COLES GROUP LIMITED – COL Elliott Wave Technical Analysis TradingLounge

Updated Elliott Wave Analysis for ASX: COL

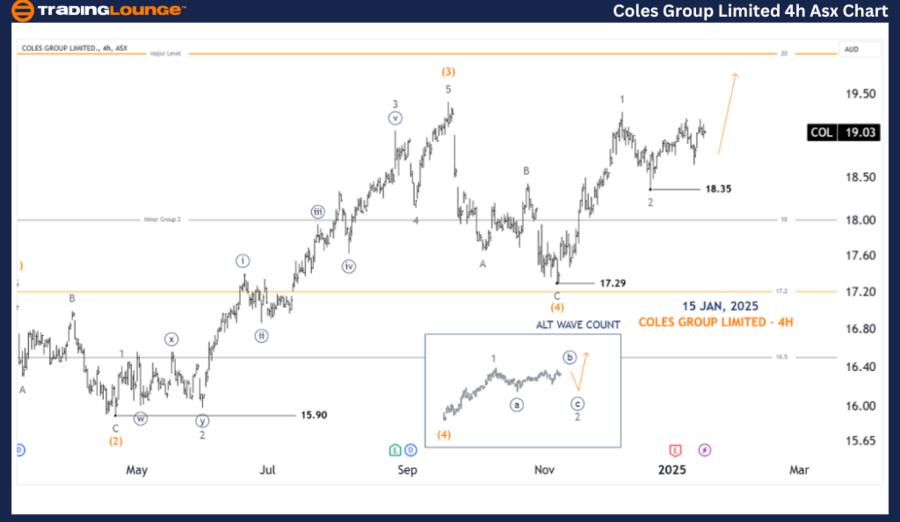

Discover the latest insights into the Australian Stock Exchange (ASX) with our Elliott Wave analysis of COLES GROUP LIMITED (ASX:COL). We anticipate a potential upward move in the (5)-orange wave. This analysis highlights key levels and turning points, helping traders and investors recognize when the current uptrend might conclude.

COLES GROUP LIMITED – COL (1D Chart) Elliott Wave Technical Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave (5)-orange

Analysis Details:

- Wave (4)-orange likely ended at a low of 17.29, with Wave (5)-orange beginning its upward move.

- The wave is expected to form an Extension, subdividing into waves 1, 2-grey, with wave 3-grey potentially advancing toward the 20.00 price level.

- Invalidation Point: If the price falls below 18.35, the current wave structure is invalidated.

COLES GROUP LIMITED – COL (4-Hour Chart Analysis)

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave 3-grey of Wave (5)-orange

Analysis Details:

- Wave (5)-orange remains an Extended Wave and is advancing higher.

- As long as the price stays above 18.35, the analysis holds.

- A break below 18.35 would suggest an alternative scenario (ALT), where wave 2-grey requires more time to complete before advancing to wave 3-grey.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX: RIO TINTO LIMITED Elliott Wave Technical Analysis

Conclusion

Our Elliott Wave analysis of COLES GROUP LIMITED – COL delivers key insights into market behavior and trading opportunities. By focusing on specific price points, such as validation and invalidation levels, we enhance confidence in our wave count and market forecast. This approach ensures a professional and objective understanding of current trends, empowering traders and investors to make informed decisions.