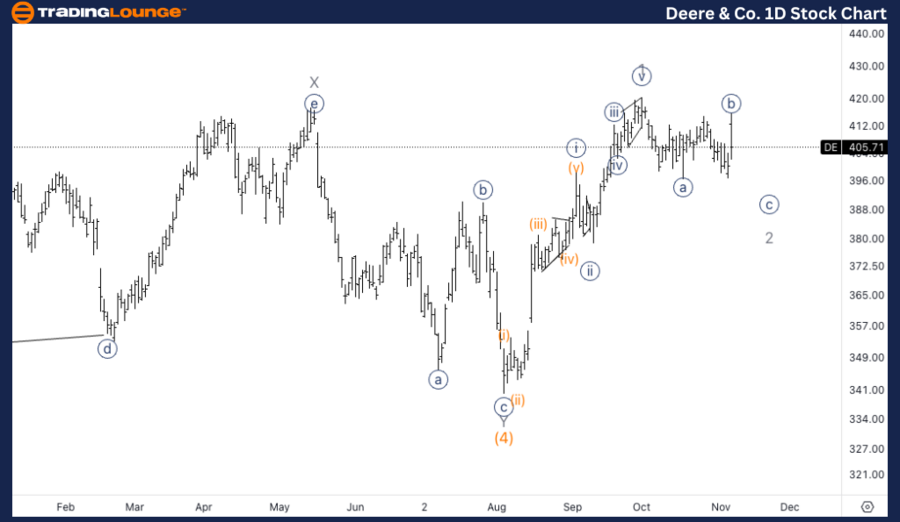

DE Elliott Wave Analysis - Trading Lounge Daily Chart

Deere & Co. (DE) - Daily Chart Analysis

DE Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 2 of (5)

Direction: Bottom in Wave 2

Details: A potential bottom in wave (4) seems to have formed near $330 after an extended corrective period over the past few years. Now that DE has broken above the $400 mark, there is a strong indication of further upside, supporting a bullish outlook.

DE Elliott Wave Technical Analysis – Daily Chart

The daily chart for Deere & Co. indicates that wave (4) — a multi-year correction — likely ended near $330. Following a breakout above the key resistance level at $400, a bullish trend appears to be setting up, signaling the start of wave (5). With confirmation from the recent price action, further gains are anticipated as this impulsive wave structure develops. Sustained trading above $400 will reinforce the bullish trend, targeting higher levels in wave 3 of (5).

Deere & Co. (DE) - TradingLounge 1H Chart

DE Stock Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {c} of 2

Direction: Downside in Wave {c}

Details: A further downward move is expected in wave {c} of 2, forming a three-wave corrective structure. The price continues to find support near MediumLevel $400, which has served as a significant level during this correction. The next move lower in wave {c} will be critical in determining if the corrective phase is nearing its end.

DE Elliott Wave Technical Analysis – 1H Chart

The 1-hour chart analysis shows wave 2 unfolding with a probable three-wave correction in progress. A further downside leg in wave {c} of 2 could retest support near the MediumLevel $400. This level has consistently acted as a support zone throughout the correction, and any additional downside action in wave {c} will provide further clarity on whether the correction is nearing its final stages.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Eaton Corp PLC (ETN) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support