CAT Elliott Wave Analysis – Current Trend Structure of Caterpillar Inc. (CAT)

This analysis delves into the latest trend structure of Caterpillar Inc. (CAT) using Elliott Wave Theory, applied to both the daily and 1-hour charts. Below is a detailed breakdown of the stock's position and potential future movements.

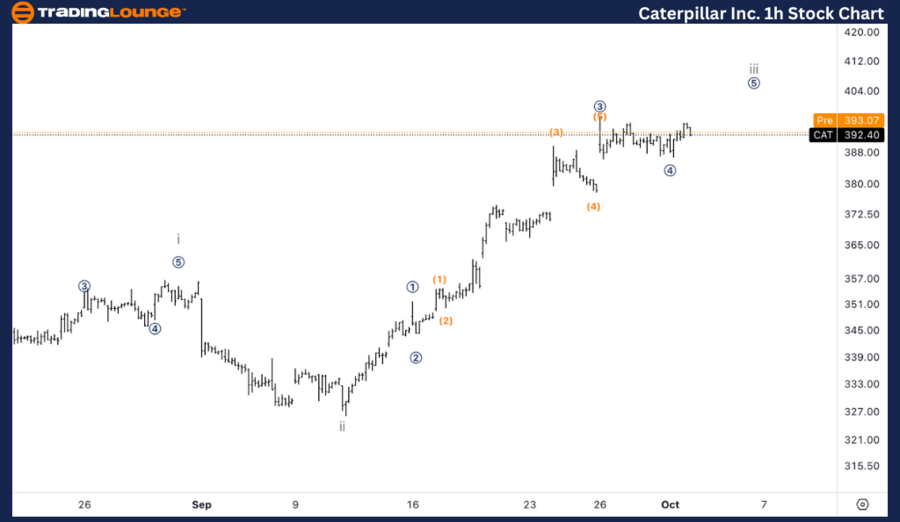

CAT Elliott Wave Analysis – TradingLounge Daily Chart

Caterpillar Inc. (CAT) Daily Chart Technical Analysis

CAT Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Minute {iii}

DIRECTION: Upside into wave (v) of {iii}

DETAILS: The stock is expected to continue moving higher within Wave {iii}, with the potential to eventually reach $500.

CAT Stock Technical Analysis – Daily Chart Overview

On the daily chart, Caterpillar Inc. is advancing within an impulsive motive structure in Minute Wave {iii}. The stock is progressing upward and is currently within Wave (v) of {iii}. This indicates further upside potential, with $500 being the projected target for the completion of Wave {iii}.

Caterpillar is showing strong bullish momentum. Traders should watch for continued upward movement, especially as the stock approaches key resistance levels.

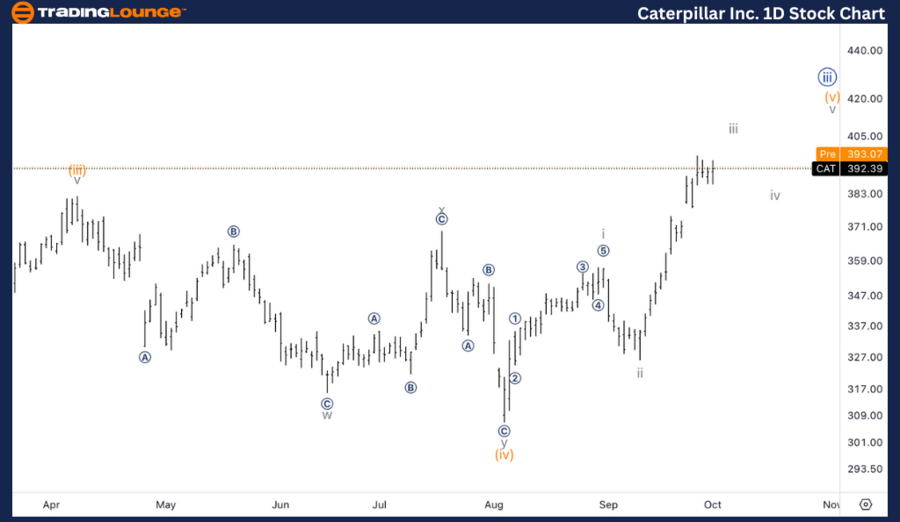

Caterpillar Inc. Elliott Wave Analysis – TradingLounge 1H Chart

Caterpillar Inc. (CAT) 1H Chart

CAT Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave iii

DIRECTION: Micro wave 5 of iii

DETAILS: Expecting at least one more leg higher within Wave iii, as the stock has been correcting in Micro Wave 4 and is now resuming upward toward $400.

Caterpillar Inc. Elliott Wave Technical Analysis – 1H Chart Overview

On the 1-hour chart, Caterpillar appears to be advancing within Wave iii, specifically in Micro Wave 5 of iii. After completing a correction in Micro Wave 4, the stock is now resuming its upward trend, with the next upside target projected around $400.

This final leg of Wave iii suggests at least one more push higher before a possible corrective phase begins. Traders should keep an eye on the resistance near $400, as it may lead to some short-term consolidation before further upward movement.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Fortinet Inc. (FTNT) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support