market movements.

- Recognizing wave transitions enables traders to prepare for potential entry and exit points, optimizing their trading strategies.

- Understanding the completion of one wave and the emergence of another allows for better risk management and position sizing.

- By integrating Elliott Wave principles, traders can develop a more structured trading approach, ensuring readiness for evolving market dynamics.

S&P 500 Elliott Wave Analysis – Trading Lounge Weekly Chart

S&P 500 Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 4

Position: Navy Blue Wave 1

Next Higher Degree Direction: Orange Wave 5

Detailed Market Analysis

The S&P 500 Elliott Wave Analysis on the weekly chart offers a broader perspective on the index’s market cycle, helping traders identify major trend shifts and long-term opportunities.

- The market remains in a counter-trend phase, dominated by corrective movements.

- Orange Wave 4 continues to unfold within Navy Blue Wave 1, reinforcing its place in the larger wave count.

- With Orange Wave 3 completed, the market is now transitioning into Orange Wave 4, a phase typically marked by sideways consolidation or retracements before a new trend emerges.

- Orange Wave 4 is approaching its final stages, suggesting Orange Wave 5 may soon begin.

- Traders should monitor the final developments of Orange Wave 4 and prepare for a potential shift into Orange Wave 5, which could bring renewed bullish momentum.

Market Insights & Trading Strategy

This S&P 500 weekly chart analysis provides traders with long-term insights into market cycles, allowing them to make strategic adjustments based on Elliott Wave principles.

- The weekly chart gives a macro-level perspective, helping traders identify major trend shifts and key reversal points.

- Recognizing Elliott Wave structures aids in understanding when corrective waves conclude and impulse waves resume, allowing for better trade execution.

- Adapting strategies to align with Elliott Wave projections can lead to improved risk management and market positioning.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: S&P/TSX 60 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support