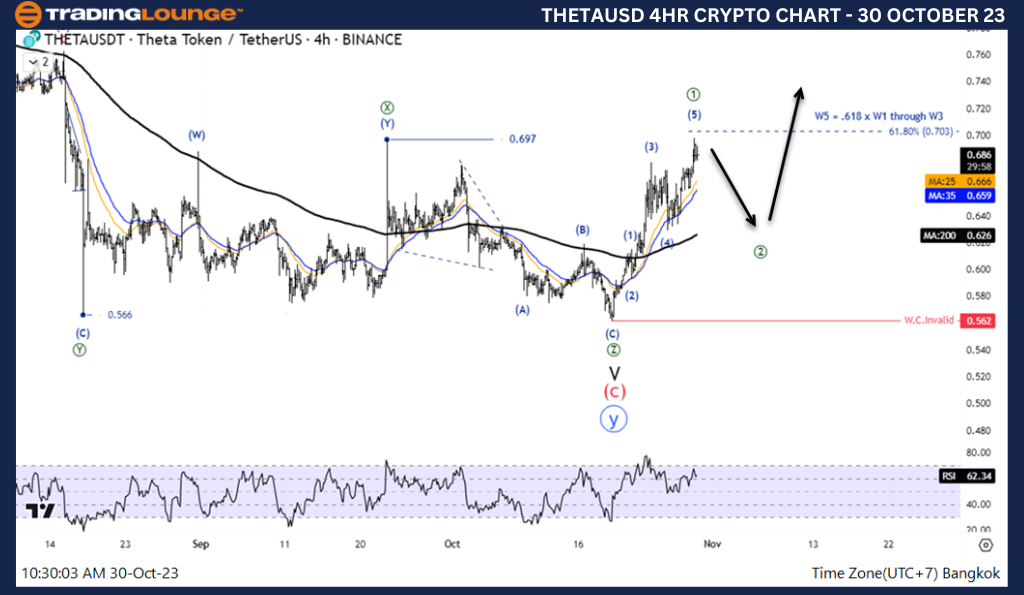

Elliott Wave Analysis TradingLounge Daily Chart, 30 October 23,

Theta Token/U.S. dollar(THETAUSD)

THETAUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Diagonal

Position: Wave V

Direction Next higher Degrees: wave (C) of Zigzag

Wave Cancel invalid Level:

Details: Wave V maybe complete and five-wave rise will support idea.

Theta Token/U.S. dollar(THETAUSD)Trading Strategy: It looks like the correction is likely to end after the price recovered well from the 0.562 level, combined with Bullish Divergence signals, Theta Token is likely to reverse. We ourselves are looking at a five-wave increase to help support this idea.

Theta Token/U.S. dollar(THETAUSD)Technical Indicators: The price is Below the MA200 indicating a Downtrend, RSI is a Bullish Momentum.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: Tradinglounge.com get trial here!

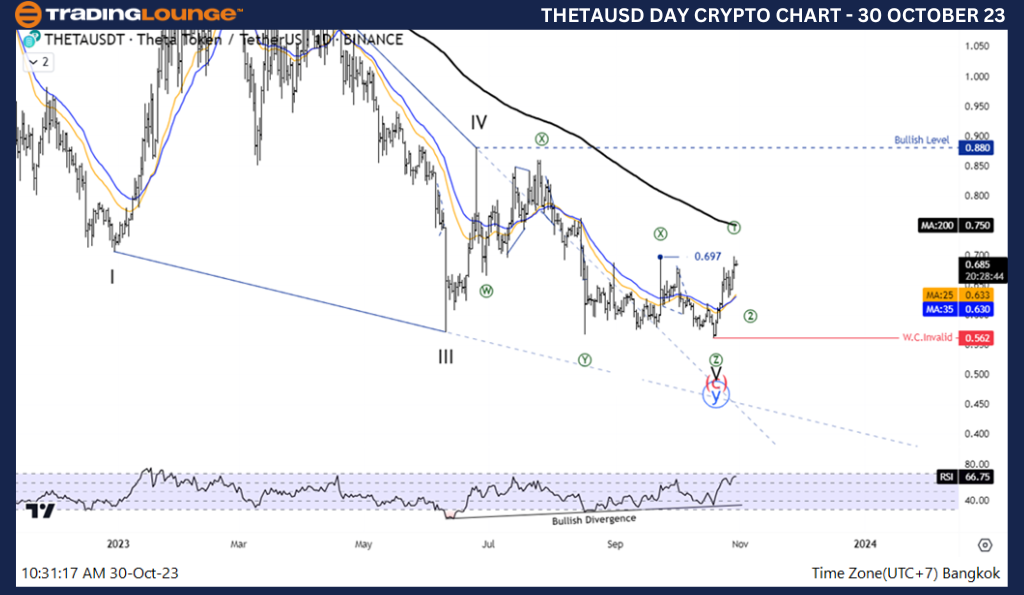

Elliott Wave Analysis TradingLounge 4H Chart, 30 October 23,

Theta Token/U.S. dollar(THETAUSD)

THETAUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Diagonal

Position: Wave V

Direction Next higher Degrees: wave (C) of Zigzag

Wave Cancel invalid Level:

Details: Wave V maybe complete and five-wave rise will support idea.

Theta Token/U.S. dollar(THETAUSD)Trading Strategy: It looks like the correction is likely to end after the price recovered well from the 0.562 level, combined with Bullish Divergence signals, Theta Token is likely to reverse. Moreover, the increase in five waves supports this idea. A break below 0.5262 will give us another opportunity to join the uptrend.

Theta Token/U.S. dollar(THETAUSD)Technical Indicators: The price is above the MA200 indicating an uptrend, RSI is a Bullish Momentum.