WTI Crudeoil Commodity Elliott Wave Technical Analysis

Function: Counter-trend for wave 2

Mode: Corrective

Structure: Impulse for wave a of 2

Position: Wave 2

Direction: Wave 3

Details: With the extended rally from 72.47, we count higher for wave 2. The structure from 72.7 is tricky, so we should wait for a 5-swing down below 80 to confirm the start of wave 3.

WTI Elliott Wave Technical Analysis

WTI crude oil is retreating after a month-long rally from June 4th to July 5th, 2024. This downside break suggests that the larger decline, which started in April 2024, has the potential to continue below the June 4th low. If the decline is not that deep, it should at least retrace 50% of the immediate rally to the April 5th low.

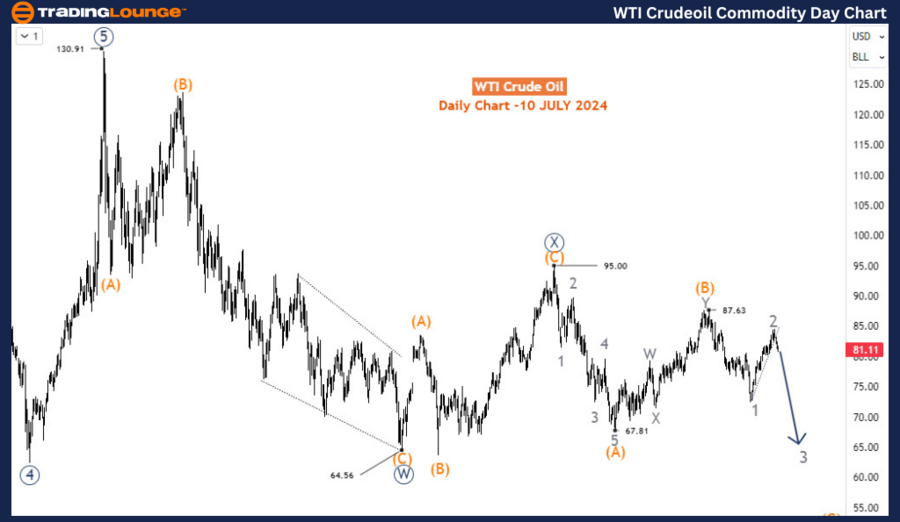

WTI Crudeoil Long-Term Analysis

In the long term, WTI is undergoing a bearish correction. This correction is a response to the impulse rallies from the COVID-19 lows to the highs during the Russia/Ukraine conflict at $130.91. The bearish correction began at $130.91 in March 2022. The daily chart reveals that the long-term bearish corrective cycle is developing into a double zigzag structure. Wave W (circled) concluded at $64.56 in March 2024, followed by wave X (circled), which finished at $95 in September 2023. Wave Y (circled) then began, potentially forming a double zigzag subdivided into waves (A)-(B)-(C). Waves (A) and (B) ended at $67.8 and $87.6 in December 2023 and April 2024, respectively. The commodity is now anticipated to decline in wave (C), which could develop into either an impulse or a diagonal 5-wave structure. It appears that waves 1 and 2 of (C) have been completed, setting the stage for a decline in wave 3.

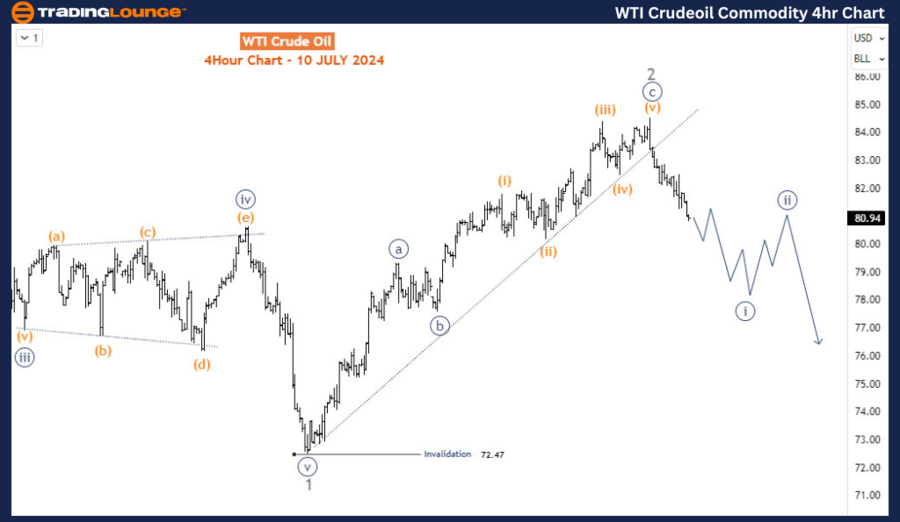

WTI Crudeoil 4-Hour Chart Analysis

On the H4 chart, wave 2 appears to have ended with a zigzag structure, followed by a downside break for wave 3. A break below $80 with an impulse wave would confirm the start of wave 3. While the downside forecast for wave 3 is not yet solidified, there is a significant chance of a continuous decline toward and below $72.47 if the price stays below the current wave 2 high of $84.5.

Conclusion

Both the long-term and H4 charts indicate that WTI crude oil is amid a bearish correction with the potential for further declines. The double zigzag structure on the daily chart and the zigzag completion on the H4 chart suggest that the price is likely to continue its downward trajectory. By closely monitoring the development of wave (C) on the daily chart and wave 3 on the H4 chart, traders can identify strategic entry points to capitalize on the anticipated decline. If the price remains below $84.5, a substantial move toward $72.47 or lower is highly probable, providing ample opportunities for bearish positions.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Silver XAGUSD Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support