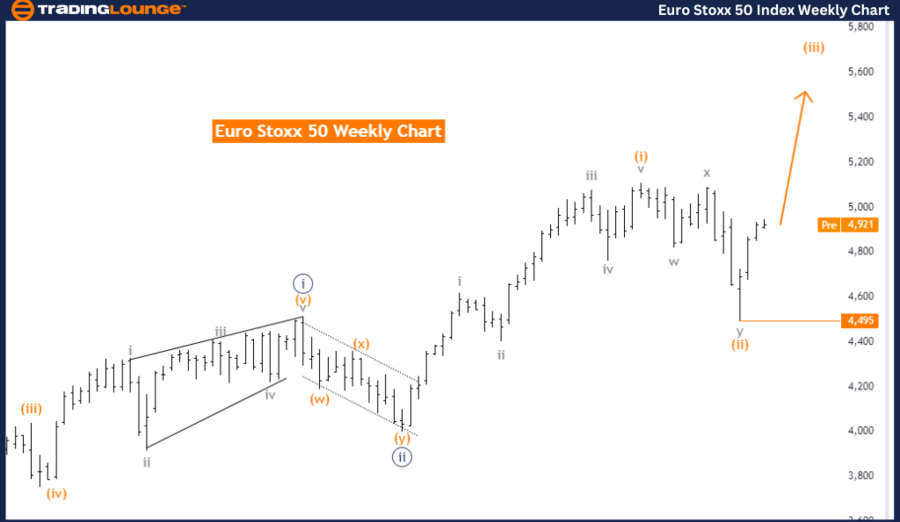

Euro Stoxx 50 Elliott Wave Analysis - Trading Lounge Day Chart

Euro Stoxx 50 Index Daily Chart Analysis

Euro Stoxx 50 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 1

POSITION: Orange Wave 3

DIRECTION NEXT LOWER DEGREES: Gray Wave 2

DETAILS: Orange Wave 2 appears completed. Now, Gray Wave 1 of Orange Wave 3 is in progress. Wave Cancel invalid level: 4495

The Euro Stoxx 50 index indicates a bullish trend according to Elliott Wave analysis on the daily chart. The market operates in an impulsive mode, showing strong upward momentum consistent with the overall trend. The primary structure is Gray Wave 1, signifying the beginning of a new wave cycle in this bullish trend.

Currently, the market is positioned in Orange Wave 3, which suggests advancement within the third wave of the orange degree. This advancement comes after the completion of Orange Wave 2, a corrective phase that signals the market's return to upward movement in the next impulsive wave.

Looking ahead to the next lower degrees, Gray Wave 2 is expected to follow once Gray Wave 1 completes. This suggests that after the ongoing upward movement in Gray Wave 1, the market might undergo a brief corrective phase before continuing the bullish trend.

Analysis details confirm that Orange Wave 2 is complete, and Gray Wave 1 of Orange Wave 3 is unfolding. This points to the market resuming its upward trend, with this bullish movement expected to continue as the new impulsive wave progresses.

Summary:

The Euro Stoxx 50 index shows a strong bullish trend on the daily chart, with an impulsive Gray Wave 1 in progress. The completion of the corrective Orange Wave 2 has triggered the start of Orange Wave 3, indicating a continuation of the upward trend. The analysis suggests sustained bullish momentum, with a possible brief correction in Gray Wave 2 after the current wave concludes.

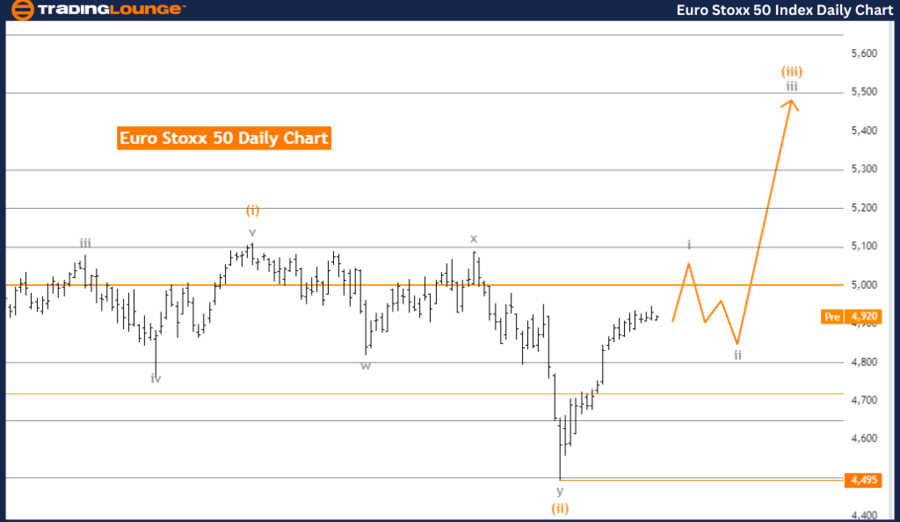

Euro Stoxx 50 Elliott Wave Analysis - Trading Lounge Weekly Chart

Euro Stoxx 50 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 3

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3 (continuing)

DETAILS: Orange Wave 2 of Navy Blue Wave 3 appears completed. Now, Orange Wave 3 is in progress. Wave Cancel invalid level: 4495

The Euro Stoxx 50 index continues to display a bullish trend based on Elliott Wave analysis on the weekly chart. The market remains in an impulsive mode, reflecting strong upward momentum aligned with the ongoing bullish trend. The primary wave structure under focus is Orange Wave 3, a segment of the larger Navy Blue Wave 3.

The market is currently positioned within Navy Blue Wave 3, indicating advancement within this phase. This follows the completion of Orange Wave 2, a corrective phase within the broader Navy Blue Wave 3. The end of this corrective phase suggests the market has resumed upward movement in the next impulsive wave.

The analysis indicates that the direction for the next higher degrees will be driven by the ongoing Orange Wave 3, implying that the bullish momentum is likely to persist as Orange Wave 3 progresses, pushing the market higher.

Key details highlight that Orange Wave 2 of Navy Blue Wave 3 is now complete, with Orange Wave 3 currently unfolding. This signals that the market has resumed its upward trajectory, and the bullish trend is expected to continue with Orange Wave 3 as the main driving force.

Summary:

The Euro Stoxx 50 index exhibits a strong bullish trend on the weekly chart, with an impulsive Orange Wave 3 in progress. The completion of the corrective Orange Wave 2 within Navy Blue Wave 3 has led to the continuation of the bullish movement. The analysis suggests this upward trend is likely to persist, driven by Orange Wave 3, provided the invalidation level of 4495 is not breached.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: TASI Index Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support