NESTLE INDIA Elliott Wave Analysis | Trading Lounge Day Chart

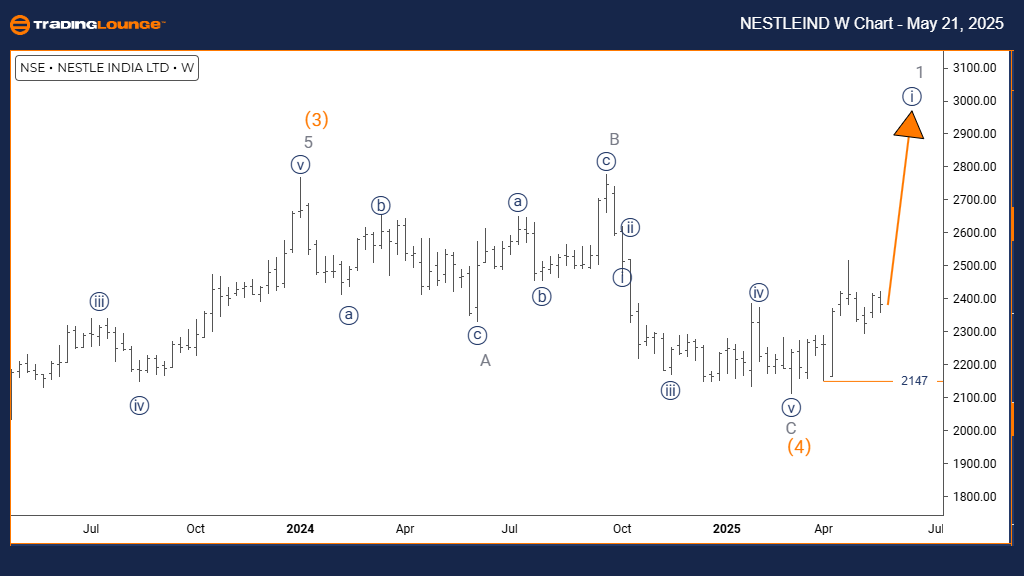

NESTLE INDIA Stock Day Chart Analysis

NESTLE INDIA Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange wave 3

POSITION: Navy blue wave 1

DIRECTION NEXT HIGHER DEGREES: Orange wave 3 (in progress)

DETAILS: Completion of orange wave 2 is likely; orange wave 3 of 1 appears to be unfolding.

Invalidation Level: 4147

The daily Elliott Wave analysis for Nestle India stock shows a bullish setup, driven by the development of orange wave 3 inside navy blue wave 1. The earlier phase, orange wave 2, has seemingly concluded, allowing the next impulsive move upward to start. This typically signifies a strong rally within the wave count.

The internal structure indicates robust buying activity, suggesting momentum will likely persist. Given its position in navy blue wave 1, the strength of this impulsive wave supports continued bullish behavior. The key invalidation point remains at 4147—any drop below that would challenge the current wave scenario.

This chart setup underlines a positive phase for Nestle India. If the wave count holds, the stock may move into a sustained upward trend. Traders should remain alert to bullish confirmations and be cautious of upcoming corrective actions post this impulse phase.

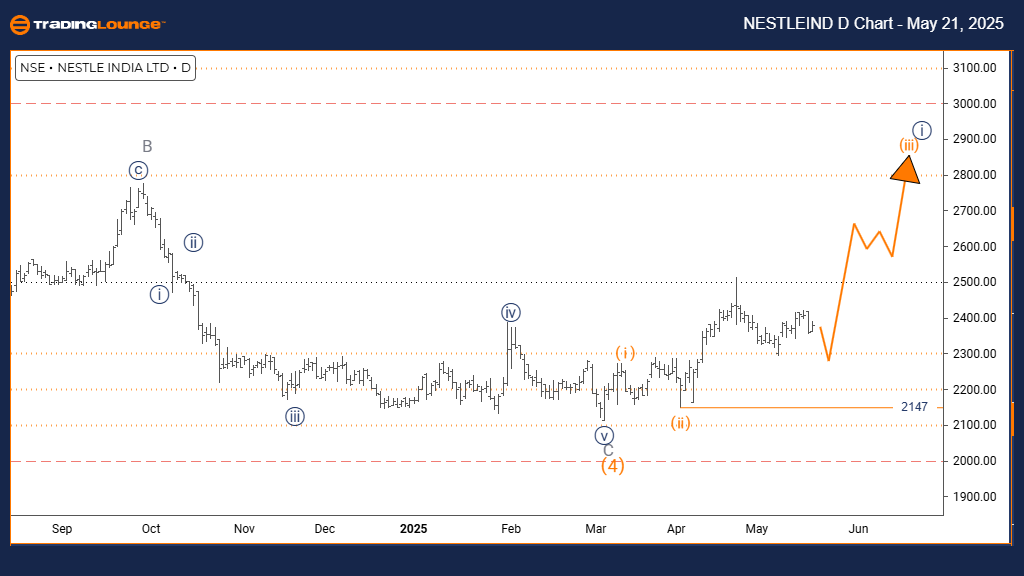

NESTLE INDIA Elliott Wave Analysis | Trading Lounge Weekly Chart

NESTLE INDIA Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy blue wave 1

POSITION: Gray wave 1

DIRECTION NEXT LOWER DEGREES: Navy blue wave 2

DETAILS: Orange wave 4 seems completed; navy blue wave 1 within gray wave 1 is advancing.

Invalidation Level: 4147

On the weekly timeframe, Nestle India continues to exhibit long-term bullish momentum. The current wave structure supports navy blue wave 1 developing inside gray wave 1, following the likely end of orange wave 4. This configuration points to the early stage of a broad upward cycle.

The impulsive behavior signals underlying strength, likely fueled by sustained buying from institutional investors. The level at 4147 acts as a crucial invalidation benchmark; breaching it would call for a reassessment of the wave count.

This scenario supports a long-term bullish outlook. The present wave 1 may precede a brief corrective move as navy blue wave 2 develops. Monitoring the price closely will be essential for confirming wave progression and managing downside risks near the invalidation level.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: HDFC BANK Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support