KO Elliott Wave Analysis for The Coca-Cola Company (KO)

In this Elliott Wave analysis of The Coca-Cola Company (KO), we will review the latest price movements and wave structure to identify potential trading opportunities. The analysis will cover both the daily and 1-hour charts to provide a complete overview of KO's trend and momentum.

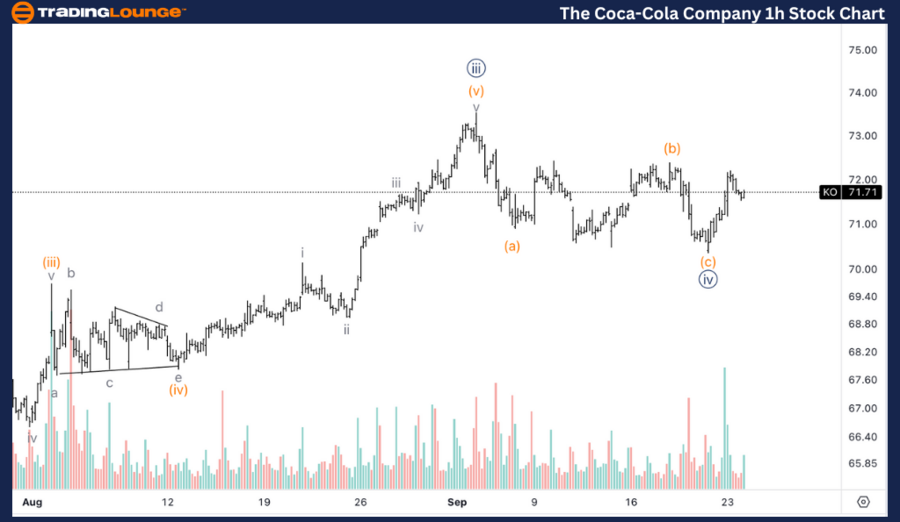

TradingLounge KO Elliott Wave Analysis: Daily Chart

The Coca-Cola Company (KO) - Daily Chart

KO Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 3

Direction: Upside in Wave 3

Details: Currently, we are observing a correction around the middle of MinorGroup2 (MG2) at $72, with the expectation of one final push into Wave {v} of 3. The target for this upward movement is $80.

The Coca-Cola Company Daily Chart Technical Analysis:

On the daily chart, Coca-Cola is advancing through an impulsive trend within Wave 3 of the overall Elliott Wave structure. The stock is consolidating around $72, which is the midpoint of MinorGroup2 (MG2), indicating a temporary correction before the next leg upward.

The main focus is on the final push into Wave {v} of 3, with a projected target of $80. This level is expected to act as a significant resistance point as Wave 3 nears completion. Traders should be mindful of possible consolidation once this target is reached, providing opportunities for strategic positioning.

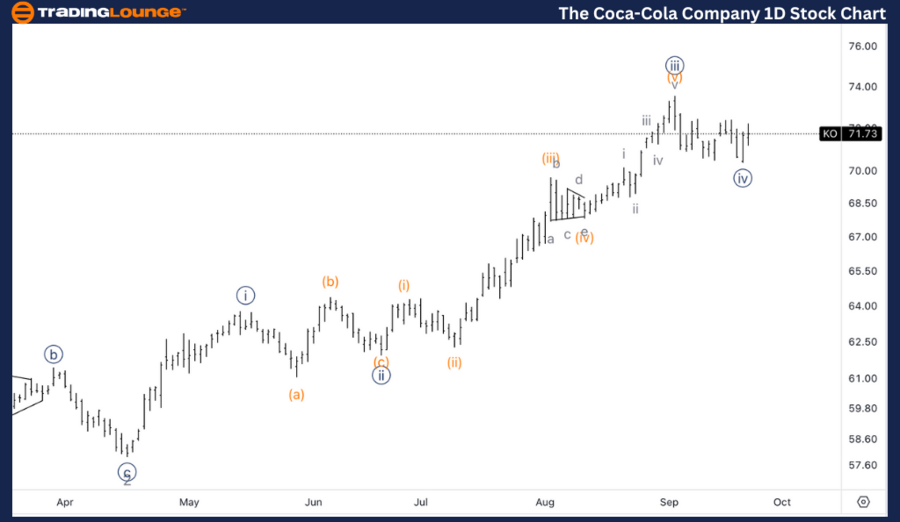

KO Elliott Wave Analysis: TradingLounge 1-Hour Chart

The Coca-Cola Company (KO) - 1H Chart

KO Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (i) of {v}

Direction: Upside in Wave {v}

Details: The price action shows a clear three-wave corrective structure into Wave {iv}, followed by a rise with increasing volume, suggesting that a potential low is in place.

The Coca-Cola Company 1-Hour Chart Technical Analysis:

On the 1-hour chart, Coca-Cola is in the early phase of Wave (i) of {v}, with the price trending upward as the stock progresses through Wave {v}. A recent three-wave corrective structure in Wave {iv} has completed, and the increase in volume indicates that the correction has likely ended, signaling the beginning of a new impulsive wave.

This suggests that a potential low is already established, and the next upward movement within Wave {v} could push the stock toward the $80 target identified in the daily chart analysis.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Alphabet Inc Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support