Silver XAGUSD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Double Zigzag for wave B (circled)

Position: Wave (Y) of B

Direction: Wave 1 of (1) of C (circled)

Details: Wave B (circled) appears completed, and wave C (circled) is now emerging upwards. Currently, we are counting wave 1 of (1) or wave (1).

Silver Elliott Wave Technical Analysis

Silver Recovery and Forecast Silver is recovering from a pullback that began in late May 2024. This recovery is expected to lead to a series of rallies, continuing the year-long bullish impulse cycle. Long-term and medium-term Elliott Wave forecasts support further rallies for this precious metal.

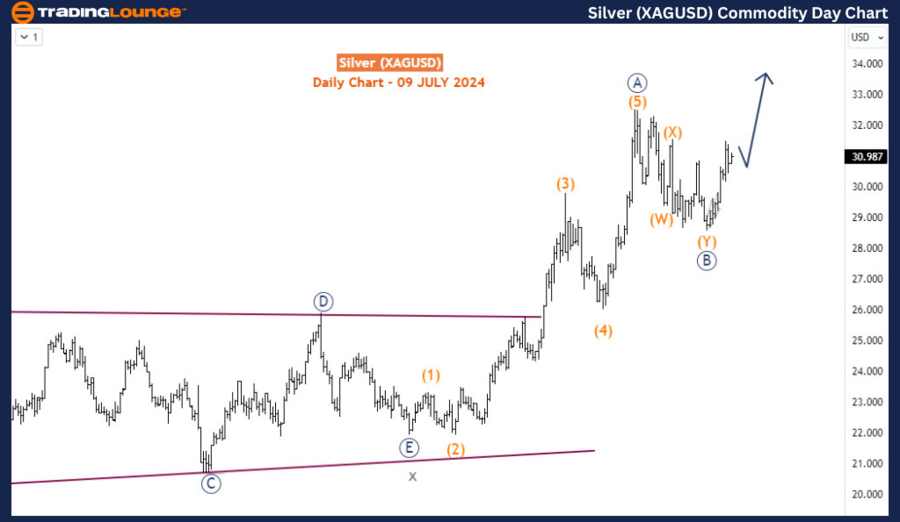

Daily Chart Analysis

On the daily chart, we identified that the impulse wave sequence starting in January 2024 completed in May 2024, followed by a corrective pullback. This bearish corrective structure, which lasted for five weeks, appears to have concluded with a double zigzag pattern. However, the correction is relatively shallow, suggesting the possibility of another leg lower. Yet, if the impulse reaction from late June continues to rise and does not turn corrective, it would indicate that the market has accepted the shallow nature of the pullback. Overall, it is likely that Silver will continue to climb, potentially reaching new highs in 2024.

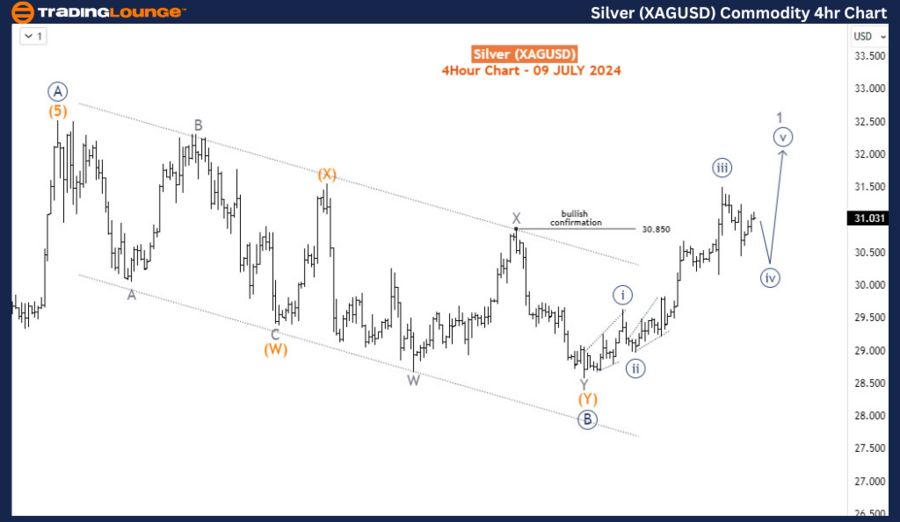

H4 Chart Analysis

On the H4 chart, the impulse response is in the process of completing the first sub-wave, or wave 1. Currently, wave iv (circled) might experience one more leg lower before reversing upwards to complete wave v (circled), thereby finishing wave 1. Following this, a larger pullback for wave 2 is expected. Conversely, if the current dip extends below $30, we may consider the high on July 5, 2024, as the end of wave 1 and the current dip as wave 2. In either scenario, provided that Silver's price does not approach $28.5, the price action supports further rallies from the dip, continuing the year-long bullish sequence.

Conclusion Both the daily and H4 charts indicate a continued bullish trend for Silver, offering multiple opportunities for traders. By monitoring the development of wave 1 on the H4 chart and the impulse sequence on the daily chart, traders can identify strategic entry points to maximize returns. The recent shallow correction suggests that Silver's bullish momentum remains intact, with further rallies likely as the metal continues its long-term ascent.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Cron Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support