XRPUSD Elliott Wave Analysis TradingLounge Daily Chart

In the realm of cryptocurrency trading, understanding Elliott Wave theory is paramount for strategic decision-making. Let's delve into the Elliott Wave analysis for XRPUSD, focusing on both counter-trend and trend-following perspectives.

XRPUSD Elliott Wave Technical Analysis

XRPUSD Daily Chart Analysis:

Function: Counter Trend

Mode: Corrective

Structure: Triangle

Position: Wave E

Direction Next higher Degrees: Wave 4 of Impulse

Wave Cancel invalid level: 0.486

Details: The XRPUSD daily chart reveals a counter-trend movement characterized by corrective waves. Presenting a triangular structure, the current position marks Wave E within the Elliott Wave sequence. Looking at higher degrees, this wave aligns with Wave 4 of an overarching Impulse pattern. It's imperative to note the wave cancel invalid level set at 0.486, indicating a critical threshold for wave validation. Previously, XRPUSD exhibited movement within the confines of a triangle before embarking on an upward trajectory once again.

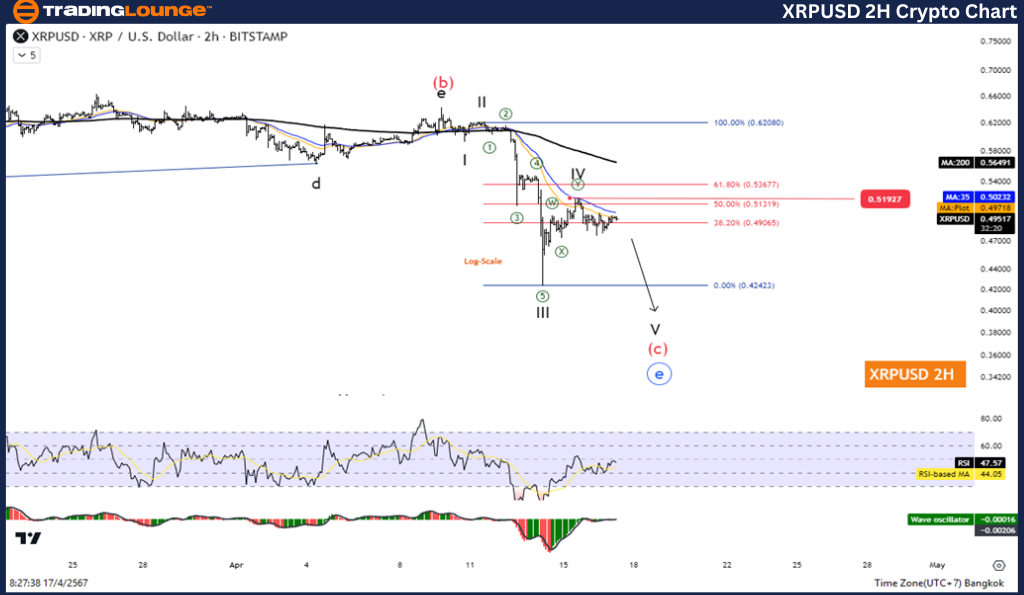

TradingLounge XRPUSD Elliott Wave Analysis 2H Chart

XRPUSD H2 Chart Analysis:

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 4

Direction Next higher Degrees: Wave C of Zigzag

Wave Cancel Details invalid level:

Details: Transitioning to the XRPUSD H2 chart, the focus shifts towards trend-following analysis. Here, the function is to follow the trend, indicating a motive movement. The structure unfolds as an impulse pattern, with the current position identified as Wave 4. Looking at the broader picture, this wave corresponds to Wave C within a Zigzag pattern. Notably, a wave cancel invalid level isn't specified, underscoring the importance of monitoring price action closely.

Technical Analyst: Kittiampon Somboonsod

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: VeChain/USD (VETUSD)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE