ASX: ARISTOCRAT LEISURE LIMITED (ALL) Elliott Wave Technical Analysis – TradingLounge

Greetings,

Today's Elliott Wave analysis presents an updated outlook on ARISTOCRAT LEISURE LIMITED (ALL) on the Australian Stock Exchange (ASX).

ASX: ALL maintains its upward momentum in the short term. However, our latest analysis identifies key price levels that may indicate a potential trend shift. These signals suggest that bearish pressure could gradually increase over time.

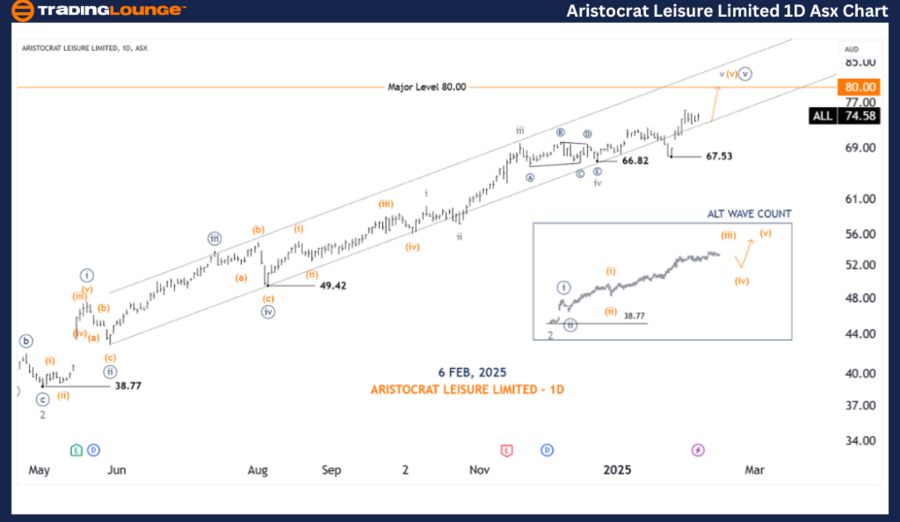

ASX: Aristocrat Leisure Limited Elliott Wave Analysis (1D Chart - Semilog Scale)

- Function: Major trend (Minor degree, grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave v-grey of Wave (v)-orange of Wave ((v))-navy

Details:

The v-grey wave continues to push higher. However, traders should consider the Alternative Wave Count (ALT WAVE COUNT), which suggests that wave (iii) of the ((iii))-navy wave has reached completion.

If wave (iv)-orange develops a deeper downward movement, it may confirm an increased bearish outlook.

🔹 Key price level to watch: A fall below 66.82 would reinforce this alternative scenario.

🔹 Invalidation point: 66.82

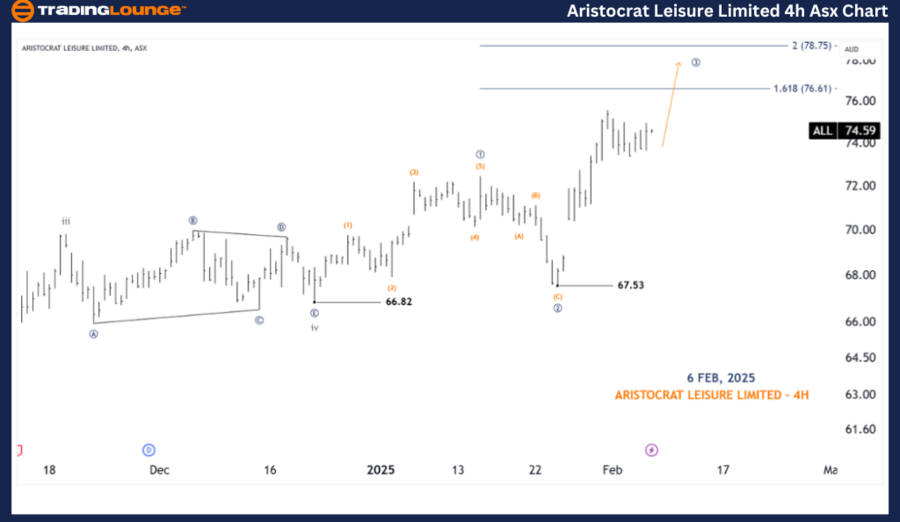

ASX: ARISTOCRAT LEISURE LIMITED (ALL) 4-Hour Chart Analysis

- Function: Major trend (Minute degree, navy)

- Mode: Motive

- Structure: Impulse

- Position: Wave ((iii))-navy of Wave v-grey

Details:

A closer analysis of the 66.82 price level indicates that the v-grey wave remains in an upward phase. Additionally, emerging subwave formations suggest that this impulse wave is extending.

🔹 Next upward target: The 76.61-78.75 range, where the ((3))-navy wave could fully develop.

🔹 Invalidation point: 67.53

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ANZ Group Holdings Limited Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis provides a detailed market forecast for ASX: ARISTOCRAT LEISURE LIMITED (ALL) based on current wave structures and key price action levels.

We emphasize important price points that serve as validation and invalidation levels, equipping traders with clear signals to improve their market confidence. By integrating these insights, traders can maintain a professional and objective perspective on ASX:ALL’s price trends.