ASX: RIO TINTO LIMITED - RIO Elliott Wave Technical Analysis TradingLounge

Greetings, this Elliott Wave analysis provides an updated outlook for the Australian Stock Exchange (ASX) RIO TINTO LIMITED - RIO. The potential for ASX:RIO to rise in a third wave suggests an upcoming bullish trend. This analysis highlights visual price levels and critical points to help determine the onset of the uptrend or when the bullish perspective needs reassessment based on technical signals.

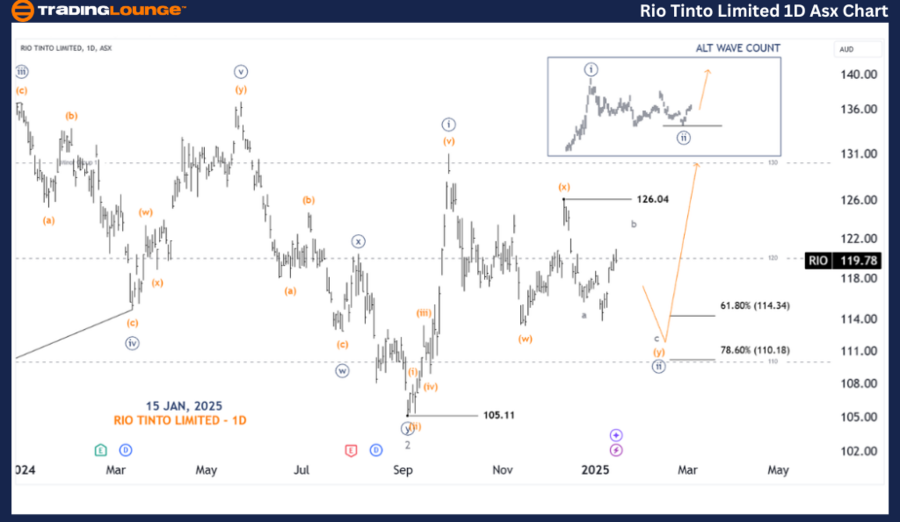

ASX: RIO TINTO LIMITED - RIO 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave ((ii))-navy of Wave 3-grey

Details:

- Wave ((ii))-navy might extend lower before turning upward.

- A break above 126.04 would confirm the ALT alternative scenario, indicating that Wave ((iii))-navy could initiate sooner than anticipated.

- Invalidation Point: 105.11

- Confirmation Point: 126.04

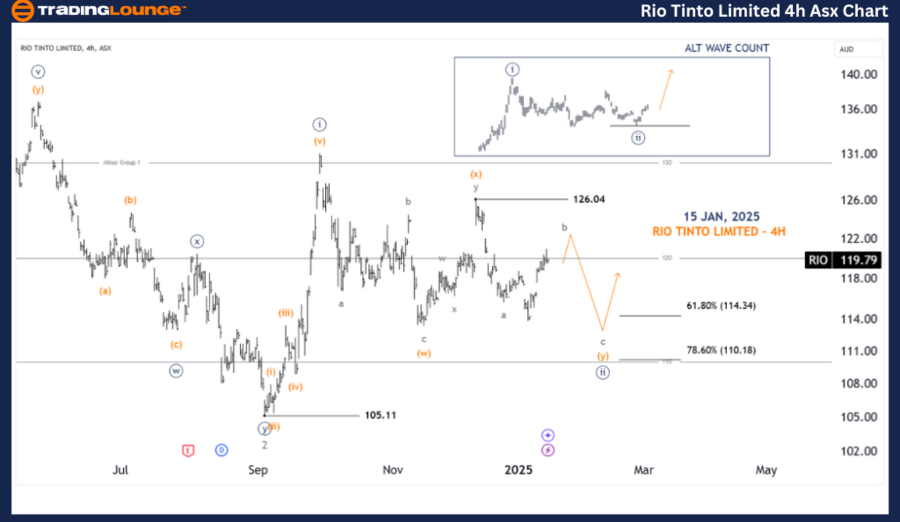

ASX: RIO TINTO LIMITED - RIO 4-Hour Chart Analysis

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave c-grey of Wave (y)-orange of Wave ((ii))-navy of Wave 3-grey

Details:

- The 4-hour chart aligns with the 1D chart’s analysis.

- Key Level to Watch: 126.04 remains the pivotal point for observing the next market move.

- Invalidation Point: 39.43

- Confirmation Point: 126.04

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX: Fortescue Ltd (FMG) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This analysis offers a clear forecast for ASX: RIO TINTO LIMITED - RIO by outlining key market trends and actionable price levels. The specified confirmation and invalidation points enhance confidence in the wave count, ensuring readers can navigate the market effectively. By combining these insights, we aim to deliver an objective and professional perspective to capitalize on emerging opportunities within the ASX market.