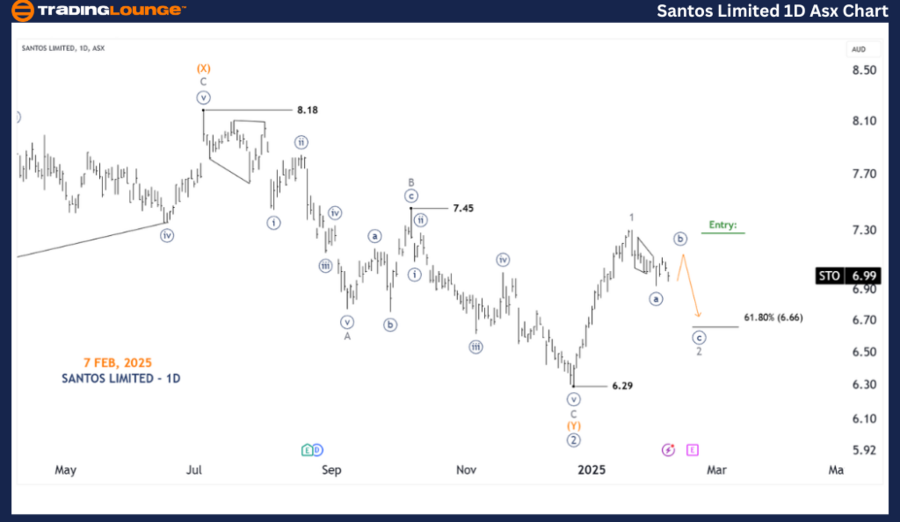

SANTOS LIMITED - STO Elliott Wave Analysis (1D Chart) | TradingLounge

SANTOS LIMITED Stock 1D Chart Analysis

STO Elliott Wave Technical Analysis

Function: Major Trend (Minor Degree, Gray)

Mode: Motive

Structure: Impulse

Position: Wave ((3)) - Navy

Details:

- Wave ((2)) - Navy appears to have completed, with wave ((3)) - Navy now moving upward.

- This wave is extended, indicating a potential pullback with wave 2 - Gray before resuming the uptrend.

- High-quality long trade setups may emerge if the price breaks above the wave 1 - Gray endpoint, which serves as a confirmation of the trend.

✅ Invalidation Point: 6.29

✅ Key Level: End of Wave 1 - Gray

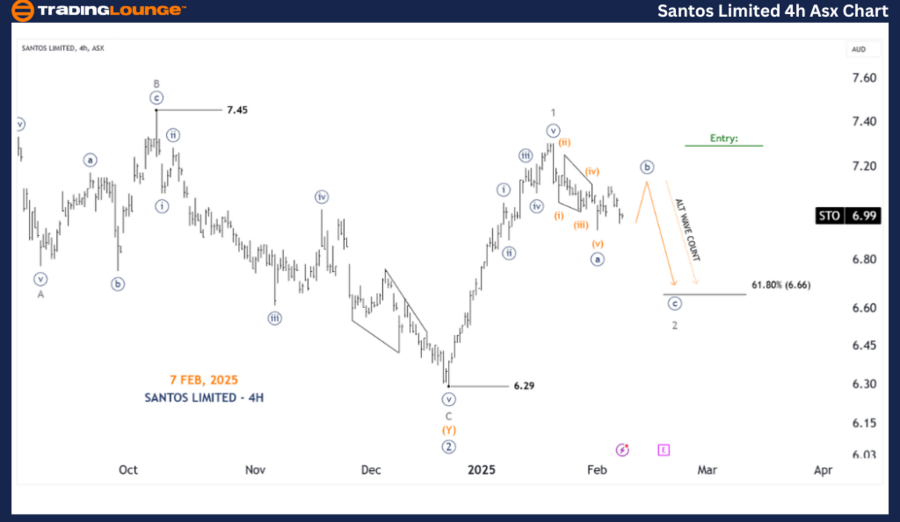

SANTOS LIMITED - STO Elliott Wave Technical Analysis (4-Hour Chart) | TradingLounge

Function: Major Trend (Minor Degree, Gray)

Mode: Motive

Structure: Impulse

Position: Wave (ii) - Orange of Wave ((iii)) - Navy

Details:

- Wave 1 - Gray has formed a five-wave structure, while wave 2 - Gray appears to be a zigzag correction, potentially driving prices slightly lower.

- The ideal correction target is around 6.66, after which the price is expected to move higher.

- A break above the end of wave 1 would confirm a bullish trend resumption.

✅ Invalidation Point: 6.29

✅ Key Level: End of Wave 1 - Gray

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ARISTOCRAT LEISURE LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for SANTOS LIMITED - STO provides valuable insights into market trends and trading opportunities. By pinpointing key price levels, we identify validation and invalidation signals, strengthening confidence in market direction. This structured approach helps traders make well-informed trading decisions based on Elliott Wave principles.