ASX: ORIGIN ENERGY LIMITED – ORG Elliott Wave Technical Analysis

Greetings, today’s Elliott Wave analysis for the Australian Stock Exchange (ASX) focuses on ORIGIN ENERGY LIMITED – ORG. Our insights highlight ASX:ORG moving significantly higher within wave (iii)-orange of wave ((iii))-navy. This technical review addresses whether now is an ideal time to go long or identifies the optimal entry points alongside key visual markers to confirm potential future trends.

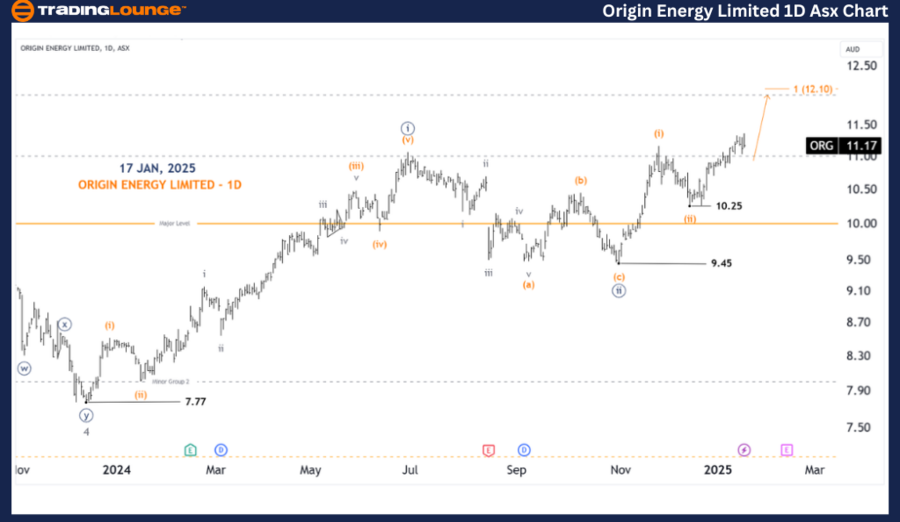

ASX: ORIGIN ENERGY LIMITED – ORG 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange of Wave ((iii))-navy

Details:

- Wave ((ii))-navy concluded at 9.45, initiating wave ((iii))-navy, which is currently extending higher.

- Wave (iii)-orange, as part of this larger structure, is expected to unfold further upward.

- A more granular view through the 4H chart analysis will provide actionable "go long" setups.

Invalidation Point: 10.25

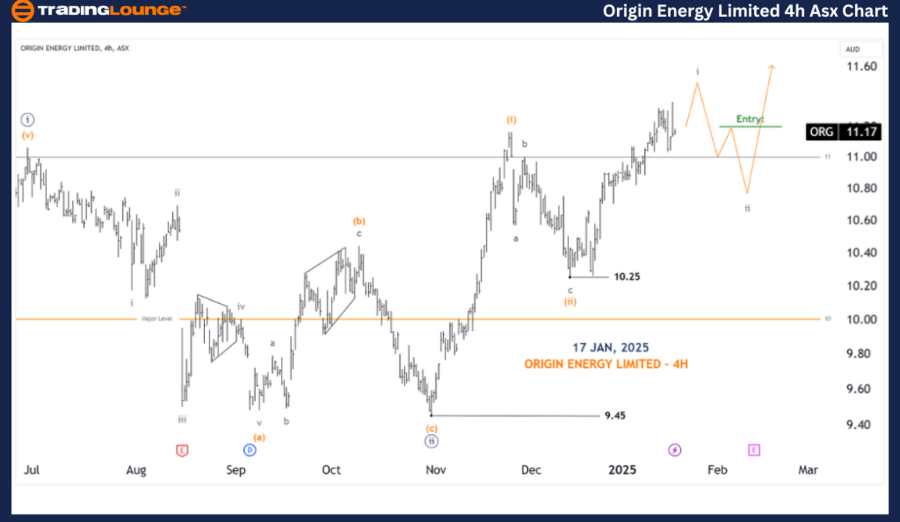

ASX: ORIGIN ENERGY LIMITED – ORG 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave i-grey of Wave (iii)-orange

Details:

- Wave iii-grey within wave (iii)-orange is advancing upward.

- Wave i-grey is nearing completion, with a possible three-wave correction (wave ii-grey) to follow.

- Once price forms a bounce and establishes 11.00 as a tested support level, it provides a favorable and safer long position.

Invalidation Point: 10.25

Key Point: Wave b of Wave ii-grey

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: COLES GROUP LIMITED – COL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our analysis for ASX: ORIGIN ENERGY LIMITED – ORG aims to deliver actionable insights into current and future market trends. By identifying specific price levels for validation and invalidation of our wave count, we enhance confidence in the forecast. These insights, combined with a detailed review of Elliott Wave structures, help traders make informed decisions about capitalizing on upcoming market movements effectively.